One of the key tenets of behavioral finance is loss aversion theory—the idea that investors feel the pain of losses much more acutely than they feel the pleasure derived from gains. This is one of the few areas where the psychological, irrational tendencies of behavioral finance actually square up well with sober, rational mathematics.

As we will illustrate in this blog post, minimizing losses is more important to the ultimate success of an investment plan than maximizing gains.

In a previous blog post, Growth Creates Growth, we explored the power of compounding returns. If an investment is allowed to grow at a constant rate, the appreciation of wealth accelerates.

However, the “miracle” in the miracle of compounding returns depends upon a constant rate of growth. Losses, or negative returns, can throw an investment plan off course and severely impact the ending value of the investment. And just like compounding growth impacts wealth in an exponential, non-linear fashion, so do losses.

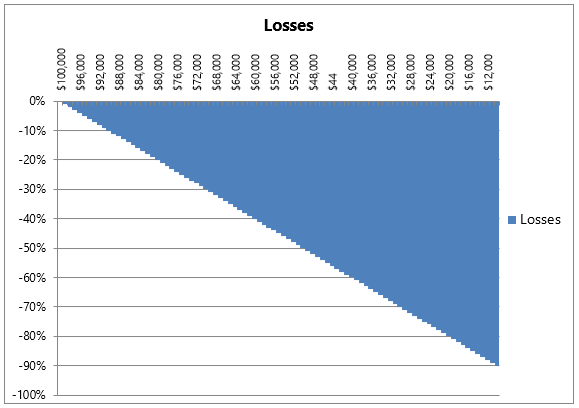

As before, the best way to demonstrate this point is via a simple, theoretical example. The following graph illustrates the impact of losses on a theoretical investment of $100,000, in both dollar terms and stated as percentage returns.

Source: Swan Global Investments

Source: Swan Global Investments

When we start off, the relationship between losses and percentages is simple and straightforward: a loss of 10% is $10,000, a loss of 20% equates to $20,000, and a loss of 50% represents $50,000. Nothing surprising there.

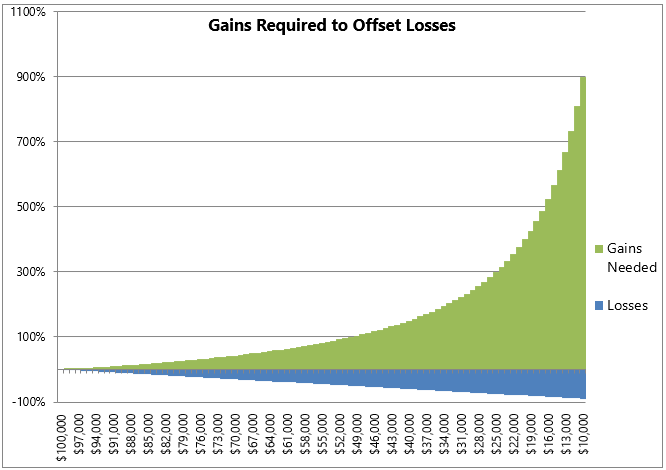

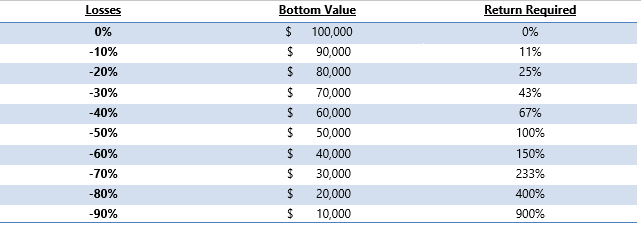

However, once we start talking about the returns necessary to get our depleted account back to our starting value of $100,000, the dollars and the returns start to diverge.

Simply put, the larger the losses, the larger the gains have to be to recover the losses.

An investment worth $90,000 needs to return 11.1% to get back to $100,000, not 10%. An investment worth $80,000 needs a 25% return to break even, not 20%. And an investment worth $50,000 needs to return 100% to get to $100,000.

The graph below illustrates the returns needed (in green) to compensate for the losses discussed previously (in blue). While losses increased in a straight, linear fashion, the gains needed to recover from those losses do not; they grow at an exponential rate. In plain English, the deeper the hole, the more difficult it is to work your way out of it.

Source: Swan Global Investments

Source: Swan Global Investments

Granted, this is a simple, theoretical example used to prove a point: that losses are more important than gains, everything else being equal.

What implications does this have for real-world investing?

Outperforming the S&P 500 is too often the only measure many investors look at when determining the success or failure of an investment strategy. The clamor for beating the market becomes especially pronounced during a long bull market, after memories of the last bear market start to fade. In such environments investors myopically focus on the last one, three, and/or five years of market returns and are disappointed when anything—diversified portfolios, different asset classes, contrarian strategies, etc—fail to outperform “the market.”

However, the job of outperforming the market becomes much easier if losses are minimized in the first place.

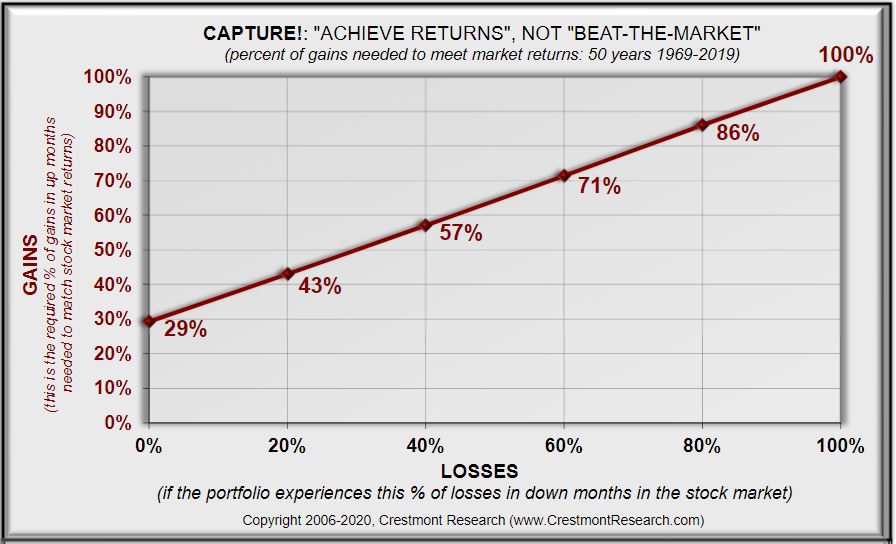

The graph below is from Crestmont Research and illustrates this phenomenon.

The rightmost portion of the diagonal line states that if an investor experiences all of the market’s losses, then the investor will also need to capture all of the market’s gains in order to match the market.

That much should be obvious. However, the left-most portion of the diagonal line shows that if the investor avoided all of the market’s losses, then they would only need to capture 26% of its gains in order to match the market returns over the long-term.

Of course, it is unlikely that anyone invested in the market would experience 0% of its losses. Realistically, the focus should be on the middle of the graph. In the middle of this range, an investment with a 40% down capture needs a 55% up capture to match the market. Moreover, an up capture in excess of 55% would see the investment outperform the market over the full-time frame.

Helping investors avoid large losses begins with adjusting their mindset away from chasing gains and refocusing it on capital preservation.

Timing the market is unreliable and hard to successfully execute regularly. Diversification alone is not enough. And bonds are facing risks that threaten their capital preservation role.

So what other options to advisors have?

A strategy that utilizes put options may be a suitable risk management strategy for investors who are seeking another tool for reducing the impact of drawdowns on their long-term financial plans.

*This post was updated, originally posted on August 10, 2016.

Avoiding Big Losses Matters

Low yields make generating income in retirement more difficult. However, an investment strategy that can minimize large losses and generate consistent returns over market cycles may sustain systematic withdrawals. See how the DRS can serve as a source of retirement cash flow.

NEXT ARTICLEMarc Odo, CFA®, CAIA®, CIPM®, CFP®, Director of Investment Solutions, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. This analysis is not a guarantee or indication of future performance. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com.

464-SGI-121319