This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksThe DRS was launched in 1997 to provide investors with a better way to invest over full-market cycles—generate consistent returns and mitigate risks to irreplaceable capital.

So how’d we do?

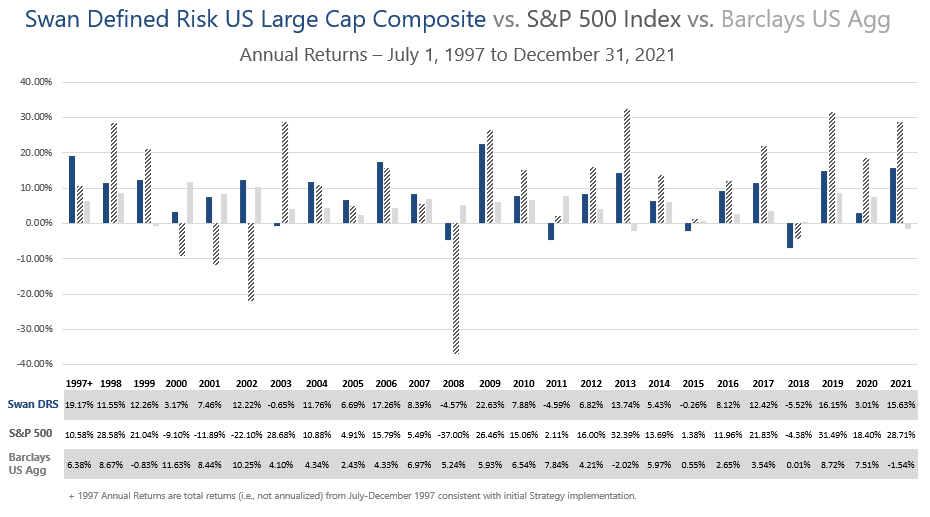

Source: Zephyr StyleADVISOR and Swan Global Investments. All data is based on the historical performance of the S&P Total Return Index and the Swan Defined Risk US Large Cap Composite, net of fees, since inception as of 12/31/2021. Prior performance is not a guarantee of future results.

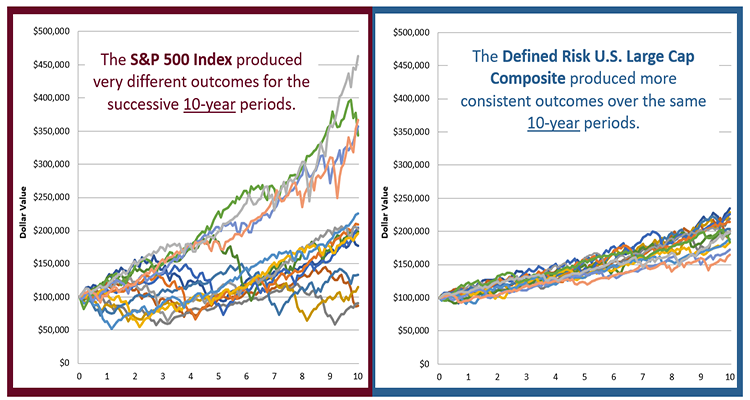

By reducing volatility and avoiding major losses, our hedged equity approach has a dramatic impact on investor experiences through market cycles.

The graphs show an investment of $100,000 over fourteen successive, 10-year investment periods. The first period is 1/1998 to 12/2007; the last period is 1/2012 to 12/2021. Each period, except two, contains at least one bull market and one bear market.

Source: Swan Global Investments and Morningstar; the Barclays U.S. Aggregate Bond Index and the S&P 500 Index are unmanaged indices, and cannot be invested into directly. Past performance is no guarantee of future results. DRS results are from the Swan Defined Risk US Large Cap Composite, net of fees, as of 12/31/2021. Structures mentioned may not be available within your Broker/Dealer.

Bear markets are unpredictable but inevitable.

Diversification alone didn’t work to protect most investors in 2008, or 2020. What are you doing differently now to protect your irreplaceable capital?

Our hedged equity approach has performed admirably in protecting investor capital during the last two bear markets. Ask your investment advisor about the DRS.

The Defined Risk Strategy is available in various structures and across major asset classes.

Hedged Equity Strategies

The success of our Defined Risk Strategy prompted us to apply it across multiple products and assets, providing our clients with additional opportunities to use this time-tested approach.

Hedged Equity ETFs

Hedged Equity Funds

Hedged Equity SMAs

Where Hedged Equity Fits

LEARN MORE

Learn more about the various types of investment structures or contact a Swan investment consultant for more information.