With historically low yields, many institutions have steadily increased equity exposure, yet their return expectations for equities are diminishing.

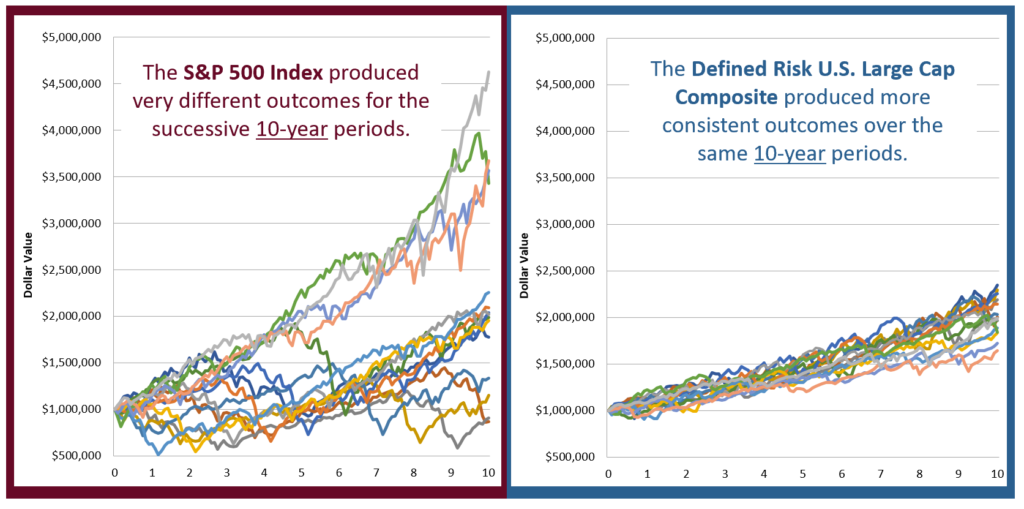

Consistency of Returns – Sustainability of Impact

Return consistency through market cycles, by reducing the impacts of equity market drawdowns, is critical to funding the mission or meeting long-term obligations.

Our rules-based, hedged-equity approach has a proven track record of generating consistent long-term outcomes through cycles.

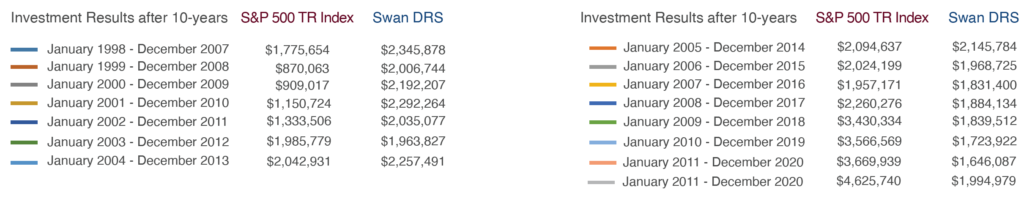

Source: Zephyr StyleADVISOR and Swan Global Investments. All S&P 500 data based on the historical performance of the S&P Total Return Index. All historical performance of the Swan DRS Select Composite is net of fees. Prior performance is not a guarantee of future results.

The graph above shows an investment of $1,000,000 held over sixteen successive, 10-year investment periods. The first period is 1/1998 to 12/2007; the last period is 1/2013 to 12/2022.

By remaining always invested for growth and always hedged for protection, our Defined Risk Strategy (DRS) may serve institutional investors seeking consistent outcomes through full market cycles.