Seeking a Sustainable Downside Protection Strategy

Options-based strategies have been growing rapidly over the last decade, both in terms of available solutions as well as assets under management. As of December 31, 2021, there were 247 funds with over $54bn AUM in the Morningstar category “Options Based.” So what makes this options-based strategy so popular?

As part of our ongoing comparison series, we will explore the following:

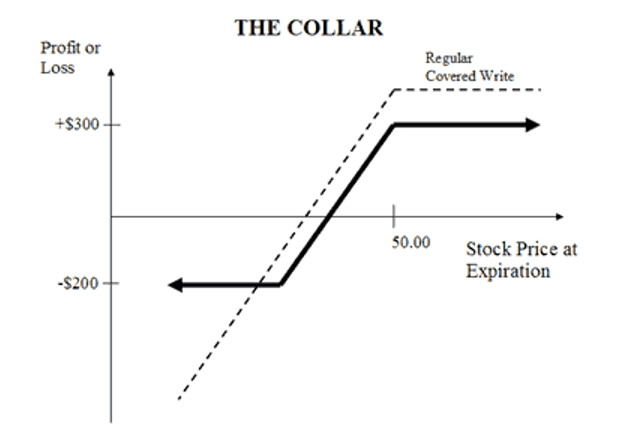

With a collar strategy, the manager typically has a long underlying position in a portfolio of stocks. The manager seeks to protect against downside risk by purchasing an out-of-the-money put option. While it is certainly prudent to protect against downside risk, put options obviously cost money.

To help offset the cost of the put options, a collar strategy seeks to generate income by writing out-of-the-money call option(s) against their market position. In effect, this caps the upside potential of a collar. This is the fundamental trade-off of a collar strategy: downside protection is purchased in exchange for selling away some of the upside potential.

A collar typically has three components:

Below is a graph outlining the return profile of a covered call strategy.

Source: www.theoptionsguide.com

If the above chart looks a bit familiar, it should. The collar strategy is closely related to the covered call. In fact, two of the three legs of the collar are the same as the covered call: the long equity position and the short call position.

With the covered call strategy, we stated that one of the drawbacks is there is no downside protection. One way of thinking of collars is that they are essentially “protected” covered calls: using the premium they generate from the short calls not for income but to purchase downside protection.

The primary driver of the collar strategy’s returns is the movement of the market itself. Not only is the direction of the market important but the degree or magnitude of the market’s move is also significant. It is often said that a collar is a moderately bullish strategy.

The key word is moderately. Since the core of a collar is a long position in a portfolio of equities, the holder obviously hopes that the market goes up. However, the risk is if the market goes up too much, the call options will go from being out-of-the-money to being in-the-money. Under such circumstances, the portfolio manager really only has a few options.

One, they could close out the trade and take a loss on the option trade. Two, the underlying asset could be called away and miss out on the gains. Or three, the portfolio manager could cross their fingers and pray that the market reverses direction and dips back below the strike price before being called. Either way, the collar has effectively sold off its upside potential in a sharply rising market.

Of course, the benefit to the collar strategy is when the market goes down. If the market goes past the put strike and if the collar was implemented correctly, the strategy should be protected from losses beyond a certain point.

That is why the strategy is called a collar: The range of returns is meant to be “collared” with limited downside but also limited upside.

The first risk is the most obvious one: that a collar strategy has sold off its upside potential. This is more of an “opportunity cost,” where gains beyond a certain point are forgone. However, there are additional risks to a collar. As always, the devil’s in the details.

One risk has to do with what’s known as the skew of option pricing. In layman’s terms, skew refers to the fact that the prices of put options are usually significantly higher than the price of call options. If a collar strategy is buying high-priced put options and hoping to offset the cost by selling low-priced call options, the collar might not be generating premium to fully pay for the put.

This leaves the portfolio manager with some difficult choices.

The other major risk to a collar strategy is the cost of maintaining it through a prolonged bear market. When collars are established, the protection is usually short-term in nature with the puts going out three months or so. Sometimes more, sometimes less, but three months is typical.

What happens to a collar strategy during an extended market downturn after its initial hedge is cashed in? If the collar is to be maintained, new put options will need to be purchased. But in a protracted bear market like the dot-com crash (2000-02) or the Global Financial Crisis (2007-09), buying new puts every quarter can become prohibitively expensive. The price for short-term protection skyrocketed in such environments and, in some cases, maintaining a collar might be impossible thus leaving the underlying unprotected from downside risk.

There is no “silver bullet” strategy that works well in every situation. Every strategy has environments it works well or works poorly. Collar strategies tend to work best in either modestly upward markets or short-term, minor corrections of 5%-10%.

In the case of the former, the collar will enjoy modest gains without too much upside called away. With the latter, the short-term put offers some protection, and hopefully the sell-off isn’t too steep or too prolonged. A case can be made for having a portion of one’s portfolio in such a strategy.

However, if one expects to capture most of the upside in a strong bull market or if one is looking for bear market protection, a collar is not likely to be the best fit.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan Global Investments offers and manages the Defined Risk Strategy for investors including individuals, institutions and other investment advisor firms. All Swan products utilize the Swan DRS but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results and comparing results among the Swan products and composites may be of limited use. Indices are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. DRS results are from the Select Composite, net of fees, as of 12/31/2016. The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions. Hypothetical performance analysis is not actual performance history. Actual results may materially vary and differ significantly from the suggested hypothetical analysis performance data. This analysis is not a guarantee or indication of future performance. Swan claims compliance with the Global Investment Performance Standards (GIPS®). Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997 and are net of fees and expenses. All data used herein; including the statistical information, verification and performance reports are available upon request.

The benchmarks used for the DRS Select Composite are the S&P 500 Index, which consists of approximately 500 large cap stocks often used as a proxy for the overall U.S. equity market, and a 60/40 blended composite, weighted 60% in the aforementioned S&P 500 Index and 40% in the Barclays US Aggregate Bond Index. The 60/40 is rebalanced monthly. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The advisor’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the advisor invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com. 260-SGI-062218