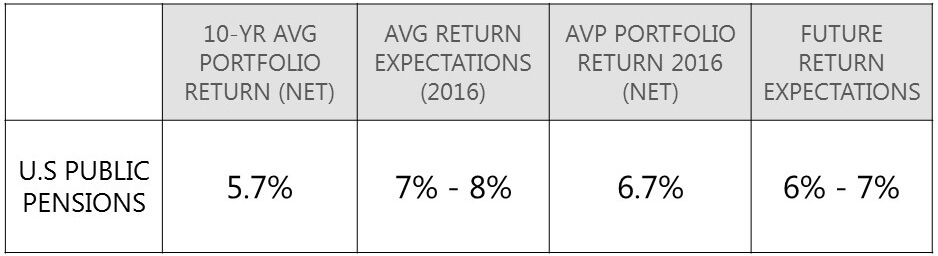

As public and private pensions lower return expectations, a low-yield environment challenges their ability to maintain obligations and funded status.

Consistency of returns, portfolio resiliency, and sustainable income are of premium concern, yet solutions seem scarce.

Source: Public Plans Data produced by the Center for Retirement Research, 2016 OECD Survey, and 10-year pension portfolio return data from Cliffwater, LLC report data 9/30/17.

In the midst of the second longest equity bull market in history, coupled with historically low yields, many institutional investors are tempering their return expectations.

Many institutions are facing rising costs.

For example, over the last 10 years, the year-over-year increase in the Commonfund HEPI is 2.34%.

The margin for error is diminishing.

Many public pensions are underfunded and some are facing insolvency if another major drawdown occurs.

Striking the balance between risk asset exposure to generate returns and providing sustainable income is critical to meeting future obligations over full market cycles.

Consistency of returns and downside protection are hallmarks of the Defined Risk Strategy.

The Swan Defined Risk Strategy (DRS), launched in 1997, is a rules-based, hedged-equity approach with a track record of generating consistent returns while minimizing losses during large equity market declines.

See how adding the Swan DRS may reduce the lasting impact major drawdowns have on account funded status

Our Defined Risk Strategy (DRS) is applied to many asset classes and can be accessed via several structures, including custom portfolio overlays and separately managed accounts to help your institution meet long-term objectives.