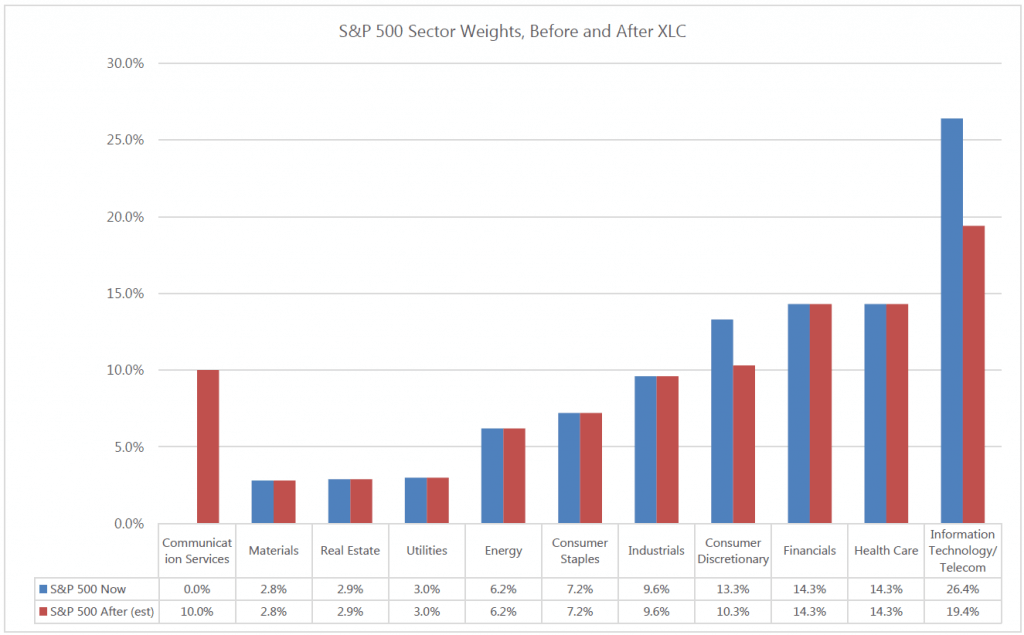

S&P Dow Jones Indices and MSCI are responsible for the development and maintenance of the Global Industry Classification Standards (“GICS”). Near the end of 2017 they announced the creation of a new sector, Communication Services. This new sector will be comprised of stocks currently in Information Technology, Consumer Discretionary, and Telecom sectors.

This change was designed to reflect the ever-changing nature of our economy. As social media, internet services, and integrated media & entertainment companies take a bigger role in our lives, a new sector was deemed necessary to capture these changes. This is one of the biggest changes to the GICS structure since its inception.

Source: State Street, MSCI, S&P Dow Jones

The State Street Global Advisors Select Sector SPDRs ETFs are designed to track the GICS indices. In order to accommodate this change, SSgA has created the Communication Services Select Sector SPDR Fund with the ticker XLC. When the reclassification of those stocks into Communications Services occurs on September 21, 2018, just over two dozen names will be sold out of the existing ETFs and then only available in the XLC ETF.

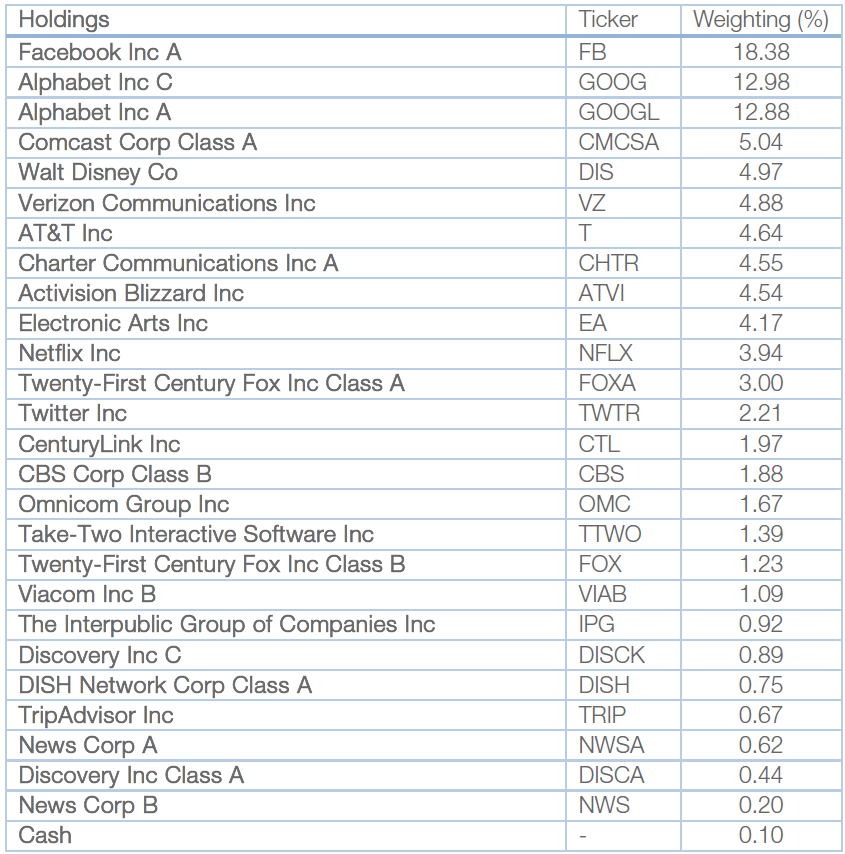

The new XLC ETF will contain the following. Weights are estimates, and change based upon daily price fluctuations.

Source: Morningstar Direct, 7/30/18

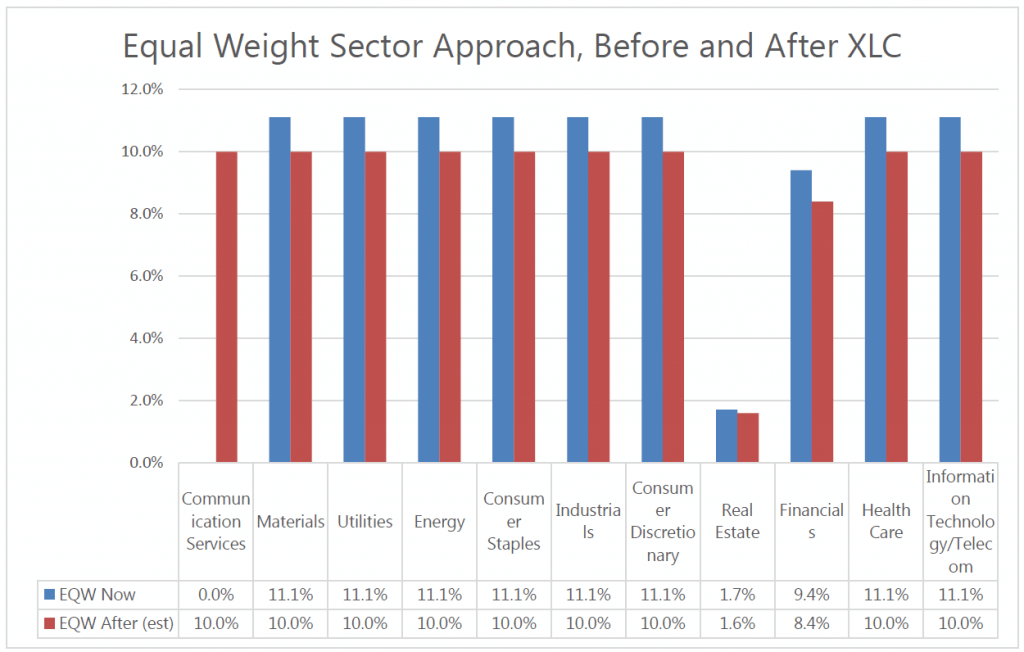

Swan currently uses the line-up of SSgA Select Sector SPDRs to gain access to the U.S. Large Cap market in its flagship Defined Risk Strategy offering. Each sector is given a target weighting equal to the others. With nine primary sectors available, each sector currently has a target allocation of 11.11% of the total equity allocation[1].

With the creation of the new Communication Services ETF, Swan plans to maintain its equal-weight approach across the primary sectors. So rather than nine sectors with 11.11% each, there will be ten sectors with a target of 10.00% each[2].

Source: Swan Global Investments

So essentially 1.1% will be shaved off of every existing sector and allocated to XLC.

This change is simply too big to ignore. If Swan were to exclude XLC from its allocation, it would be missing a significant part of the market, including some of the biggest names in the S&P 500.

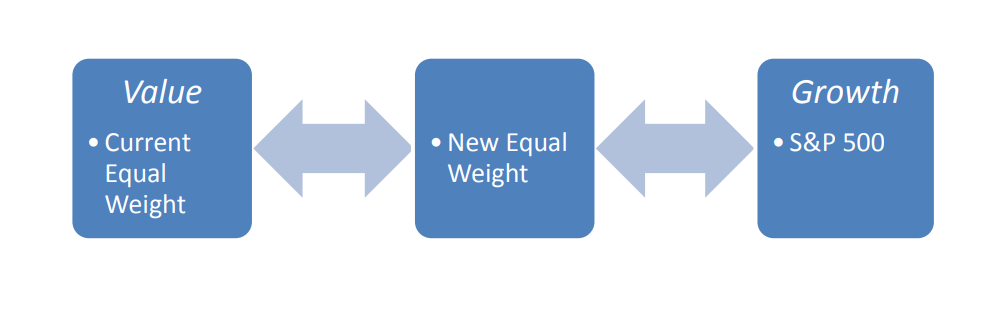

The equal weight sector approach gives the aggregate portfolio more of a value-tilt and a lean away from some of the mega-cap names that dominate the S&P 500. Sectors like heath care, financials, and most notably technology are underweighted. More value-oriented sectors like energy, utilities, and materials are overweighted.

Post reclassification, the revised equal weight will still have a bias towards value and away from mega-cap, but the difference will not be as pronounced. This change moves the aggregate portfolio a little closer to the S&P 500 in some ways. Because 1) many names in the newly created Communications Services sector will be sourced from the Technology sector and 2) the target weight for Communications Services is now a full 10%, the overall exposure to the “new economy” names will increase.

If one created a spectrum with value on one side and growth on the other, it might look like the following:

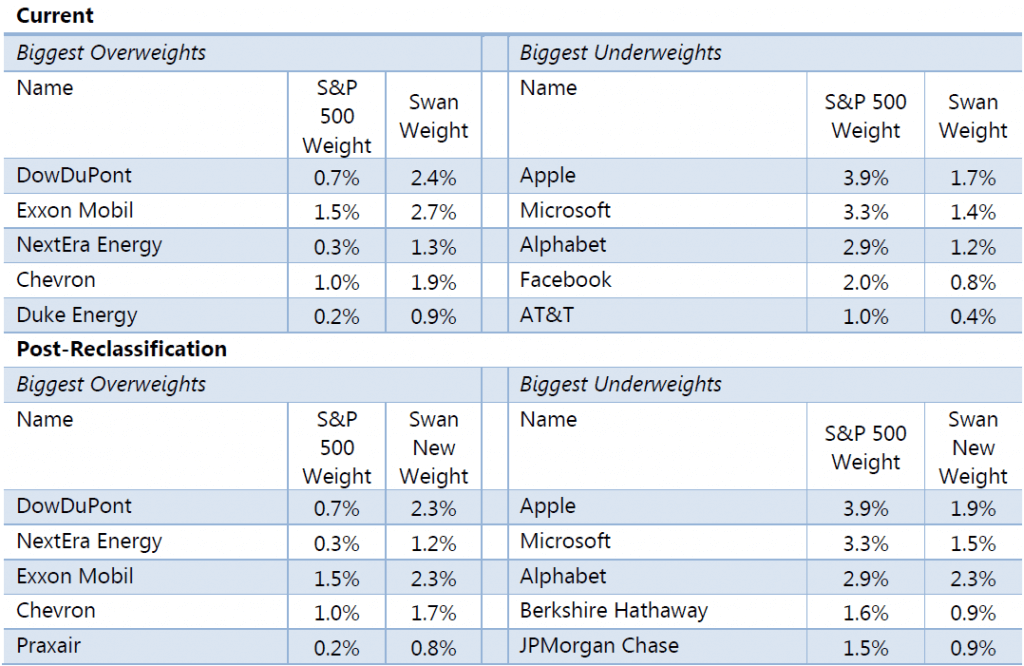

The upper half of the table below shows estimates of the five biggest over- and under-weighted positions relative to the S&P 500. The lower half shows the same information after the reclassification.

Those positions that move from Technology to Communication Services get the biggest boost. Those names that remain in Technology make up a larger slice of a now smaller pie, so they get a slight increase.

Source: Swan Global Investments, Bloomberg

The top overweights are slightly reduced by the reclassification. In fact, it is not just the top five – it is almost all of the overweights. Even though many of the sectors are not impacted by the reclassification at all, the fact that Swan will be reducing the standard weight from 11.1% to 10.0% reduces many overweight positions and slightly increases some underweight positions in sectors like Financials and Healthcare.

When it comes to taxes, there are two topics to discuss: the impact of the change within the ETFs like Technology (XLK) and Consumer Discretionary (XLY) and the impact as Swan rebalances from 11.1% to 10.0% weightings as the Communication Services ETF (XLC) is added.

State Street Global Advisors has stated that they expect little to no impact from rebalancing XLK and XLY and moving those two dozen names over to XLC.

When it comes to Swan adjusting the equal weight sector targets from 11.1% each to 10.0%, the tax impact is also expected to be minimal compared to regular rebalances. The existing targets are only being reduced by 1.1% each. In addition, Swan has carry-forward losses from past years’ put options from hedging the portfolio.

Moreover, due to the daily price moves on the various sectors, the actual allocations to the sectors are often a bit different from their targets. Swan monitors these actual allocations and when they drift too far will initiate a rebalance back to target.

With the addition of XLC to the portfolio, this will create a situation where most of sectors will likely be slightly off-target. Using their existing rebalancing infrastructure, Swan plans to give XLC its targeted 10% allocation by slightly reducing all other sectors.

Since 2012 Swan has opted to equally weight the various GICS sectors rather than use the capitalization weighted S&P 500 for its market exposure. The Achilles Heel of capitalization-weighting is that the only thing that matters is a company’s price. The more a company’s stock price goes up, the bigger the company gets, the more a cap-weighted index is forced to buy it. This creates a positive feedback loop that can lead to bubbles in sectors or individual stocks. The equal-weighted approach is a way to introduce more of a value-tilt into the portfolio.

A full discussion of equal-weight sectors can be found in these two blog posts:

Worth the Weight

Worth the Weight, Q&A

In 2016, S&P and MSCI had a reclassification where they created a sector for Real Estate. There are two key differences between the Real Estate reclassification two years ago and the pending Communication Services.

With the Communication Services reclassification, stocks are migrating over from multiple sectors, namely Information Technology, Consumer Discretionary, and Telecom. Moreover, the new sector will be a significant part of the S&P 500, anticipated to be around 10% of the market. It could be argued that the Real Estate carve-out was unnecessary.

Two years ago, Swan made the decision to keep the relative weights between the Financials ETF (XLF) and the newly created Real Estate ETF (XLRE) in roughly the same 4:1 ratio they were before the carve out. The combined XLF/XLRE position was kept at its original 11.1% weight, since those stocks in the past had always been classified as Financials.

State Street Global Advisors has produced a wealth of information on this topic. A good starting point would be these links:

Communication Services Sector SPDR XLC

Communication Services – Investing to Reflect a New Reality

New GICS Sector is On It’s Way – Preparing Portfolios

New Sector SPDR debuts with 3 FANG stocks

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research for 11 years at Zephyr Associates.

[1] An exception is made to the roles of real estate (XLRE) and finance (XLF). The two have a current combined weight of 11.11%. This is discussed in greater detail towards the end of this FAQ.

[2] The exception for real estate and finance will be maintained. The two will have a combined allocation of 10%.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.www.swanglobalinvestments.com. 319-SGI-080318