This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanks

A good starting place for understanding a put-spread collar is a basic collar. The two are closely related. The put-spread collar is a variation of the collar, with more upside potential coupled with more downside risk.

A basic, traditional collar typically has three components:

The put-spread collar is a variation to the traditional collar’s long equity + long put hedge + short call premium. It takes a fourth position, selling put options at a strike price some distance below the long hedge put option to generate additional monies to combine with the short call premium to cover the hedge costs.

The primary benefit to this approach versus a traditional collar is that the additional premium from the put option sale allows the manager to raise the strike price on the call and therefore raise the cap. The cost for the increased cap, however, is that the investor accept protection limited to the range between the long put (hedge) and the short put strikes during the collar term.

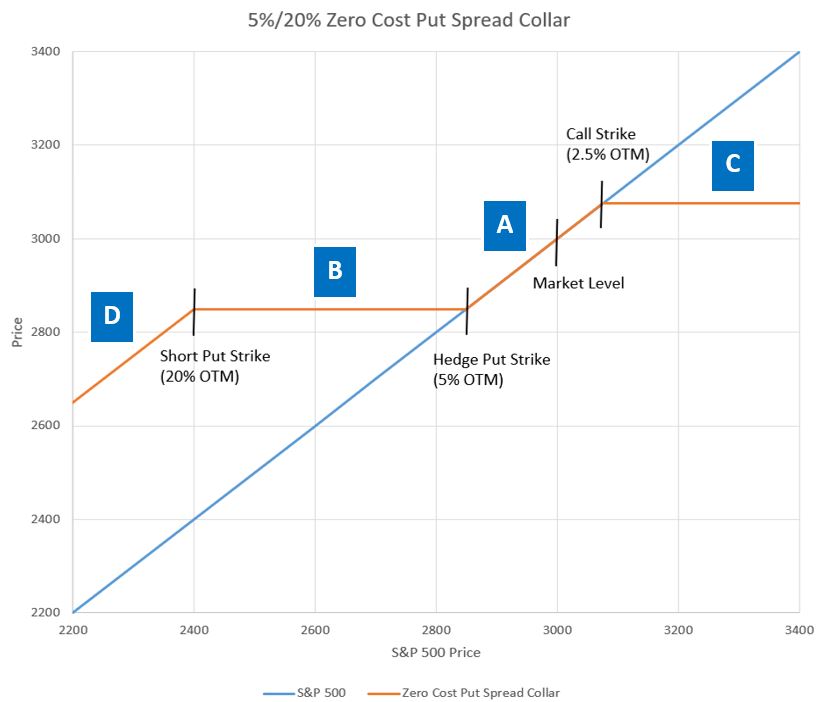

Profit and loss versus the market (S&P 500) is depicted in the following illustration. Notice that the hedge and short call strikes are more symmetric in their position relative to the current market level than the traditional collar’s positioning of these securities. Specifically, more upside is possible (2.5% in this case) due to the premium received from selling the put option (i.e. 20% OTM).

Source: Swan Global Investments

There are four positions that compose a put-spread collar. Likewise, there are four “zones” in the above graph detailing the return profile of the put-spread collar. In each of the zones, one of the four positions dominates or drives the returns of the put-spread collar.

A. In zone “A” the long exposure to the market or reference assets drives returns and the trade matches the moves in the market.

B. In zone “B” the long put option hedges against losses. The market is down but the trade doesn’t participate in those losses in zone B.

C. In zone “C” the short call position drives returns. The market may be up but those gains have been sold away. The put-spread collar does not participate in market gains in zone C.

D. Finally, in zone “D” the put-spread’s returns are driven by the short put position. The trade is exposed to market losses in this range.

While the primary driver of the put-spread collar strategy’s returns is the movement of the market itself, whether or not the trade will participate in the market returns depends upon the degree to which the market moves.

There are two primary risks to the put-spread collar. The first risk is to the upside: the put-spread collar sells off its upside potential past a certain point. This is best viewed as an “opportunity cost”, where potential gains are forgone.

The second primary risk is to the downside. There exists open-ended risk to the downside due to the short put position. The long put hedges losses up to a certain point, but beyond that point there is no cap to the downside in a put-spread collar.

While the traditional collar is like health insurance with a maximum out-of-pocket cost once you satisfy a deductible, the put-spread collar strategy is like dental insurance which has a deductible + maximum coverage during a specified period. The investor takes more risk for more upside (i.e. higher upside cap). Assuming the manager can place the downside cap (i.e. short put) below normal market declines during the design term (e.g. 1 month, quarterly, yearly, etc.), the investor can profit with higher upside which over extended periods of time can combine for significant return.

In addition, there are some other risks that are harder to quantify. These are based upon volatility conditions as well as “skew” (i.e. the relative price between puts and calls). The primary, up-front cost to establishing a put-spread collar will be the cost of the long put position. During times of elevated volatility or market stress, the purchase price of those long puts might be rather expensive. The investor might have to take on significant risk by either 1) capping upside potential or 2) taking on the risk of further losses in order to generate enough income to purchase the long put required for hedging.

On the risk-return spectrum, the put-spread collar is slightly more aggressive than a traditional collar and but is certainly more conservative than an unhedged position. The put-spread collar would most likely fill a capital preservation role coupled with some modest growth potential.

However, it is essential that investors realize put-spread collars do not hedge against “fat tail” or “black swan” risk– i.e. the small probability of an extreme loss. If anything, “fat tail” or “black swan” risk is the Achilles’ Heel to put-spread collars. While put-spread collars are a useful tool in an investor’s tool box, if the investor has absolutely no tolerance for losses, a put-spread collar would not be appropriate.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, FRM®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. His responsibilities also include producing most of Swan’s thought leadership content. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments is an SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (DRS). Please note that registration of the Advisor does not imply a certain level of skill or training. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance that future performance will be comparable to past performance. This communication is informational only and is not a solicitation or investment advice. Further information may be obtained by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 254-SGI-100121