There is a familiar story that pops up every so often in the pages of the financial press: “Option Strategy Blows Up, Loses Nearly All of Investors’ Money.” Readers shake their heads and wonder how anyone could be so foolish to lose 50%, 75% or 100% so quickly. This leads investors to conclude options are dangerous instruments that should be avoided altogether.

But this line of reasoning is far too simplistic.

There is nothing fundamentally dangerous or risky about options. Used correctly, options can create just about any risk/return profile desirable. Options are simply a tool. Like a power drill or an automobile, they can be used safely and be very helpful—unless the user is reckless or ignorant about their characteristics.

It is not the options themselves that are risky; it is how they are used that matters.

It is an unfortunate truth that the investment landscape is littered with strategies that blew up spectacularly over the last few decades. But there are lessons we can learn from them.

Upon examining the blow-ups that have occurred, there appear to be three primary areas where option strategies can get into trouble. Typically, it is not just one factor that sinks a ship, but a combination of two or all three of these factors. These factors are: excessive leverage, lack of liquidity, and inadequate risk controls.

This series begins with the problem of excessive leverage.

It is important to acknowledge that options are levered instruments. A typical option contract covers 100 shares of an underlying asset. The calculation for notional value is:

Contract size X Underlying price = Notional Value

If the standard contract size is 100 and the price on the S&P 500 is, say, $2,500, an option contract on the S&P 500 has a notional value of $250,000. Certainly, one of the first factors one should understand when dealing with options is just how much notional value is covered by a standard contract on a given asset.

That said, when option strategies tend to get in trouble with leverage, it tends to be related to the coverage ratios between the number of options shorted or written against the amount of collateral owned. Option writers are often described as having a high probability of a small gain, coupled with a low probability of a large loss. If the low-probability/high-loss scenario comes to pass, the obligation to cover the losses can overwhelm the ability of the collateral to offset losses.

The simplest example of this situation is writing “naked” options. Writing a naked option means the writer does not already own the underlying stock. They are writing the call option hoping the underlying will go down in value.

The chart below shows a standard “hockey stick” diagram that illustrates the profit and losses associated with writing a call on a given asset. The writer collects the premium, which is the compensation for assuming the risk of an option. If the asset stays flat or goes down, the option expires out-of-the-money. The writer keeps the premium and is free from any further obligation. However, if the asset value goes above the strike price, the losses are theoretically uncapped.

Source: Swan Global Investments

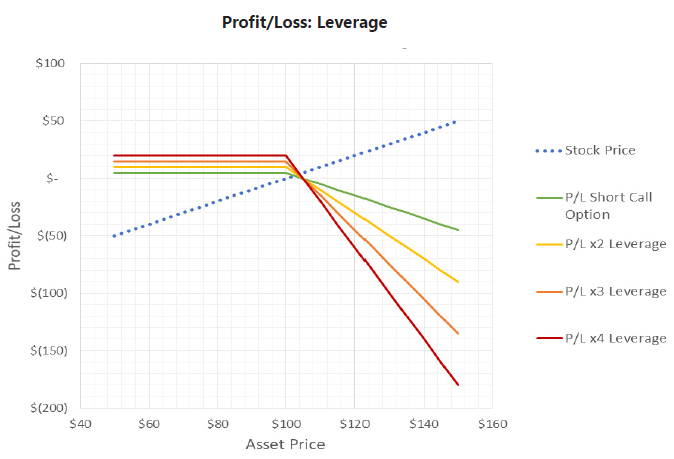

This scenario can be dramatically exacerbated if the manager chooses to write multiple options on a given asset. In the profit/loss diagram below, we see a situation where someone chooses to write multiple call options on an asset thus leveraging the position.

It is frightening to see how quickly losses can get out of control when a position is leveraged.

Below is a simple illustration of the impact leverage can have in an adverse market move.

Source: Swan Global Investments

When analyzing the graveyard of historical blow-ups, a common theme was the excessive use of leverage when writing options.

So when considering an options strategy to include in a portfolio, it is important to inquire about leverage so you can make the best decision to fit your clients’ needs.

Some questions to consider during your due diligence meetings are:

While leverage can intensify losses, it may be even worse when liquidity also poses a problem. That will be the focus of the next post in this series.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research at Zephyr Associates for 11 years.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 252-SGI-060619