Stand out in a “Sea of Sameness”. We have surveyed the outsourcing landscape and find almost universal reliance on the same investment methodology (MPT) and long-only or tactical managers, while offering similar technologies.

Differentiate yourself as an advisor, deliver distinct and innovative investment options, and save time to focus on what you love—helping investors and building your practice.

With yields near all-time lows and U.S. equities near all-time highs, the investing landscape presents significant challenges for investors to reach long-term objectives.

Meanwhile, advisors are being increasingly disintermediated and their value commoditized in the minds of many investors.

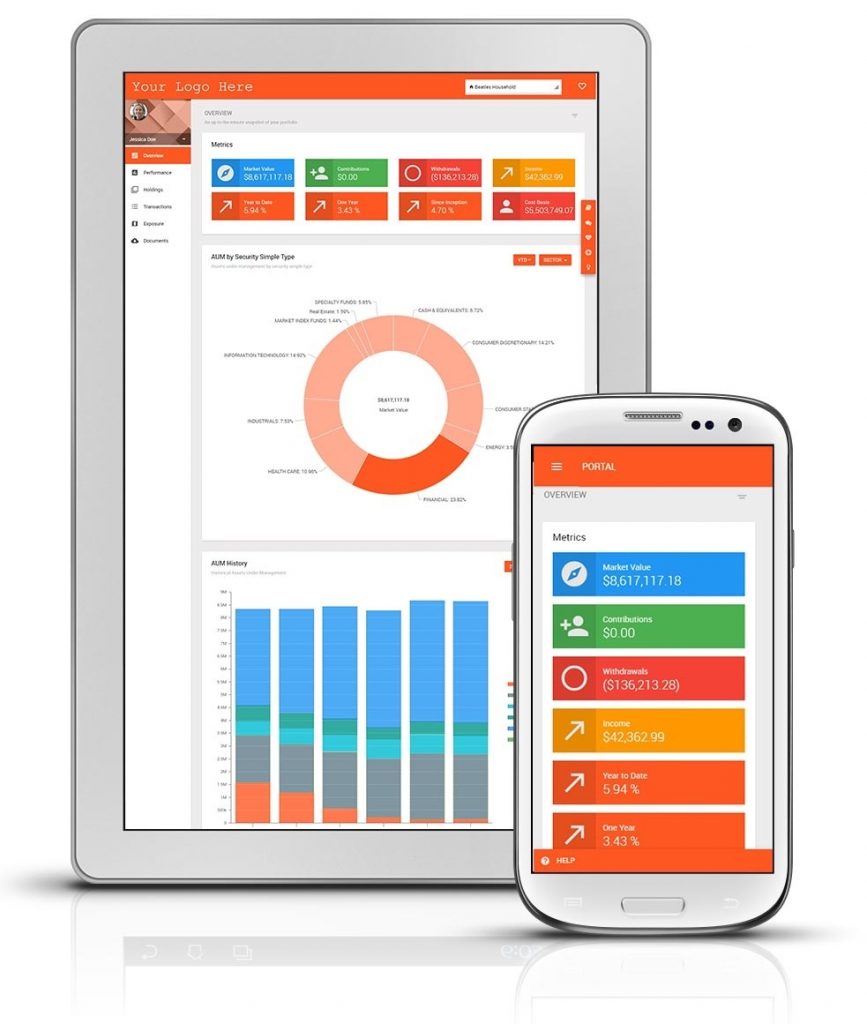

The Defined Risk Solutions platform combines our distinct, time-tested investment approach with proven marketing solutions and time-saving technology- all in one platform.

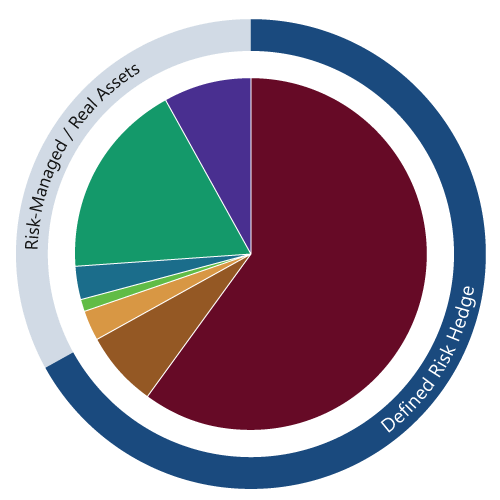

Outcome-Oriented — A multi-asset, multi-manager suite of portfolio models for the full range of investment objectives and investor risk tolerances.

Client-Centered — Investment models built around the primary needs of investors, with a distinct, time-tested approach to risk management at the core.

Innovative & Unique — A time-tested and rules-based investment approach that seeks to:

Low-Cost, Risk-Managed Approach — Focused on defining portfolio risk, hedging both “left-side” or negative tail risks and “right-side” or positive tail risks with core positioning, and optimizing performance through diversification and non-correlated satellite positioning.

This framework is based on academically rigorous research, actual battle-tested results over two decades of implementation, and theoretical models across four decades.

Portfolios for tomorrow—today. A proven approach to consistent returns and protection of capital.

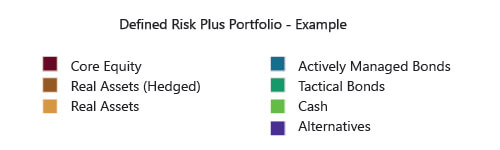

Industry-Leading Technology Solutions

Rapid industry changes require next-generation investment infrastructure platforms, solutions, and services.

Leverage powerful, differentiated messaging, and a unique story to stand out in a sea of sameness.

Marketing and thought leadership materials centered around addressing investor needs, perspectives and challenges.

Attract, engage, and inform investors with a robust content library including:

Videos,

Brochures & presentations,

Email templates & scripts,

Client seminars,

Insightful research,

Market commentary and more.

Differentiate. Connect. Grow.

While the investment landscape and technologies continue to change, investors’ needs generally remain the same.

Your clients need capital preservation and consistent growth through market cycles.

So does your practice.

We intimately understand these needs and challenges.

Consistency of returns and downside protection are hallmarks of our Swan Defined Risk Solutions for advisors.

Innovative. Client-Centered. Outcome-Oriented.

* Swan uses FinFolio to provide financial technology services for its Solutions program. Swan’s Chief Strategy Officer is on the Board of FinFolio. Although this relationship may potentially provide an incentive for Swan to use FinFolio, Swan has reasons other than this relationship to use the firm.