– Powered by O’Shares Investments

The Swan Enhanced Dividend Income Strategy focuses on total return, seeking both sustainable income and capital appreciation, via actively managed covered call-writing on a quality dividend growth stock portfolio.

Actively Seeking More – This unique approach combines Swan’s decades of options management expertise alongside O’Shares’ leadership in index strategy and development.

A Synergy of Expertise

Delivering a Distinct, Sustainable Solution

Recognized leaders in their respective domains join forces to build the Enhanced Dividend Income Strategy, a distinct solution to best serve investors through market cycles and in different interest rate environments.

Index Providers

A recognized leader in index strategy development, O’Shares developed a custom index as the basis of the strategy, powered by stocks selected for both strong fundamentals and dividend growth.

Our ‘Active-Active’ Approach Creates a Dual-Alpha Income Solution

The strategy seeks income and total return through the contribution of three drivers of return:

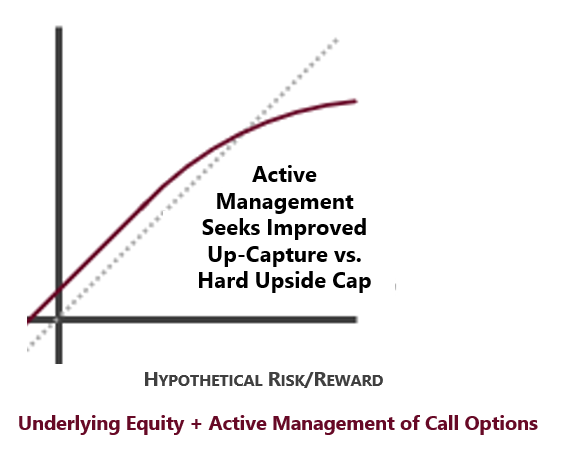

Providing investors an alternative to passively-managed equity income strategies, which may be unable to adapt to market conditions, unduly cap upside potential, and/or erode an investor’s capital base over time.

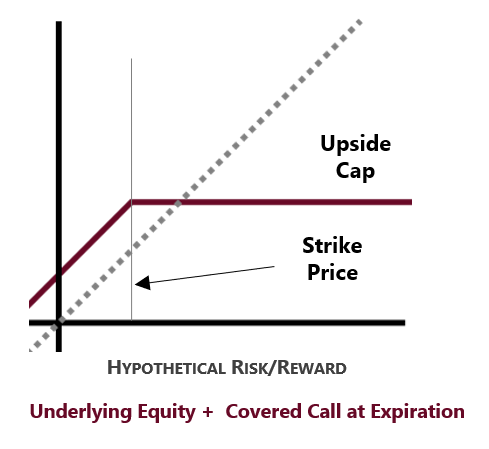

Typical, Passive Covered Call

Our Active Approach

* The degree to which a position may be OTM will vary based on several factors, including but not limited to, stock and overall market trends, volatility, and options pricing. The resulting hypothetical performance analysis is not actual performance history. Actual results may materially vary and differ significantly from the suggested hypothetical analysis performance data.

Connect with our team to discuss more details on this distinct process, differentiation versus other derivative strategies, and how this strategy can complement other income strategies within a portfolio.

Recognized leaders joined forces to build a distinct solution aiming to provide investors with sustainable income and capital appreciation through market cycles and different interest rate environments.

This strategy is available for separate accounts at major custodians and several broker-dealer platforms. For more information about the strategy and platform availability, please feel free to contact our investment consultants.

Learn More About this Synergy of Expertise & Our Distinct Solution

Defining Separately Managed Accounts

A Separately Managed Account (SMA) is a portfolio of assets under the management of a professional investment firm. The SMA structure is for qualified investors through financial advisory firm relationships and require a minimum investment. The vast majority of such investments firms are called registered investment advisors, which are regulated by of the U.S. Securities and Exchange Commission (SEC) under the Investment Advisors Act of 1940. One or more portfolio managers are responsible for day-to-day investment decisions, supported by a team of analysts, operations and administrative staff. SMAs differ from pooled products, like mutual funds or ETFs, in that each portfolio is unique to a single account, in which the manager has discretion to make investment decisions for each account.