We understand the challenges that many institutions face, particularly the need to achieve their spending targets in a low yield environment.

Striking the balance between risk asset exposure to generate returns and providing sustainable income is critical to meeting spending obligations or funding the mission over market cycles.

Low yields have pushed many to move to riskier higher yielding investments, but there are other ways to meet spending objectives.

The key is to avoid large losses while growing capital over market cycles.

Adding the DRS may reduce the lasting impact major drawdowns have on account funded status.

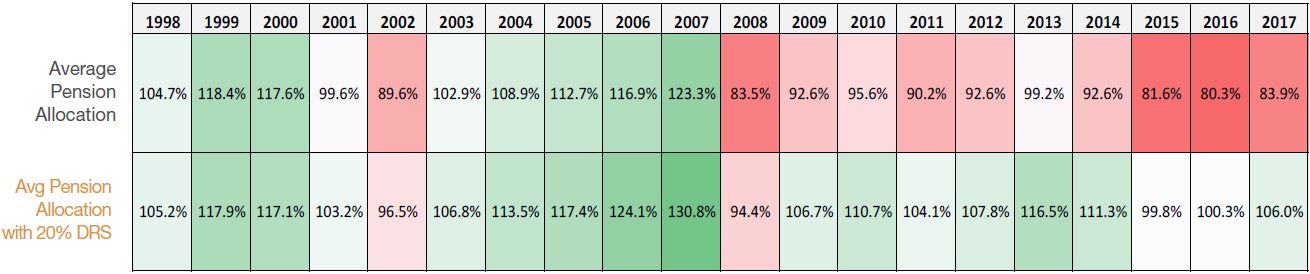

The table below presents the annual funded status, after distributions, of the average large pension allocation* from 1998 through 2017.

Source: Zephyr StyleADVISOR, Swan Global Investments, Bloomberg, CBOE, St. Louis Federal Reserve Bank and Wilshire Associates, Inc.. Hypothetical analysis above is using actual results from the Defined Risk Strategy (DRS) Select Composite, net of fees. * Assumed model allocation for the Average Pension Allocation are as follows: 39% S&P 500; 16% EAFE; 25% U.S. Fixed Income; 15% Commodity; 5% Cash. Past performance is no guarantee of future results.

Want to learn more about Facing Funding Challenges?

Many institutions are facing rising costs, yet their need for income persist.

For example, over the last 10 years, the year-over-year increase in the Commonfund HEPI is 2.34%.

Coupled with an average 5% spending rate, future portfolio returns would need to exceed 7.34% to maintain their spending power. Source: Commonfund Higher Education Price Index (HEPI), 2016 Update.

In a world hungry for income and ways to reduce risk, the Swan Defined Risk Strategy may be a prudent alternative vehicle for sustainable portfolio income.

With a track record of limiting bear market impacts and consistent returns through cycles, the Swan Defined Risk Strategy (DRS) may help sustain spending policies, while providing growth of capital.

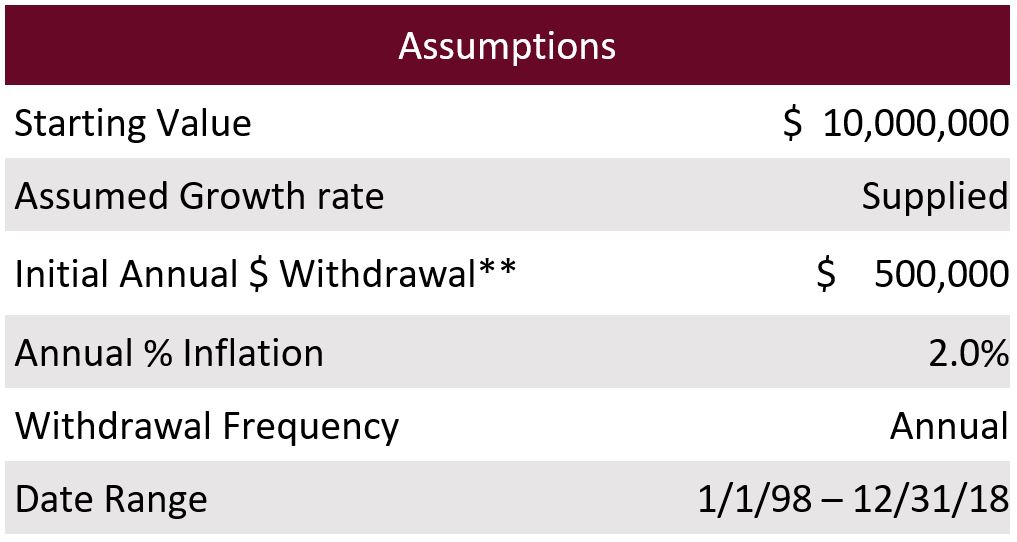

Source: Zephyr StyleADVISOR, Swan Global Investments * All data based on historical performance of the Swan DRS SMA Select Composite, net of fees. ** Calculations include a fixed annual withdrawal, starting at $500,000 in the first year. Each year thereafter that annual withdrawal amount is adjusted for inflation.