In a world of low yields and sluggish growth in most of the developed world, many consider emerging markets investing an outlet for those seeking growth of assets. However, it is also widely known that investing in emerging markets is a venture fraught with risks.

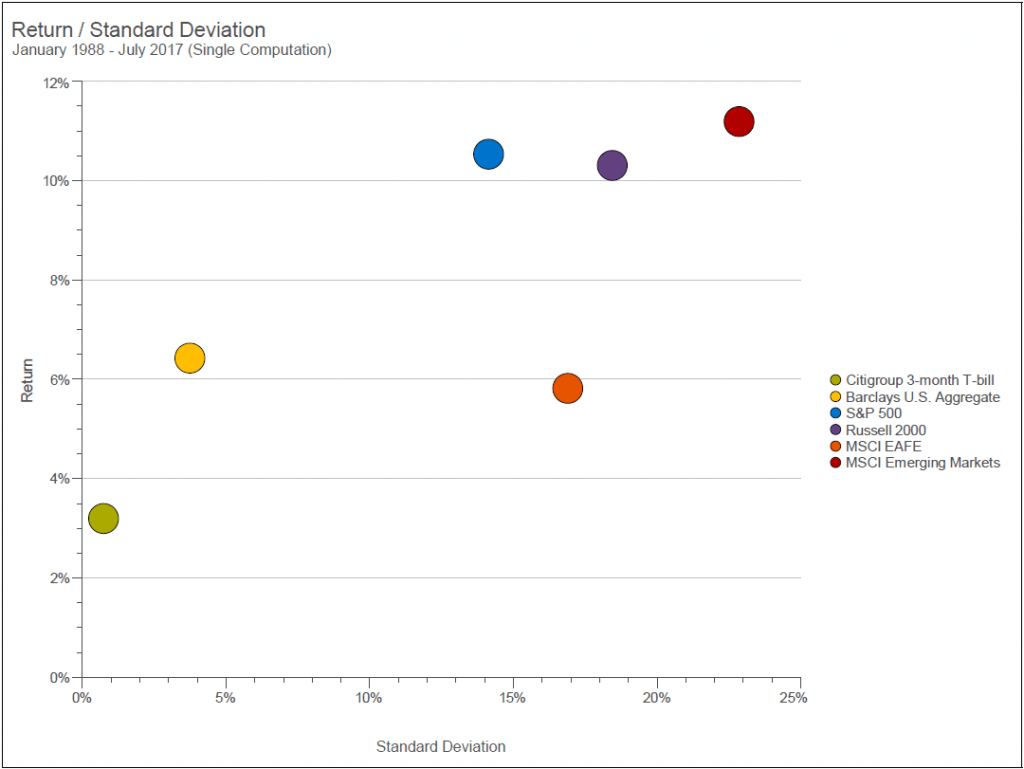

Standard financial theory states that the higher the risk, the higher the reward. An investor willing to take on volatility or the potential for losses should be compensated for accepting that risk.

Perhaps no asset class exemplifies this trade-off more than emerging markets. Since MSCI started tracking emerging markets in 1988, the asset class has clearly had highest returns and biggest risks of any of the major asset classes.

Source: Zephyr StyleADVISOR

The advantages of emerging markets are well known. Frequently cited are such strengths as:

Higher upside potential

Demographic trends favoring emerging markets over many developed countries

Burgeoning middle class and consumerism in emerging markets

Growing share of global GDP

Wealth of commodities and resources in emerging markets

Diversification benefits to traditional portfolios

Very few people argue against the upside potential of emerging markets. And yet in spite of these advantages, many investors tend to shy away from emerging markets. Overall, emerging represents only 3% of U.S. mutual fund assets (according to a recent Calamos study). For many investors, the risks of emerging markets outweigh the rewards.

No doubt about it, the risks are real. Political risk, economic risk, currency risk, and market risk are all present in emerging markets. These risks occasionally manifest themselves in higher volatility and large sell-offs.

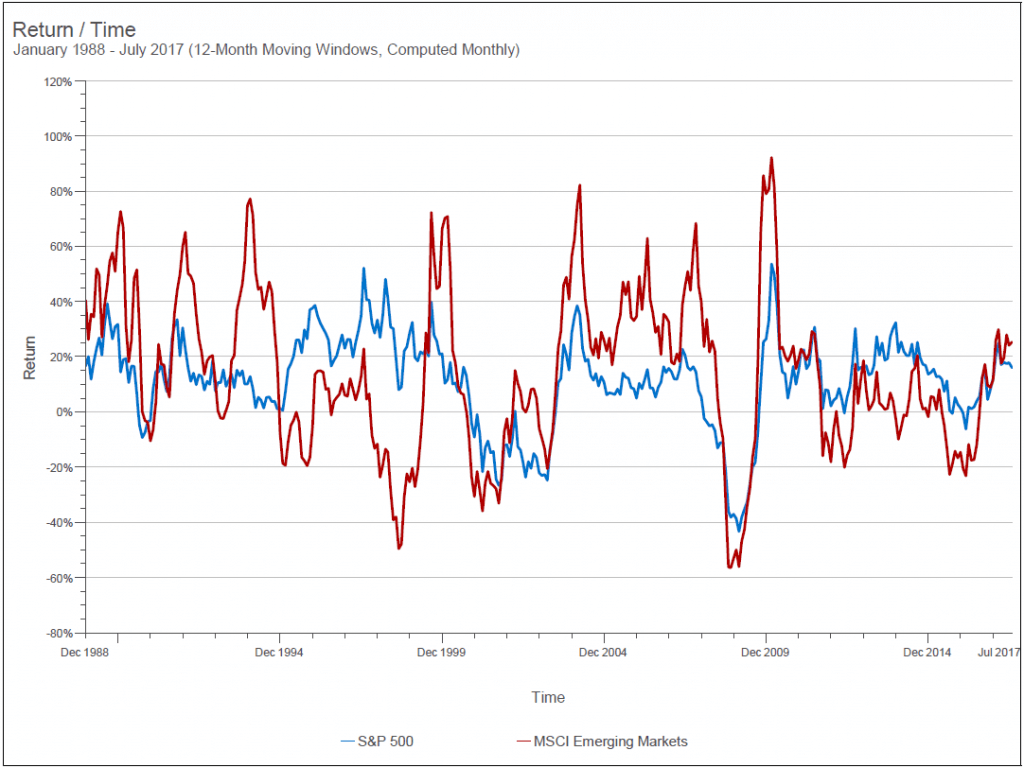

The chart below illustrates both the highs and lows of investing in emerging markets in the form of rolling, one-year returns.

Source: Zephyr StyleADVISOR

Emerging Markets Investor Conundrum: How does one maximize the potential of emerging markets while minimizing the risks?

Given the dim outlook for a traditional 60/40 balanced portfolio, emerging markets are one of the few assets with the upside potential to meet the return needs of an investor.

Swan believes it has a unique solution that can maximize return and minimize risk of emerging markets. It is the same strategy that has been successfully applied to U.S. Large Cap equities for 20 years: the Defined Risk Strategy (DRS). The DRS was built around the idea that the biggest risk to an investor’s wealth is the large scale, systematic sell-offs that occasionally befell the markets.

The DRS directly hedges against bear markets via long-term put options. Not only are the put options designed to protect during a bear market, the puts are also designed to be a source of capital for re-investing into the markets when the markets are trading at a discount after a large bear market sell-off.

By re-hedging and re-investing after a bear market sell-off, Swan believes the DRS is superior to market timing. One of Swan’s core beliefs is that it is difficult, if not impossible to call the tops and bottoms of markets and to build a successful long-term strategy by timing the markets. This truth is especially relevant in emerging markets. As seen in the previous graph, emerging markets are noted not only for their steep declines but also for their very sharp rallies. In other words, if your timing is slightly off and you miss the rally, you miss big.

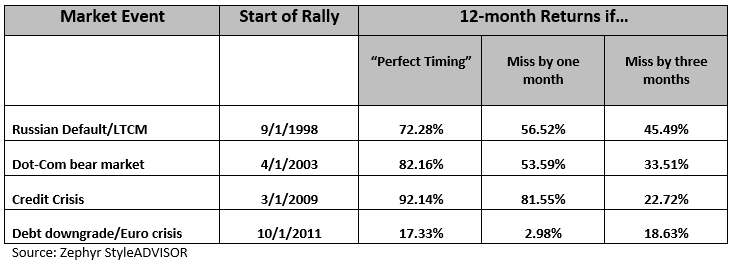

Below is a table showing the returns of emerging markets coming off the bottom. The first two columns specify a market sell off and the date of when the rally started. The middle column shows the 12-month return if someone had perfect foresight and bought at the bottom of the market. The fourth column is the impact of missing the first month of the rally and the final column shows the 12-month returns if the first three months of the rally are missed.

We believe the above information simply reinforces the importance of Swan’s motto: “Always Invested, Always Hedged.”

We also believe that our approach to managing risk in emerging markets is completely unique. By hedging against bear markets and seeking to generate cash flow through option premium, we believe we have fundamentally changed the risk/return profile of emerging markets.

Click to find out more about the Defined Risk Strategy applied to Emerging Markets, or call 970.382.8901.

Updated: August 24, 2017

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.www.swanglobalinvestments.com. 217-SGI-082417