This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksHedged equity is an increasingly popular term in investing. But what exactly is hedged equity? How can you use hedged equity in a portfolio? What are examples of hedge equity strategies? If you’re looking to answer any of these questions, we tackle all of that and more below.

Before we dive into the direct meaning and use-cases of hedged equity, first, we must define what a hedge is. If you are familiar with the definition of a hedge, feel free to skip ahead to the more advanced topics listed in the table of contents below.

Investopedia defines a hedge as “an investment that is made with the intention of reducing the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting or opposite position in a related security.” Now let’s break this down in simple terms.

A hedge, in essence, is similar to the concept of an insurance policy. In this article, we will be primarily focusing on hedging equity. So the goal of a hedge in hedged equity is to offset the potential risk of loss in your equity (or stock) asset. The Investopedia definition mentions “taking an offsetting or opposite position in a related security,” meaning the hedge is intended to move in the opposite direction of the equity, also known as inverse correlation.

Periods of large losses in the equity markets are inevitable and generally unpredictable. Hedging may mitigate one’s losses when the equity markets fall. The hedge is an offsetting position to the underlying equity asset—if the equity falls in price, the hedge gains in price, and vice versa.

There is an inherent risk-reward tradeoff when hedging. Relating back to the insurance analogy, if you purchase a fire insurance policy, there is a fee or premium to be paid. While the cost of the policy can add up over time, most individuals would choose a defined loss (policy premium) rather than losing a significant amount or all of their precious belongings in a fire. Similarly, while a hedge is not insurance, a hedge can mitigate the risk of loss, for a cost.

With a high-level definition of a hedge established, let’s dive into the meaning of hedged equity.

Hedged equity involves buying equity in some form, as an underlying investment, and then securing a hedge to potentially offset losses connected to market risk (i.e., the whole market sells off or the economy slows due to unpredictable events, like COVID-19 or a mortgage crisis).

There are many ways to hedge equity, such as options contracts, futures contracts, or other investments in assets believed to be non-correlated to (i.e move in the opposite direction as) the underlying investment (like gold or bonds) during various marketing conditions. Put options, for example, are options contracts that are inversely correlated to the underlying investment, and therefore may serve as an effective hedge to offset losses in the equity investment.

While hedging is often considered a short-term tactic, long-term investors may want to consider the benefits of a long-term hedging strategy.

Not all hedged equity strategies are the same, and that’s why it’s essential for investors to do the necessary due diligence along with speaking to an investment advisor before making investments in hedged equity strategies or funds, as well as, selecting a hedged equity asset manager.

Recently there has been a lot of justified interest in using hedged equity in a portfolio to address challenges in the current investment landscape. The question many investors ask is, “where does it fit in a portfolio?” Generally that question is followed by, “how much-hedged equity is enough?”

Incorporating hedged equity into a portfolio can be a little bit tricky for many investors in the sense that it’s neither fish nor fowl. Meaning hedged equity doesn’t fit neatly in the traditional pigeon holes that we have in conventional portfolio construction methodology. However, the ambiguous nature of hedged equity is advantageous as it allows you to use the same solution for different rolls.

Below we provide several portfolio implementation ideas for hedged equity. It is important to note, such decisions should be based on an investor’s overall investment objectives and risk tolerance.

Objective: Reduce risks associated with bonds (duration, inflation, credit), increase return potential.

Traditionally, bonds have played two roles within a portfolio: generation of yield and protection of principal (used to offset or hedge against stock market volatility).

For over 3 decades, bonds have enjoyed a bull market as interest rates declined, and bond values rose. However, the monetary policy of ultra-low or even negative interest rates worldwide and massive liquidity injections into the financial system has eroded bond yields, hurting savers and those counting on the ‘income’ form bond yields. As such, savers are now forced to choose between yield or protection of principal—they cannot have both. For more on this, see here.

Against this backdrop, it’s no wonder many analysts and investment managers have a rather bearish outlook on bonds and pessimistic about the 60/40 portfolio (consisting of 60% stocks, 40% bonds).

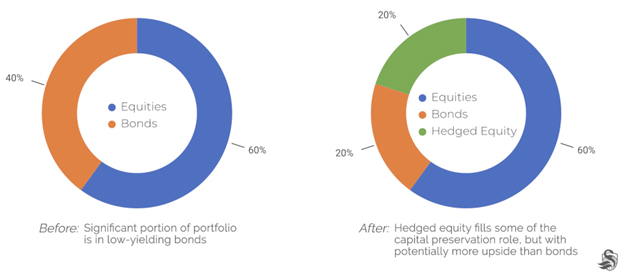

As such, investors are increasingly seeking other options to provide some capital preservation within their portfolios. Hedged equity can serve as a surrogate to bonds to serve that role.

Consider the 60/40 portfolio.

Investors could take a portion of the portfolio invested in bonds and reallocate it to hedged equity. For example, 60% equities, 20% bonds, and 20% hedged equity.

Adding hedged equity in this way may allow you to increase exposure to equity markets in order to seek necessary returns, while mitigating portfolio risk and reducing exposure to risks associated with bonds.

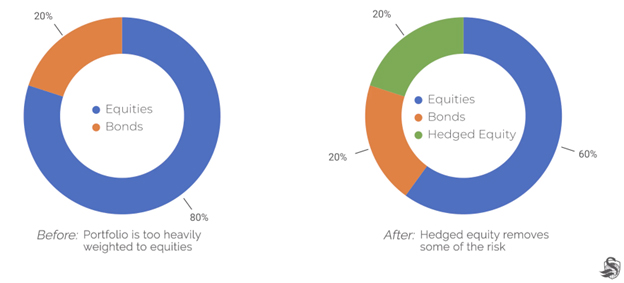

Objective: Reduce overall portfolio volatility and drawdown risk.

For investors with a more aggressive, growth-orientation to their portfolio, hedged equity can help offset some overall risk while maintaining the ability to participate in potential equity market growth.

For example, having an aggressive portfolio investing 80% in stocks or equities and 20% bonds, hedged equity can help take some risk off the table.

To offset some of portfolio risk, you can take a portion of your equities and reallocate them to hedged equity. For example, your portfolio could be split as follow: 20% bonds, 60% equities, and 20% hedged equity. As a result, your portfolio may move less wildly up or down in relation to moves in the equity market (i.e. reduce the portfolio’s beta), while maintaining the potential to participate in market growth over time.

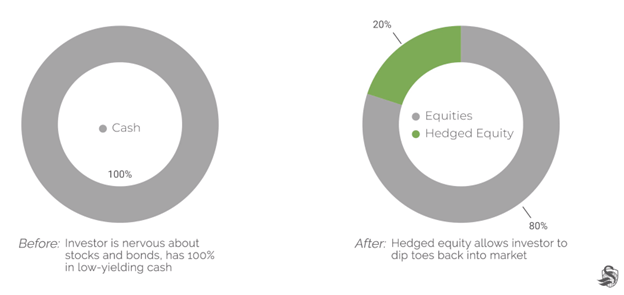

Objective: Re-enter equity markets (move cash off the sidelines) while mitigating risk.

Recent market events, such as the 2008 Global Financial Crisis or the Covid-19 Crisis, loom large on the minds of many investors. During and after such events, many investors are nervous about stocks and bonds and move some or even all of their money into cash. Often this means ‘selling low’ after big market losses and waiting too long to re-enter the markets, which can cost you over time.

While the risks inherent in investing are real, and the fear of big losses is understandable, to achieve long-term goals, and to outpace higher inflation, it is important to remain invested with a long-term view.

For those who are looking to re-invest large cash positions, hedged equity is a great way to ease back into the market without all of the risk. You could utilize 20% or more of your cash holdings to establish a hedged equity position for your portfolio to achieve market participation and risk mitigation.

To help you determine how much to invest in hedged equity, consider these three concepts.

Remember, the amount of your portfolio you devote towards hedged equity should be significant enough to move the needle. If you only have 5% of hedged equity, that won’t likely change the overall risk or return profile of your portfolio.

The investing landscape has been redefined—they face a dual dilemma in bond and stock markets. Thus, investors should consider building a redefined portfolio.

Given the dire outlook for the bond market and high valuations in the equity market, hedged equity strategies and funds, which generally fall under the ‘options-based’ category, are becoming increasingly popular.

Hedged equity strategies can be quite diverse, and one of the best ways to make sense of them is to identify their objectives, benefits, risks, and drivers of return.

It is critical investors and advisors conduct their own due diligence. Knowing what you own is the first part of this process. As with any investment, it’s also important to remember your investment objectives, risk budget, and investing timeline.

For a quick guide on due diligence into Hedged Equity

To help investors understand and select from the various ‘options’ within hedged equity category of investments, we provide a range of educational post, some of which are technical in nature, that describe, compare and contrast various options-based and hedged equity strategies.

Utilizing tools such as Riskalyze, TIFIN Personality, and FinaMetrica can not only help you determine your risk tolerance or risk capacity but also help determine the riskiness of investments and then model out scenarios to forecast potential portfolio impacts. You can also compare such strategies on Morningstar or Magnifi.

Choosing the right hedged equity asset manager is crucial when including such strategies or funds into your portfolio.

Point to consider include:

Here are some examples of hedged equity Mutual Funds, SMA’s and ETF’s

Swan Resources & Education

Our portfolio managers and analysts are dedicated to creating relevant, educational articles, podcasts, white papers, videos, and more.