This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksInvestors need the return potential of stocks to grow wealth and outpace inflation.

Yet stock market investments expose investors to a bumpy ride with unpredictable periods of severe losses.

The trouble with ‘buy and hold’ is that a bumpy ride makes it hard to know when to buy and difficult to hold on.

Bumpy rides often cause investors to ‘buy and fold’ – causing detrimental effects on long-term results.

Financial plans are built with the best of intentions and generally assume a consistent return.

But the reality is, the stock market is unpredictable.

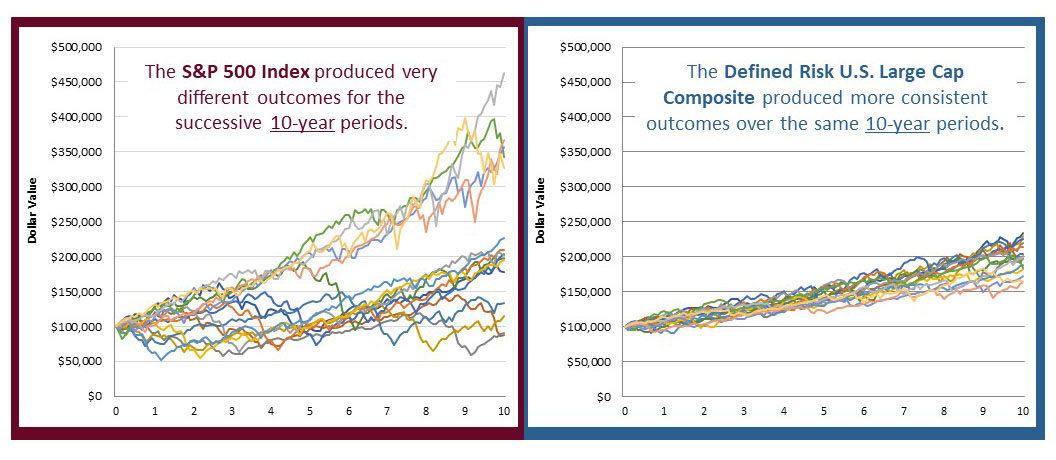

Which looks like a smoother ride to you? Which would you prefer in building a financial plan?

Source: Zephyr StyleADVISOR and Swan Global Investments. The chart shows sixteen 10-year period returns; the first period is from January 1, 1998 through December 31, 2007 and the last period is from January, 2013 through December, 31 2022, for the S&P 500 Index and the Swan Defined Risk US Large Cap Sectors Select Composite, net of fees. The S&P 500 Index is an unmanaged index, and cannot be invested in directly. NOTE – this chart is for illustration purposes, not a guarantee of future performance. The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions.

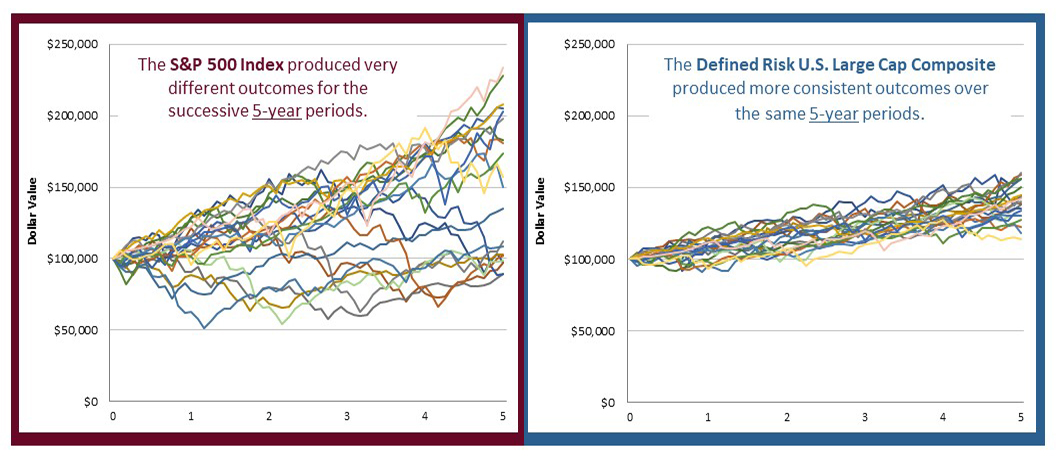

Let’s consider shorter-term investment periods.

Over 5-year rolling periods, the outcomes for investments in the S&P 500 are also far from consistent, with many resulting in a loss of principal.

Our hedged equity approach provided investors with a narrower range of outcomes, all of which are positive, and a smother investment experience overall.

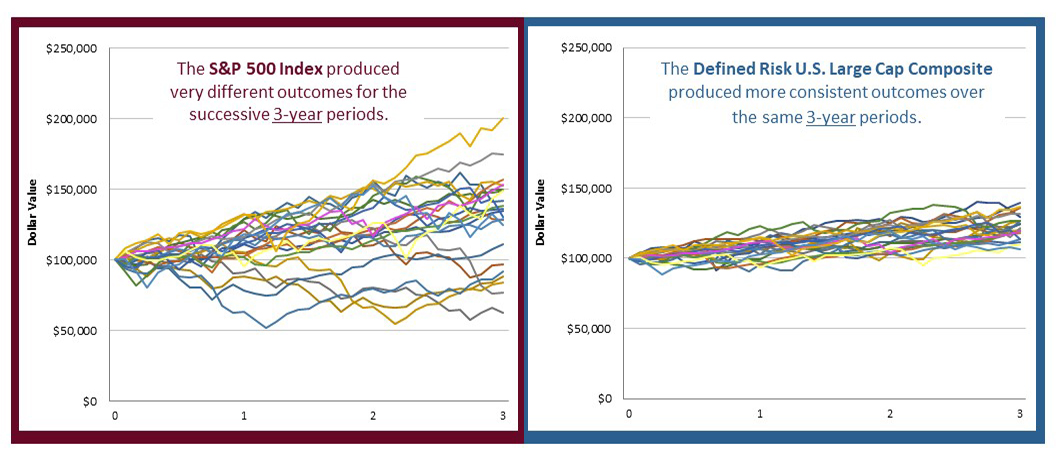

Source: Zephyr StyleADVISOR and Swan Global Investments. The graphs above show an investment of $100,000 over twenty-three successive, 3-year investment periods. The first period is 1/1998 to 12/2000; the last period is 1/2020 to 12/2022, for the S&P 500 Index and the Swan Defined Risk US Large Cap Sectors Select Composite, net of fees. The S&P 500 Index is an unmanaged index, and cannot be invested in directly. NOTE – this chart is for illustration purposes, not a guarantee of future performance. The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions.

Looking at an even shorter time frame, the outcomes for 3-year investment periods in the S&P 500 Index again prove to be far from consistent, with many periods resulting in loss of capital.

Our Defined Risk Strategy again provided investors a smoother investment experience and a tighter range of outcomes.

Source: Zephyr StyleADVISOR and Swan Global Investments. The chart shows sixteen 10-year period returns; the first period is from January 1, 1998 through December 31, 2007 and the last period is from January, 2013 through December, 31 2022, for the S&P 500 Index and the Swan Defined Risk US Large Cap Sectors Select Composite, net of fees. The S&P 500 Index is an unmanaged index, and cannot be invested in directly. NOTE – this chart is for illustration purposes, not a guarantee of future performance. The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions.

Over time, the S&P 500 Index has proven to be a bumpy ride with inconsistent returns, creating outcome uncertainty.

By reducing volatility and bear market impacts, our strategy helped smooth the ride and produce consistent outcomes.

“Market risk, also called ‘systematic risk’, cannot be eliminated by diversification, though it can be hedged against.”

– Investopedia

Our distinct combination passive equity investing with active risk management helps investors navigate and capitalize on unpredictable crises and bear markets, to seek consistent outcomes through market cycles.

Learn more about the key tenets of the Defined Risk Strategy.

Additional Disclosures: Swan Global Investments, LLC (“Swan”) is an independent Investment Advisory company headquartered in Durango, CO. Swan is registered with the US Securities and Exchange Commission under the Investment Advisers Act of 1940. Note that being an SEC registered Investment Adviser does not denote any special qualification or training. Swan offers and manages The Defined Risk Strategy (“DRS”) for its clients including individuals, institutions and other investment advisor firms. Swan Global Investments has affiliated advisers including Swan Global Management, LLC, Swan Capital Management, LLC, and Swan Wealth Advisors, LLC. There are nine DRS Composites offered: 1) The DRS Select Composite which includes non-qualified accounts. 2) The DRS IRA Composite which includes qualified accounts. 3) The DRS Composite which combines the DRS Select and DRS IRA Composites. 4) The DRS Institutional Composite which includes high net-worth, non-qualified accounts that utilize cash-settled, index-based options held at custodians that allow participation in Clearing Member Trade Agreement (CMTA) trades. 5) The Defined Risk Fund Composite which includes mutual fund accounts invested in the S&P 500 equities. 6) The DRS Emerging Markets Composite which includes mutual fund accounts invested in emerging markets equities; 7) The DRS Foreign Developed Markets Composite which includes all research and development account(s), and mutual fund accounts invested in foreign developed markets equities; 8) The DRS U.S. Small Cap Composite which includes all research and development account(s), and mutual fund accounts invested in U.S. small cap equities; 9) The DRS Growth Composite which includes all research and development account(s), and mutual fund accounts invested in the S&P 500 equities. Additional information regarding Swan’s policies and procedures for calculating and reporting performance returns is available upon request.