Avoid the Trap in Passive Derivative Income Strategies with an Active Approach

Source: public domain, via Wikimedia Commons. Painting: “Faust and Mephistofle” by Eugène Siberdt (1851-1931)

Studies on high-yield, passive derivative income strategies (covered calls) reveal a significant negative relationship between income and overall returns. Investors who overlook this trade-off might have unwittingly entered into a disadvantageous “Devil’s Bargain”.

In this post, we will explore research concerning passive, covered call income strategies, give an overview of the derivative income category and due diligence considerations, and take a closer look at a ‘active-active’ approach deployed in a new ETF.

Source: Morningstar Direct, 12/31/23

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

A recent paper by Roni Israelov and David Nze Ndong explored the trade-off between generating high distributions and total returns. Their paper can be summarized by the old saying, “You can’t have your cake and eat it too.”

Published in October of 2023, this paper was entitled “A ‘Devil’s Bargain’: When Generating Income Undermines Investment Returns,” and its release was very timely.

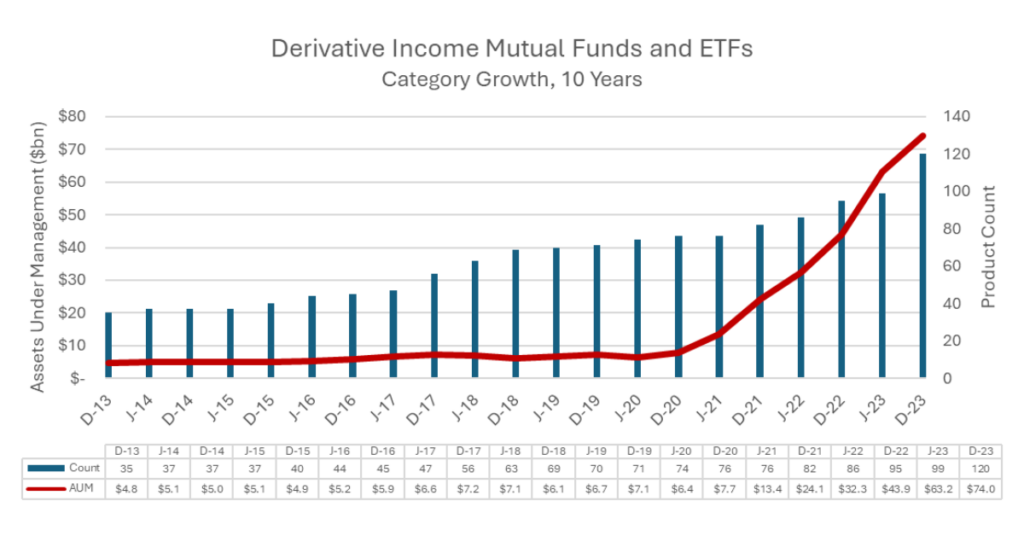

The number of strategies and assets within the Derivative Income category has grown at an extremely rapid pace over the last decade. Investments in this asset class have grown from under $5bn to $74bn. The number of products has increased from 35 to 120, with new products being launched on a weekly basis. Most of this growth has occurred in the last five years.

Most of these strategies employ a variation of covered call writing. While covered call writing can be a good source of returns, one should realize that call writing is not “free money.” The amount of premium available from writing calls is directly related to the risk of the trading strategy.

To stand out in a crowded field, some funds offer double-digit distributions. One new fund was extremely successful in fundraising by offering eye-popping distributions. It was able to raise almost a billion dollars in a year’s time by distributing a yield in excess of 75%.

If a strategy has set investor expectations that they will receive a high level of distributions every month or quarter, simply writing options might not be sufficiently profitable to maintain a high “yield.” Faced with a “distribution shortfall”, a Derivative Income strategy might have to resort one or more of the following:

This last one is harder to detect. If a strategy ramps up its risk, those risks tend to be exposed in a sharp, sudden event. However, the return of capital is more a slow, gradual erosion that only becomes apparent after the passage of time. While both are usually unsustainable in the long run, their weaknesses are revealed in different ways.

An example helps illustrate this point. Say, for example, a strategy heavily advertises its annual distributions of 15%. Simple math suggests this strategy will need to manufacture 1.25% per month, every month, to maintain a steady stream of distributions that meets its investors’ lofty expectations. Potential sources of return could be price appreciation of the underlying equity portfolio, dividends from the equities, and/or premium collection from writing calls.

Keep in mind that the writing of calls explicitly limits the price appreciation potential of the underlying equity in a covered call program. The writing of calls is a trade-off where the call writer willingly forgoes some of the future capital appreciation potential in exchange for cash today. As we are often reminded, there is no free lunch.

It is quite easy to imagine a scenario where this hypothetical covered call strategy’s equities miss out on capital appreciation and the premium collection and equity dividends fail to generate monthly profits of 1.25%. If the strategy is unable to meet investor expectations, they might sell some of the underlying equities and return the proceeds to the investors.

Obviously, this type of approach is not sustainable in the long run. If one is constantly whittling down the capital base it will be increasingly difficult to generate the necessary premiums or dividends.

Moreover, such strategies would be imperiled by a steep market sell-off. Covered call strategies typically do not feature an explicit market hedge. It is true that the writing of calls tends to be profitable in downward markets. But in the face of a true bear market sell-off of -20%, -30%, -40% or more call writing would only be able to offset a fraction of that amount. Finally, when markets do rally a call-writing strategy’s participation in the upswing will likely be limited by the short call positions.

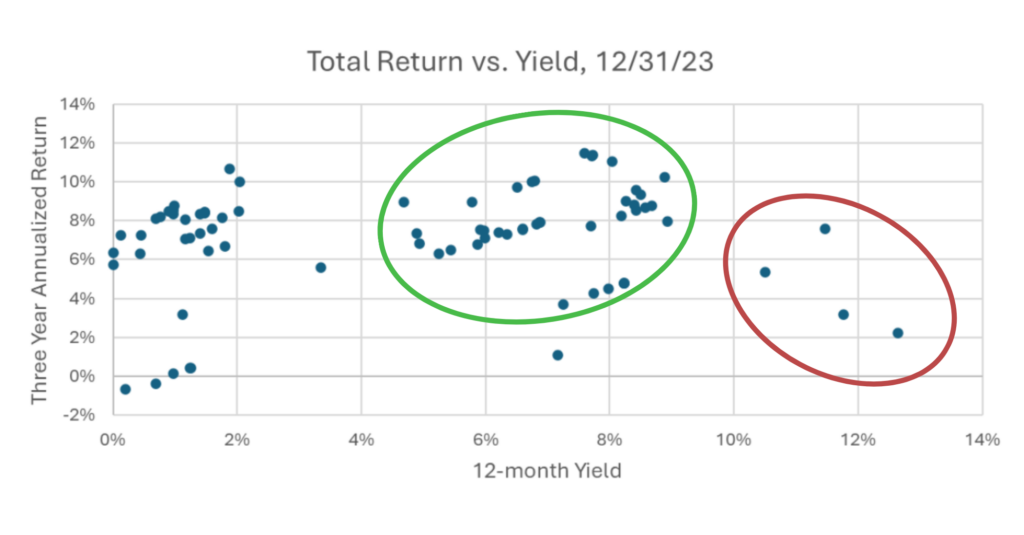

When attempting to sort through the myriad of options available in the Derivative Income category, it is important not to be seduced by the highest-yielding strategies. Looking at the historical record, strategies with more modest distributions in the 6%-8% tend to have the best total returns.

Source: Morningstar Direct, 12/31/23

Swan Global Investments recommends keeping the following points in mind when researching Derivative Income strategies.

Swan’s Enhanced Derivative Income Strategy, and the ETF launched based on this approach (ticker: SCLZ) were developed with these guidelines in mind. The underlying investment strategy follows an “active-active” approach. Total return is the goal, not the world’s highest yield.

Swan Global Investments views all these various decision points as potential sources of alpha. While it is highly unlikely that every single investment decision will be profitable simultaneously, by diversifying the sources of potential alpha and emphasizing risk control, Swan believes the Enhanced Derivative Income Strategy can generate sustainable income and long-term capital appreciation.

This distinct “active-active” approach may be a way for investors to escape the “Devil’s Bargain” when derivative income strategies face a distribution shortfall.

Marc Odo, CFA®, FRM®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. His responsibilities also include producing most of Swan’s thought leadership content. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms.

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. Further information is available upon request by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 044-SGI-021723