Advisors are facing an investment dilemma on two fronts.

Low interest rates punish savers, forcing them to stretch for income and risk principal. Yet when rates rise, principal will be eroded.

Investors need to maintain equity exposure to grow wealth, but most investors cannot afford another large drawdown and long recovery. Meanwhile, fixed income assets may not be able to serve their portfolio protection role.

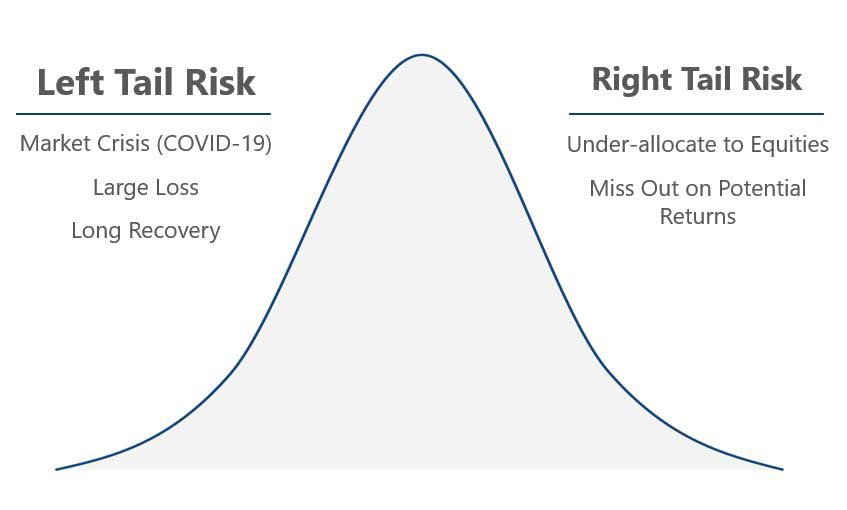

Advisors face portfolio construction challenges as they attempt to address both tail risks.

How are you addressing these historic challenges in a low-yield world?

What are you doing differently?

A Hedge for Both Tails.

Since 1997, the Swan Defined Risk approach to hedged equity has addressed this Dual Dilemma by providing a hedge against left tail risk while maintaining equity exposure within a portfolio.