Check Out Our Investment Session Video:

“Hedged Equity & The New ‘Modern’ Portfolio“

Proud to be a Gold Sponsor

We’re excited to sponsor this year’s Envestnet Advisor Summit as it focuses on strategies to help advisors grow their businesses.

Today advisors face the greatest challenges and greatest opportunities in a generation. To overcome those challenges, and steward clients to their long-term goals, advisors are seeking new options and strategies.

A redefined investment landscape requires a redefined approach to portfolio construction.

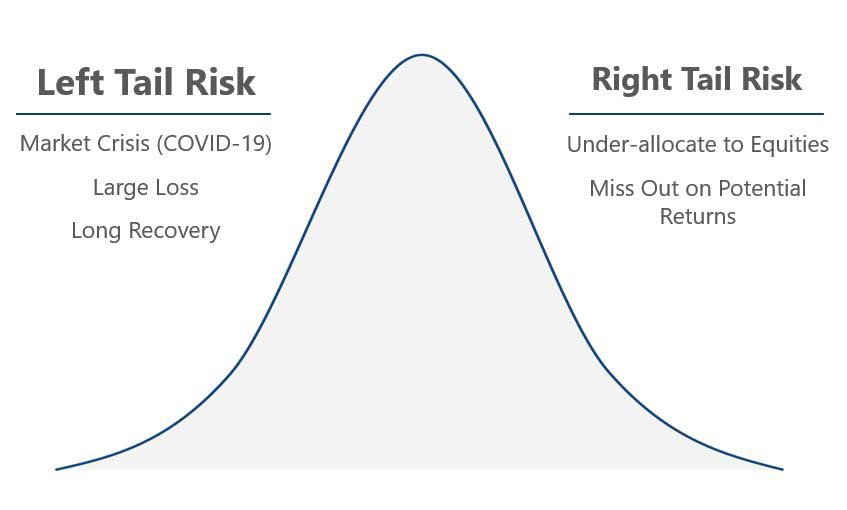

As the bond bull market ends, advisors face an investment dilemma on two fronts.

The expansive “options-based” category includes strategies with different objectives, drivers of risk/return, and suitability in various environments.

Founded by an investor, for investors, Swan Global Investments is a leader in hedged equity and options strategies.

Our distinct, time-tested approach to hedged equity seeks consistent rolling returns through market cycles while preserving irreplaceable capital. We offer solutions to serve a range of investment objectives, account sizes, and risk tolerance levels.

The world has been redefined—made increasingly difficult by the uncertainty in the post-COVID-19 world, with low to negative yields, a re-calibration of the global economy, and more.

Since 1997, we have been redefining investing. Our distinct Defined Risk Strategy has pioneered the use of options to hedge equity, defining and limiting market risk for long-term equity investing.

Equity Exposure for Growth – Maintain or increase overall exposure to equity in various markets, rotating out of bonds, to fuel returns for long-term investors.

Without All of the Risk – Active management of a long-term hedge (LEAPS) mitigates risk and provides real diversification, without duration, credit, or other risks in bonds.

MORE ABOUT OUR FIRM

THOUGHT LEADERSHIP

PROCESS PUT TO THE TEST

YOU’VE GOT QUESTIONS?