This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksAlbert Einstein supposedly once said that the most powerful force in the universe is compound interest. Naturally, investors seek compound growth, but they often fail to capture its full benefit.

The principle of compound growth can be defined as the power of exponential growth, that is, growth on growth. It’s like a snowball effect whereby you receive growth, not only on your original investments, but also on any interest, dividends, and capital gains that have accumulated — thus, your money can grow faster and faster as time goes on.

Recently we released a white paper called “Math Matters: Rethinking Investment Returns & How Math Impacts Results.” The choice of a title was deliberate: math really does matter to the ultimate success or failure of an investment plan.

However, the irrefutable truths of these mathematical principles sometimes get lost when fear and greed take over the investor’s mind. The white paper seeks to fortify rational investors by proving the importance of four mathematical concepts, namely:

The importance of variance drain/volatility drag

The value of a non-normal distribution of returns

In future blog posts, we will discuss the latter three points, but this post is focused on the power of compounding returns.

While it sounds simple, the concept of compound growth and its impact can be a difficult one to grasp.

Why is compound growth so important and how does it impact the returns one might achieve with an investment?

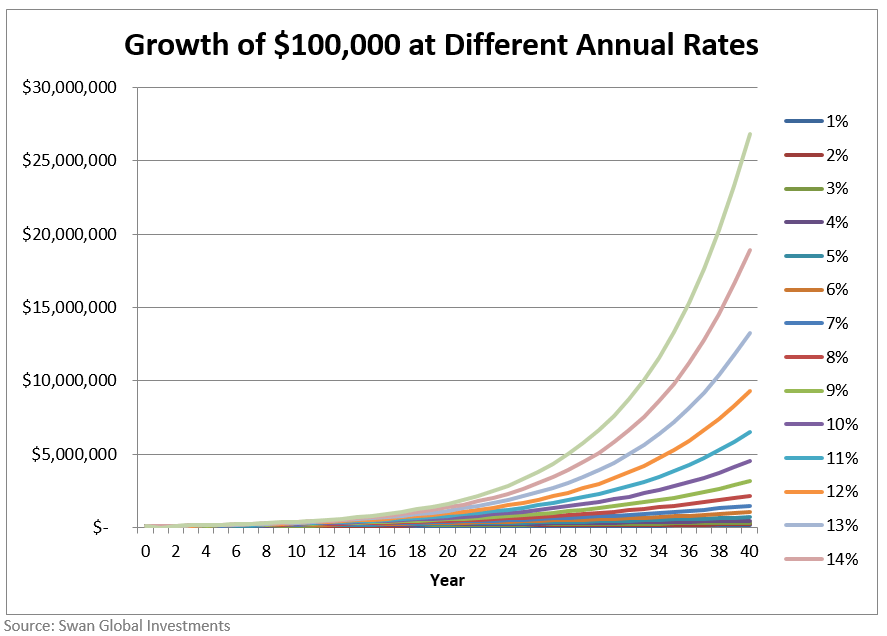

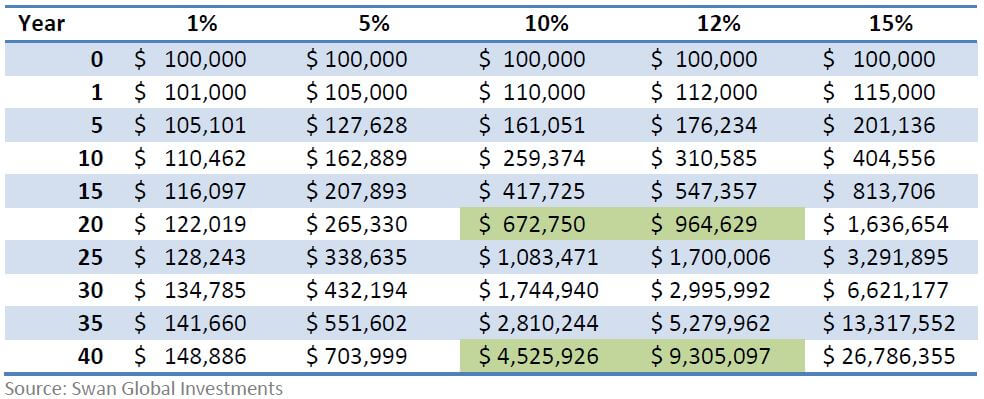

One of the best ways to illustrate the power of compound growth is through a simple hypothetical illustration.

There are two major takeaways from this illustration. The first being:

After 20 years, an initial investment of $100,000 that grows at a 12% annual rate is worth $964,629; a gain of $864,629. Not bad at all. However, over the following 20 years that $964,629 grows to $9,305,097, an increase of $8,340,468 (highlighted in the table below). That is the power of compounding returns.

The separation in the lines of the chart above, and the difference between the numbers in the table below, is not significant until years into the investment timeline. That means investors need to remain invested to allow for the time that compound growth needs to work its magic.

Viewed another way, the difference between a 10% annual rate of return and a 12% annual rate of return on an initial investment of $100,000 is only $291,879 after 20 years: $672,750 vs $964,629, respectively.

However, after 40 years the difference is immense. Those extra 200 basis points will more than double the value of an investment: $4,525,926 at 10%, $9,305,097 at 12%.

Of course, this is a theoretical example meant to illustrate a mathematical point. In the real world, it’s safe to say no one has ever seen an investment that has provided a constant 10%, 12%, or 15% annual return over 40 years with zero volatility, or fluctuation, in value over a given period.

This highlights the second major take-away from this illustration:

The hypothetical case above represents an ideal scenario: positive returns with no risk, no volatility, and no losses. In the real world, anything that causes a “reset” to the value of an investment will be detrimental.

In conclusion, yes, compound returns are a wonderful thing. However, the compounding power will be severely undermined by large losses and volatility. The extent to which large losses and volatility can limit or even overwhelm the power of compounding returns will be explored in future blog posts in this series.

Learn more about Swan’s DRS investment approach is designed to help investors remain invested and reduce volatility.

Examine the differences between the goals, track records and drivers of success between the Swan DRS and tactical asset allocation strategies.

NEXT ARTICLEMarc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. This analysis is not a guarantee or indication of future performance. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com. 154-SGI-062816