This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

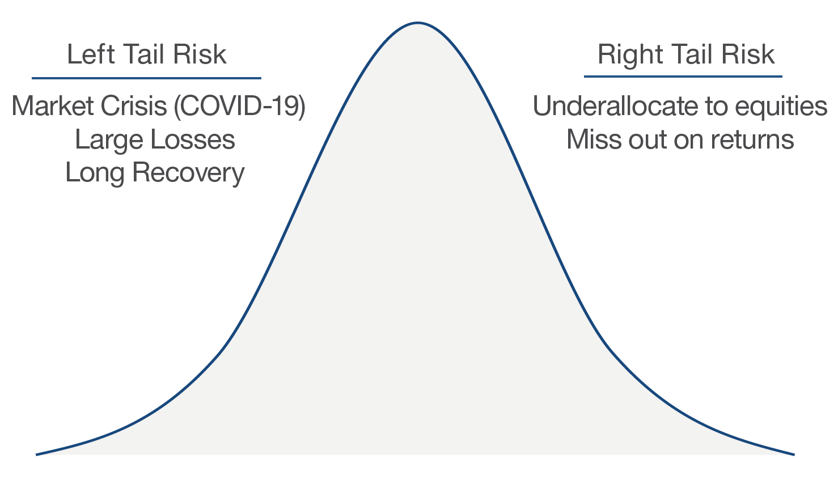

Okay, thanksOver their investment journey, long-term investors must navigate full market cycles—large ups (bull market) and large downs (bear markets). Each type of market, bull or bear, presents tail risks.

To achieve long-term goals investors must address both tail risks:

“Prophesy as much as you like,

but always hedge.”

Generally, investors are concerned with the risk of major losses, known as Left Tail risk. This name comes from the concept of distribution of returns, in which the full range of potential returns from an investment or market over a period of time sort of looks like a “bell curve”. The far left side of that curve, or the Left Tail, represents large-scale losses that statistically occur infrequently.

Yet investors must be aware of another type of risk—the risk of missing out when the market delivers large-scale returns represented on the far right side of the return distribution curve. This “missing out” is known as Right Tail risk.

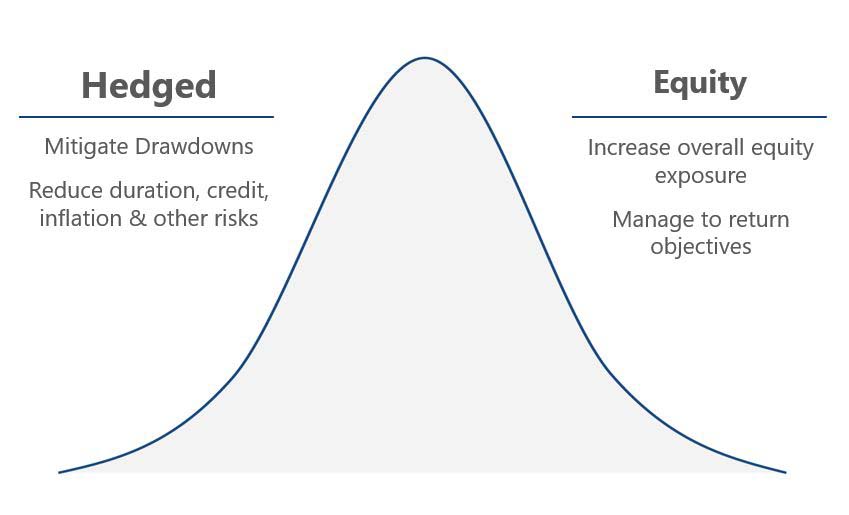

Traditional portfolio construction relied predominantly on bonds, cash, or hedging strategies to address Left Tail risk and stocks to address Right Tail risk.

However, the current investing landscape is challenging and the prospects for both bonds and stocks appear bleak.

Investors need new ways to manage both tail risks.

Hedged equity strategies may provide investors a hedge for both tails.

Our Defined Risk Strategy is a time-tested hedged equity approach that remains always invested and always hedged.

Navigate & Capitalize

The active hedging process seeks to help investors navigate market uncertainty and capitalize on market weakness:

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Learn More About the Defined Risk Strategy