An allocation to fixed income has traditionally been present in all but the most aggressive of portfolios, with conservative portfolios often being 100% fixed income. Certainly, many portfolios have benefited from their allocation to bonds over the last 35 years. But the wise investor should look forward, not backward, to determine if bonds will be able to deliver the dual role they have typically served, and if they should consider bond alternatives.

But to look forward, we must examine the state of fixed income today.

Yields have languished at historic lows and are slowly beginning to rise, but the demand for bonds has remained quite high ever since the credit crisis of 2007-08.

And why wouldn’t the demand be high when the following drove investors to bonds:

As demand for bonds has soared, the yield plummeted. As every student of finance knows, the yield on bonds is inversely related to its price. While the Fed eventually started a policy of tighter monetary conditions, the overhang from a nearly a decade of loose monetary policy still haunts the market.

This has left bond investors with an unattractive set of options:

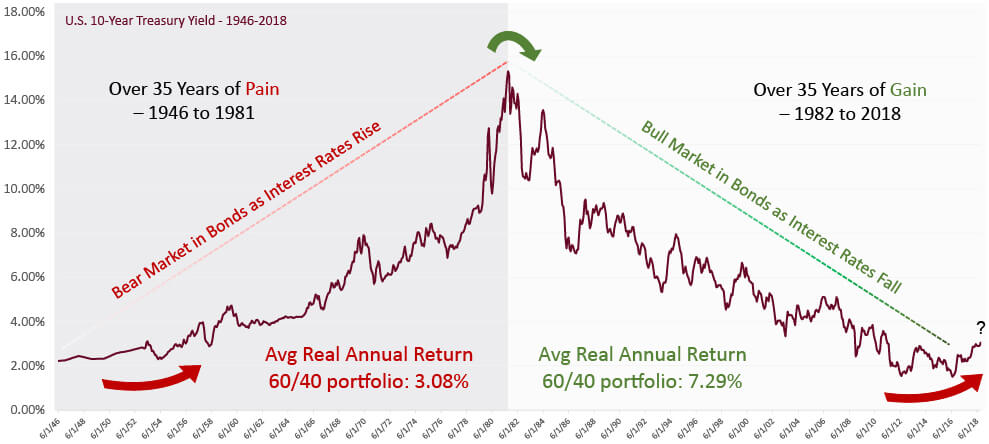

Looking at the current interest rate environment and the long-term credit cycle, the road ahead for bond investors, as well as, for traditional 60/40 portfolio construction is challenging indeed.

An Inflection Point for the Bond Market?

Source: Swan Global Investment, St. Louis Federal Reserve, Organization for Economic Co-operation and Development (OECD), Shiller, www.econ.yale.edu/~shiller/data.htm: 10 year U.S. Treasuries 1926-2018. The 60/40 portfolio refers to 60% Ibbotson US Large Stock Inflation Adjusted Total Return and 40% Ibbotson US IT Government Inflation Adjusted Total Return USD.

Historically, investors averaged 6.25% from Treasury bonds over the last 40 years. With rates roughly a third of that since the Financial Crisis, many investors were forced to reach for yield in riskier assets.

Think about it…at a 6.25% yield, a million-dollar position in ten-year Treasuries would produce $62,500 per year, or $625,000 over a decade. Alternatively, a 2.50% yield would produce only $25,000 per year. That’s roughly the definition of poverty-level income for a family of four[1]….and that’s on a million-dollar portfolio.

So investors should welcome an increase in rates, right? With an increase in rates, a decrease in value follows threatening the capital preservation role of bonds.

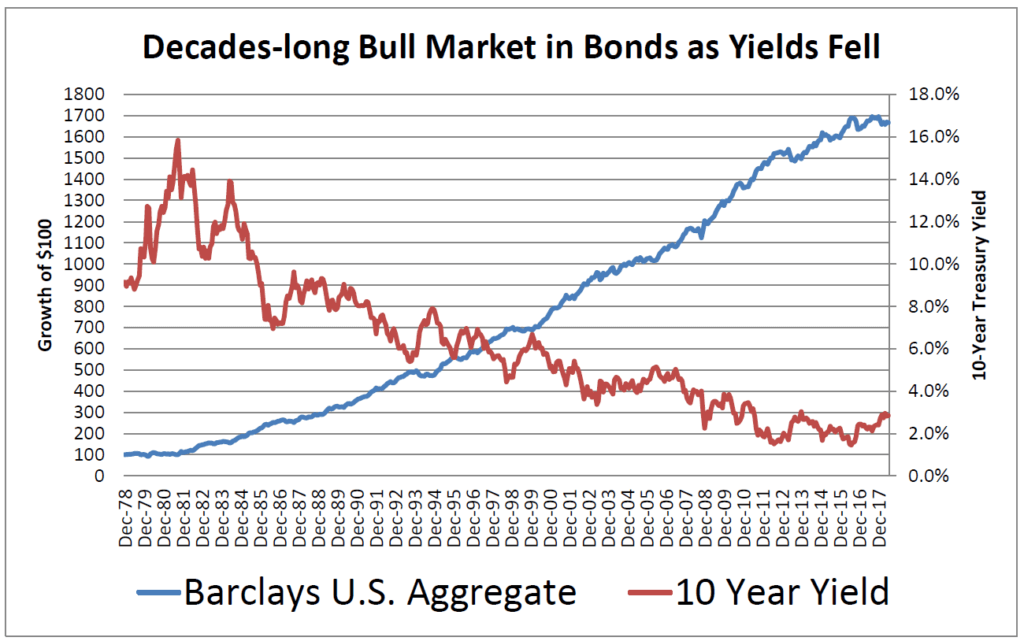

Bonds have historically been able to provide not only capital appreciation but also capital preservation. Over the last 35 years (Jul 1983 – Jun 2018) the investment grade bonds of the Barclays U.S. Aggregate Index have averaged an annual rate of 7.03%. The graph below shows why.

Source: Federal Reserve, Swan Global Investments

As inflation was tamed and interest rates descended from an eye-popping 15.8% in 1981, the value of high-yielding investment-grade bonds increased dramatically. Today, with yields at 2.85% there is little upside remaining. In fact, many would argue there is much more downside to bonds than upside.

With such a long, steady fixed-income bull market, it is easy to forget bonds can lose money, especially when interest rates change. In 2018, the Barclays Aggregate Bond Index is down -1.62% through June 30th.

The unfortunate reality is that the relationship between bond values and yields works in reverse: rising interest rates decreases the values of bonds. Duration measures the sensitivity of a bond’s price to changes in interest rates. With a current duration of 5.29 (Morningstar category average: Intermediate Term Bonds, 6/30/2018), the typical bond fund is very susceptible to capital losses should interest rates rise from their current 2.85% to the historical average over the last 40 years of 6.25%.

Those relying on bonds for downside portfolio protection or protection for their often irreplaceable capital might be in for a rude shock, and may want to consider bond alternatives for portfolio protection.

Previously bond holders were able to have their cake and eat it too. They received both income when yields were higher. Bonds provided not only capital preservation when equity markets sold off, but capital appreciation when yields fell. With the current state of bonds the way it is, investors must choose between yield or portfolio protection. They cannot have both.

This forces investors and advisors to rethink how they invest for income and manage market risk and what it means for their long term financial plans going forward. Instead of relying solely on bonds, many may have to look to bond alternatives to fulfill the two roles bonds have done in the past.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

[1] http://www.uscis.gov/sites/default/files/files/form/i-864p.pdf

Swan offers and manages the proprietary Defined Risk Strategy (“DRS”) for its clients including individuals, institutions and other investment advisor firms. Swan’s DRS performance results herein are of the DRS Select Composite which includes all non-qualified accounts. Additional information regarding Swan’s composite policies and procedures for calculating and reporting performance returns is available upon request. All Swan performance results have been compiled solely by Swan Global Investments and are unaudited. Other performance return figures indicated in this material are derived from what Swan believes to be reliable sources (i.e., S&P 500 index, other indexes and benchmarks), but Swan does not guarantee its reliability. This analysis is not a guarantee or indication of future performance. Investments in foreign securities involve additional risks including currency risk. References to the S&P 500 and other indices and benchmarks are for informational and general comparative purposes only. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular investments, ETFs and options in which Swan invests or writes may prove to be incorrect and may not produce the desired results. Swan Global Investments, LLC, Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC are affiliated entities. Further information is available upon request by contacting the company directly at 970-382-8901 or www.www.swanglobalinvestments.com. 328-SGI-080818