Emerging markets across the globe continue to present investors with attractive opportunities. As we enter the final days of 2019, many analysts and economists continue to highlight that equity valuations in developing nations remain far below those of listed companies in the United States. This has sent a signal that there may still be considerable uncaptured value within emerging economies, especially ones that are poised to benefit from dovish global monetary policies and the recent pause in international trade tensions.

The long-perceived uncertainty and volatility within emerging markets, however, leads many investors to foster a strong domestic bias when allocating capital. This bias often intensifies as investors approach, or enter into, retirement. But if there was a way to retain emerging markets exposure while remaining effectively hedged, it might be easier to break clients’ bias.

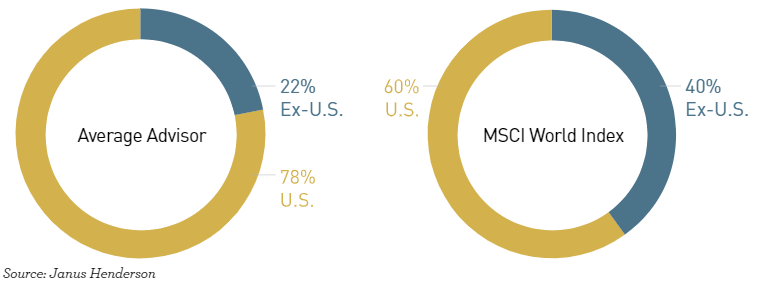

While flows into the Morningstar International Equity category have far exceeded flows into the U.S Equity category over the last three years, the average investors’ global equity allocation is still only about 22% in international equity. This figure pales in comparison to the 40% for the MSCI World Index, as shown below.

Emerging market equities present a great long-term opportunity for investors seeking total return in a low-yield world. The developing nations that indices reflect are closely related to their more developed neighbors. For example, a developing country can easily take advantage of the technological breakthroughs of its more economically advanced neighbors through trade and knowledge spillover. When economies like the United States are performing well, they can hypothetically “pull up” their neighbors through expanding demand for cheaper inputs, like labor, that an emerging market can provide.

Unfortunately, this direct relationship can work in the opposite direction as well. In the aftermath of the 2008 financial crisis, emerging markets experienced negative external pressures on their economies, such as declining trade and deleveraging by foreign banks. According to the International Monetary Fund, real output in emerging markets, on average, fell by 4% during the strongest part of the recession[1].

For parts of this year, emerging markets were suffering from the actions of global powers. The United States-China trade war and other escalating political tensions have turned some financiers away from valuable developing regions. Investors have pulled over $1 billion out of emerging market equities, according to a survey conducted by EPFR Global, a flow tracking group[2].

When the emerging markets take a downward turn, it can happen suddenly and in dramatic fashion. This table shows the largest drawdowns in the MSCI EEM Index since inception January 1988 through December 2018:

Swan Global Investments and Zephyr StyleADVISOR.

During such times, speculators panic and sell off their investments, often at or near the trough of the asset’s price. Emotional investing like this can impact long term success on a portfolio. After selling low, it can take years to catch up, with investors frequently waiting too long to jump back in.

Market timing, especially in emerging markets, can be detrimental to the success of a long-term investment strategy. Instead, creating a contingency plan that factors in bearish periods may minimize one’s losses.

At Swan Global Investments, we take a non-traditional approach to addressing domestic bias. Our Defined Risk Emerging Markets Strategy employs our distinct hedged equity approach to provide investors exposure to long-term growth opportunities in emerging markets while hedging risks. Because we are focused on long-term investing, we use long-term put options to hedge against emerging market declines, like the one we were witnessing at the peak of the trade war. Because puts are engineered to increase in value when their underlying equity decreases in price, they minimize the losses an investor can accrue during a bear market or sharp decline.

Through this distinct counter balanced approach, investors can remain always invested to participate in the upside potential in emerging markets and always hedged to mitigate risks of an unpredictable bear market.

While a trade war can be concerning for any investor, Swan Global Investments is confident that using long term hedges to address the systematic risk associated with volatile emerging markets is a wise strategy. We believe this approach will help investors spend less time falling and catching up, and therefore, their capital can spend more time compounding.

Although international investments can present a unique set of risks that investors should consider carefully, adding foreign exposure can enhance portfolio diversification, potentially lowering risk over long-term horizons while allowing investors to take advantage of growth potential outside the United States.

[1] How Did Emerging Markets Cope in the Crisis?, International Monetary Fund, 6/15/2010

[2] Emerging markets are bearing the brunt of the trade war. But they will fight back, CNBC, 5/21/2019

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 448-SGI-111919