Consultants are now under more pressure to provide innovative and effective solutions.

Following an extended bull run for both bonds and equities, future returns of many traditional investing strategies are unlikely to duplicate past success.

To meet the long-term or even perpetual objectives of their clients, consultants are realizing that they may need to take more risk, including adding equity exposure. Yet few clients are in a position to tolerate volatile rides, let alone a major drawdown.

Consistency of returns, portfolio resiliency and sustainable income are of premium concern, but solutions seem scarce.

Striking the balance between risk asset exposure and providing capital preservation is critical to meeting future obligations over full market cycles.

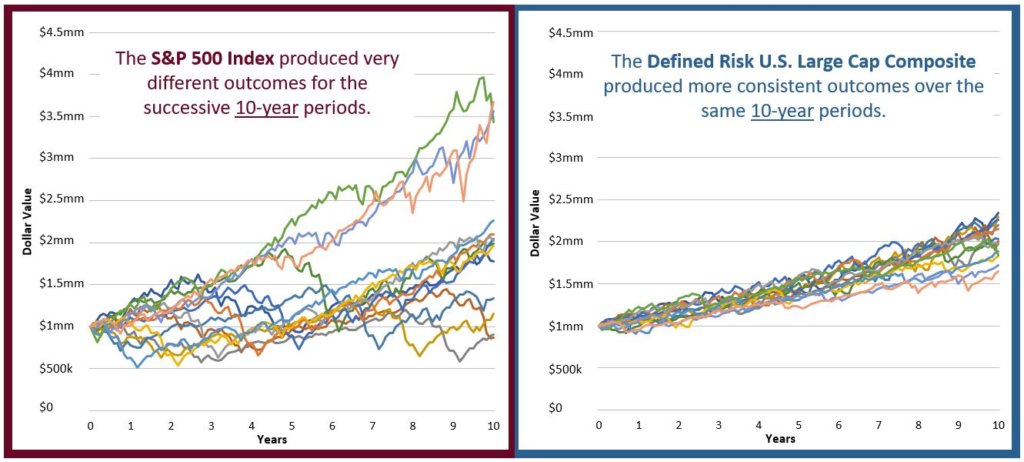

Consistency of returns and downside protection are hallmarks of the Defined Risk Strategy.

Institutional investors are in search of ‘non-correlation’. Yet many still rely on historical correlation assumptions when constructing portfolios. But 2008 showed historical assumptions can lead to a false sense of diversification.

We apply a distinct, time-tested approach to using put options, a truly inversely correlated asset, to protect capital.

The Risk That Really Hurts

Many institutions are one large drawdown away from drastic changes in spending, insolvency or worse. In such cases a view of relative loss won’t matter.

If the loss is big enough, such disastrous outcomes are likely.

Relative or Absolute – Pick Your Poison

Our focus has always been on absolute risk.

We use put options to directly address market risk and minimize absolute loss.

Since 1997, our Defined Risk Strategy has been tested by a vast array of market conditions, but has successfully and consistently minimized absolute loss on an annual basis.

Source: Zephyr StyleADVISOR and Swan Global Investments. All S&P 500 data based on the historical performance of the S&P Total Return Index. All historical performance of the Swan DRS Select Composite is net of fees. Prior performance is not a guarantee of future results.

Our Defined Risk Strategy (DRS) is applied to many asset classes and can be accessed via several structures, including custom portfolio overlays and separately managed accounts to help consultants deliver against a wide range of mandates and long-term objectives.