Most people know the Defined Risk Strategy by our motto: “Always Invested, Always Hedged.” The first two primary components of the DRS seek to balance each other out, like the different sides of a see-saw, with the equity portion being #1 (“Always Invested”) and the hedge portion being #2 (“Always Hedged”):

Source: Swan Global Investments

When the markets are down, the equity portion of the DRS is down, but the hedge portion is up and does well, and vice versa.

While we believe it is prudent to always be prepared for a bear market, there is a problem with being “always hedged”—the carrying cost. Even though we do what we can to minimize the carrying cost of the hedge and even though we have large market exposure, the hedge will be a drag on performance in up markets. That’s where the third leg of the DRS stool comes into play.

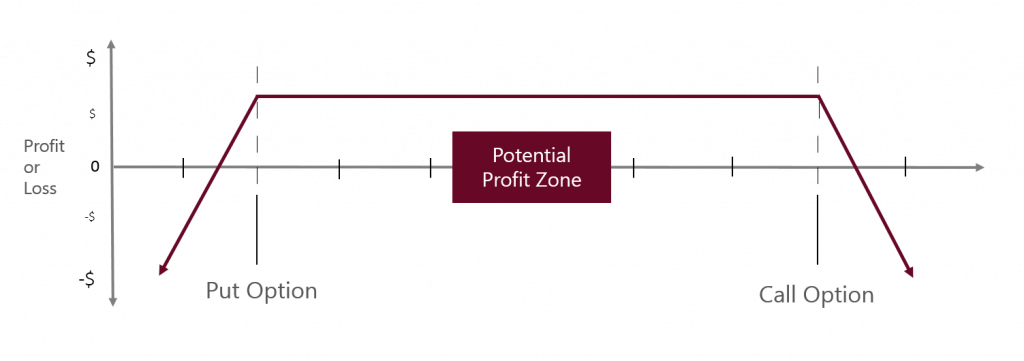

Unlike the first two components of the strategy, which are very long-term in nature, the income/premium collection trades are short-term in nature. What we typically do is simultaneously sell both a call and a put, out-of-the-money, and collect the premiums from both. Known as a Short Strangle, these trades are set up to be market neutral so that initially the risks are equally balanced between the upside and the downside.

The idea is that we bracket the market, and if the market stays within this range over several weeks, we will be able to close out the trade and repeat the process 12-15 times a year.

Source: Swan Global Investments

We have rather modest goals for each trade, hoping to collect somewhere between 0.30% and 0.50% per trade. If we do this successfully, we hope to generate enough return to help offset some, or all, of the carrying cost of the hedge in a flat or slightly rising market.

The risk in this trade, however, is if the market moves too far in either direction and starts getting close to those strike prices. We are very cognizant of those risks, and this is where our active management comes into play.

The vast majority of our portfolio management team—the traders, the risk officers, the PMs themselves—are dedicated to working this trade and keeping this trade within acceptable risk boundaries. If the market does move too far up or down we will implement additional adjustment trades to help mitigate risk, keep the trade market neutral, and try to claw back any losses an individual trade might incur.

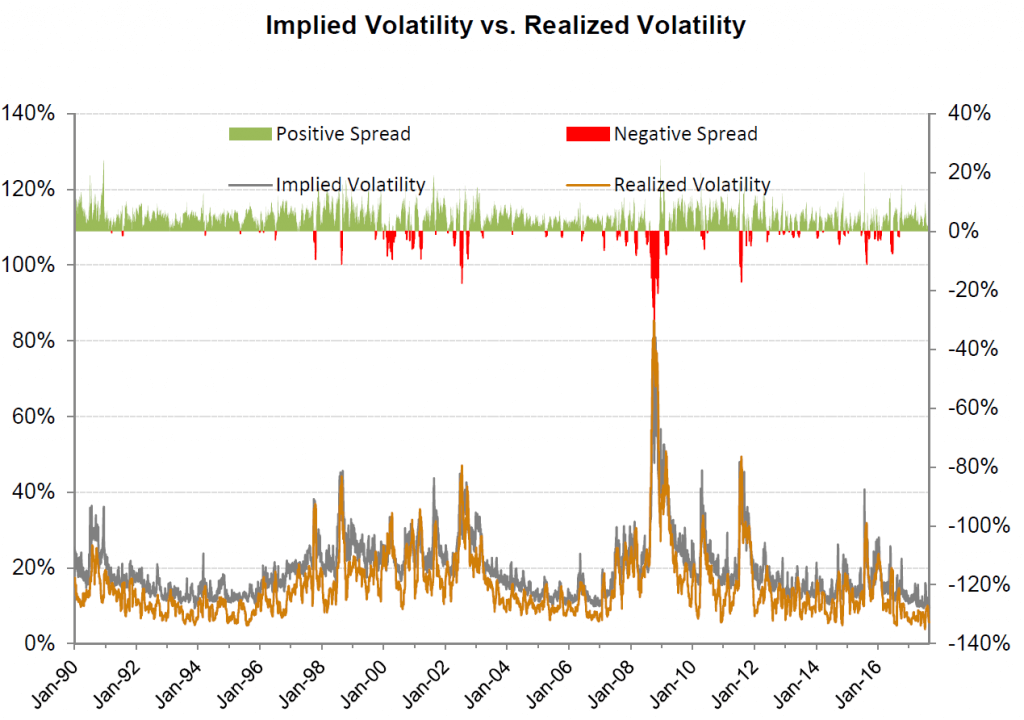

The dynamic that these premium collection trades are trying to exploit is the gap between implied volatility and realized volatility. Implied volatility is what drives the price of the options we sell, whereas realized volatility is what actually happens in the market. Often, this spread is positive, which means people tend to overpay for short-term protection giving us the opportunity to seek profitable income trades by selling short-term calls and puts.

Source: Swan Global Investments

The analogy is much like car renter’s insurance. When renting a car from Hertz or Alamo, people tend to overpay for the short-term protection the company offers, even though the probability of them getting in an accident in a single day or week is quite low. Car rental companies “harvest” this premium from their wide number of renters. Yes, occasionally, they may have to pay out a claim, but more often than not selling short-term insurance across a wide client base is a very profitable activity for them.

We have a similar dynamic with these trades. Like the car rental company, we sell potential protection to people who fear a major downtown. When they don’t exercise their option, we make a profit.

Usually, the spread between implied and realized volatility is positive (displayed in green in the graph above), and we try to capture that. That spread exists during periods of both high and low volatility. Occasionally, it does go negative, and yes, we will lose on these trades from time to time, but overall this has been a profitable endeavor for us and an important diversifying part of the strategy when combined with long equity and put options.

By incorporating the premium collection into the DRS, we hope to accomplish three things:

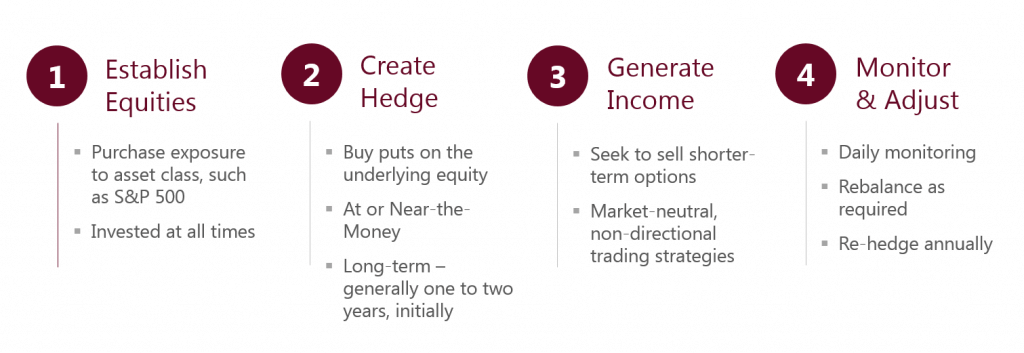

While the premium collection trades are managed separately from the equity and hedge positions, it is important to remember that the DRS is designed so that the three elements complement each other: The equity position is meant to participate in up markets; the hedge position protects in down markets; and the premium collection trades tend to do well in flat markets.

Source: Swan Global Investments

It is highly unlikely, if not impossible, to imagine a scenario when all three legs of the stool are positive at the same time. By the same token, it is hard to conceive of a market environment when all three elements are negative at the same time. This is all by design, as the three elements are designed as “checks and balances” on each other. By combining the equity, the hedge, and the premium collection the goal of the DRS is to have the whole be greater than the sum of its parts.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®,Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.www.swanglobalinvestments.com. 297-SGI-110117