Virtually every portfolio manager claims to invest in a risk-controlled manner. However, investors looking at their monthly statements during the credit crisis of 2007-08 were probably wondering what happened to those risk controls as their wealth plummeted.

How were these losses possible? If both the top-down, portfolio-builders and the bottom-up, stock-picking money managers were all focused on risk, how did investors manage to lose so much money in such a short period of time?

One explanation is that there are different ways to think of and define risk.

Many portfolios were constructed using mean-variance optimization (MVO), a strategy that seeks to minimize the volatility of an overall portfolio by diversifying across uncorrelated asset classes. At this top-down level, risk is defined as volatility, or how much an investment deviates from its long-term average. The very technique used in the creation of many portfolios- mean-variance optimization — reveals the objective of the strategy. MVO optimizes the return-versus-volatility trade-off.

Once the overall portfolio strategy was set, the job of actually investing was often implemented by a collection of active managers.

Active managers often have a different definition of risk. For many active managers risk is measured against a passive market benchmark, such as the S&P 500 or the Russell 2000. Positions are taken to over- or underweight an aspect of a benchmark. Success is measured in terms of benchmark metrics – for example, relative metrics like alpha or information ratio. Insights are gleaned via attribution analysis quantifying the sector or stock picks that helped or hurt relative performance.

What do all of these steps have in common? The framework for thinking of and measuring risk is all relative to a market benchmark.

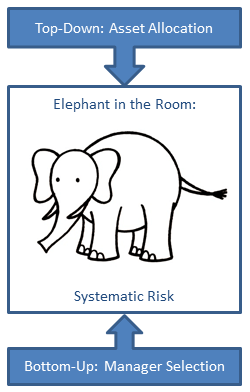

So what is missing in this approach? How does this model sometimes fall woefully short? The elephant in the room is market risk, sometimes known as systematic risk. Neither the top-down asset allocation strategy or bottom-up stock selection, explicitly addresses systematic risk.

When the market racked up losses of over 50% in 2007-08, both the asset allocators and the stock selectors were able to claim they were doing what they were hired to do – build a portfolio in the asset allocator’s case and pick winning stocks in the stock picker’s case. Yet, we find that neither the asset allocators nor the stock pickers are addressing market risk.

Swan’s Defined Risk Strategy (DRS) is built differently. At its inception in 1997, the primary objective of the DRS was to remain invested while directly managing and avoiding the large market sell-offs that periodically befall the market.

For Swan, risk management is defined as minimizing the depth, duration, and frequency of losses. For more on the merits of measuring risk in this manner, see our post on the Pain Index and the Pain Ratio.

The DRS strategy is always invested in the market, and always hedges its investment in the market via protective put options, with the goal of capital preservation in down markets and significant participation in up markets.

It is because of this unique approach to directly address systematic risk that the DRS can replace both the top-down asset allocation and the bottom-up active management. The DRS supplants both traditional approaches by defining risk in terms of losses and actively addressing that risk by hedging.

When Normal isn’t Good. Do you really want to achieve ‘market returns’? Actual market returns over time often do not fit a nice, clean, symmetric layout of a ‘normal distribution’ curve. As such, investors may not realize that striving for market returns might not be in their best interests over time. However, narrowing their distribution of returns is!

NEXT ARTICLEMarc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. This analysis is not a guarantee or indication of future performance. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com. 017-SGI-042715