Following the sharp drawdown of August 20–25, the market has hovered around correction levels, defined as a drop-off of more than 10% from its highs in May. From here, we believe there are two likely directions the market can take: a quick recovery or a long, steep bear market. While it is possible that the markets remain flat and consolidate over the coming months or years, we at Swan do not view that as a likely possibility. Our thinking parallels a recent New York Times article by Yale’s Robert J. Shiller, “Rising Anxiety That Stocks Are Overpriced.”

Swan’s credo is that we do not engage in market-timing, but it is worth discussing the impact different market scenarios might have on Swan’s Defined Risk Strategy. After all, Swan has a track record exceeding 18 years and has successfully weathered many difficult markets. While past performance does not guarantee future results, it can serve as a useful guidepost.

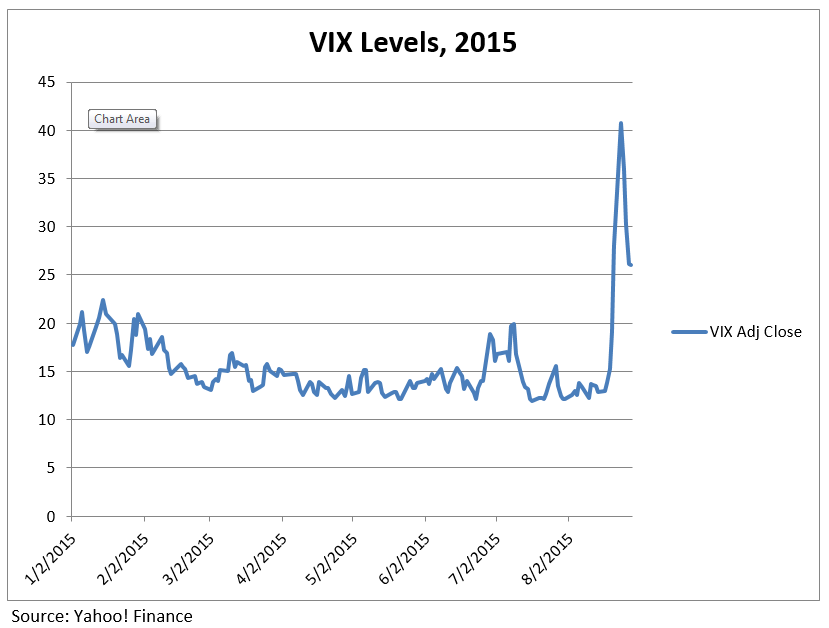

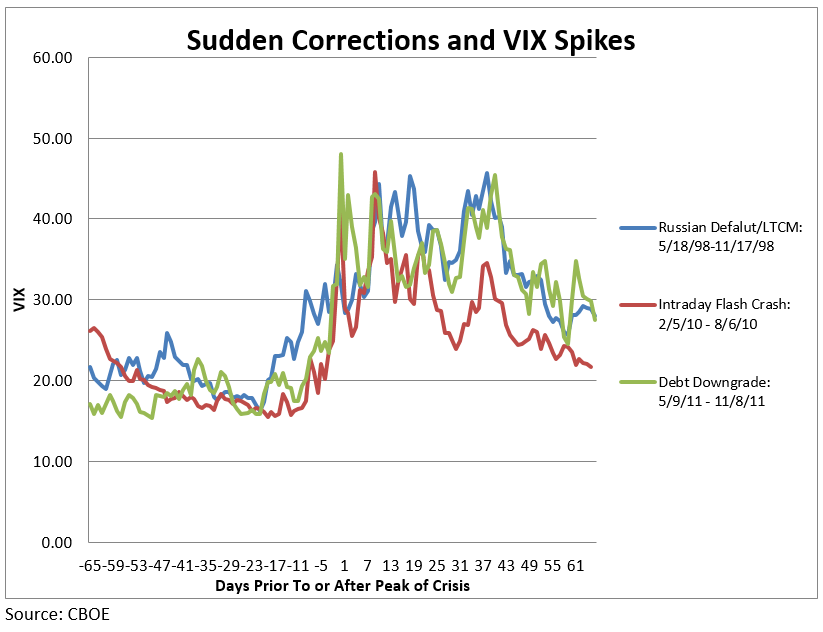

One possible scenario is that the market can quickly recover from this bout of instability and continue on its upward trajectory as if nothing happened. Such scenarios have happened before- think of the Russian default/Long-Term Capital Management debacle of August 1998, the “flash crash” of May 6th, 2010, or the Treasury downgrade of August 2011. Such a scenario is favorable to Swan’s income-generating strategy, which relies partially on moderate levels of volatility in the markets to be profitable. For most of 2015 the VIX, commonly used as a proxy for volatility or “fear”, has been complacent and stuck in the low/mid-teens.

Typically after a correction there is what we call a “hangover effect” where worry creeps in to the market and short option trades are able to command a much higher level of premium, as seen in the graph below. Such periods have historically been quite favorable to Swan’s income trades. See more in our post on recent market volatility.

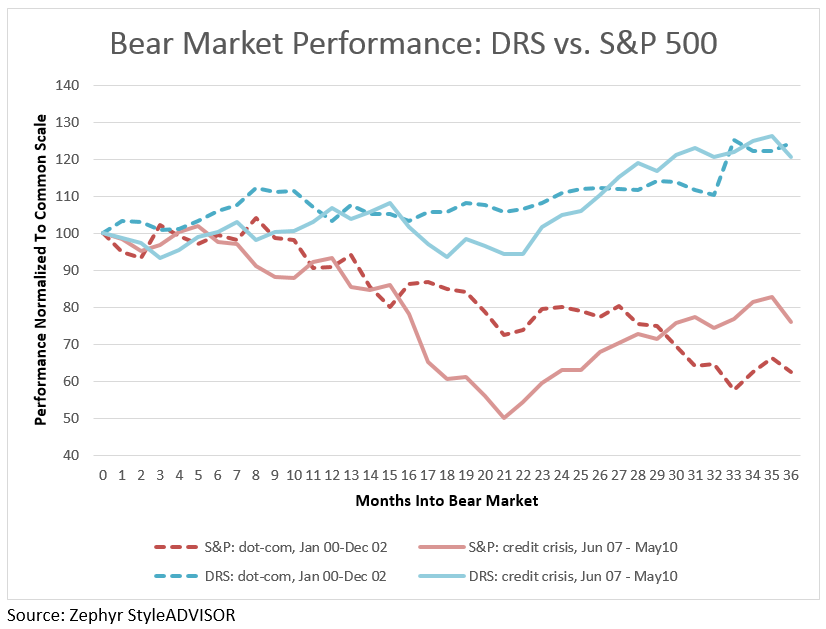

Alternatively, this sell-off could herald the coming of a long-predicted bear market, following an almost uninterrupted bull market initiated in early March 2009. It is important to remember that the DRS was designed specifically for the latter scenarios, the big bear markets that wipe out investor wealth. In such environments traditional asset allocation, stock-picking at market timing often fail to adequately address market risk. The DRS was created to outperform over a long period of time, not a short period of time.

The graph below shows the performance of the DRS Select Composite and the S&P 500 during the dot-com crash of 2000-02 and the Financial Crisis of 2007-08, normalized to the same scale. During these environments, two of the three components of the DRS are usually contributing value.

First of all, the long-term put option used to hedge market risk becomes increasingly valuable the more markets sell off. If markets sell off significantly, Swan has historically used the opportunity to harvest gains in the put and re-invest in the equity market when the markets are at depressed levels. Second, the increased volatility during bear markets has historically been conducive to the DRS’s income generating strategy.

It is also important to acknowledge that no strategy will always work in every conceivable environment. Faced with that reality, Swan has strategically chosen to accept potential short-term losses from selling short term options, as seen during this recent correction, in exchange for longer term growth opportunities. More often than not such trades are profitable, and help make the long-term, market protection possible. In the short-term, the DRS might appear less appealing than alternative strategies focused on short-term market movements, rather than a longer term growth objective. However, the DRS was designed to be successful over full market cycles, extending years, not days.

For a detailed white paper on this topic, click here.

S&P 500- The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market.

The CBOE Market Volatility® Index (VIX) shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the “investor fear gauge”.

Source for VIX and S&P 500 data: CBOE and Morningstar

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.www.swanglobalinvestments.com. 039-SGI-090115