This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksIt’s fair to say that most people like when complicated concepts or difficult tasks are ‘made easy’.

It’s also fair to say that the two biggest innovations in managed financial products over the last two decades are exchange traded products (ETPs) and target date funds. Little surprise there.

But how have some of these ‘made easy’ products delivered upon their expectations over time?

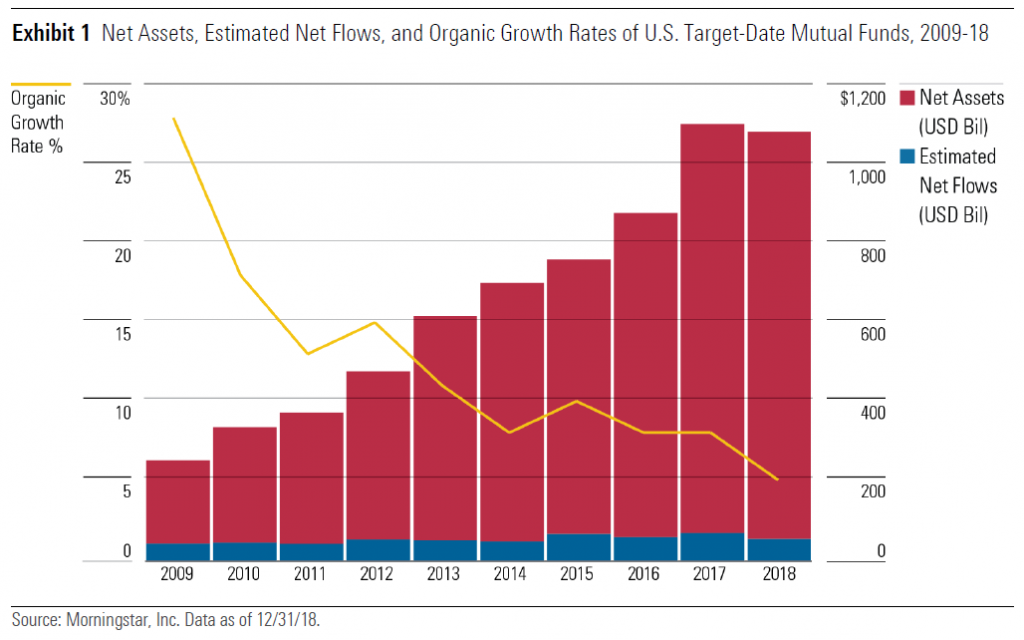

According to Morningstar’s “2019 Target-Date Landscape” report, there is an estimated $1.09 trillion of assets under management in target-date funds; growth in assets have more than quintupled since 2008. In addition, there is an estimated $660 billion in collective investment trusts (CITs) that are invested along the same lines as target date funds.

Morningstar makes the statement that “Given their default role, broad diversification, and shifting asset allocation, target-date funds may possibly serve as an investor’s single retirement-plan investment for decades.”[1]

Certainly, having a “one-click solution” for defined contribution plan participants offers a lot of advantages.

According to a May 2015 report from the Government Accountability Office[2], 52% of households over the age of 55 have no 401(k) or IRA savings, and of the 48% who do the median value is only $109,000. Given the widespread financial illiteracy and low savings rates of the average American, making the process of saving for retirement as easy and painless as possible is an attractive proposition.

The concern, however, is that by utilizing a “painless” solution at the outset, investors are setting themselves up for pain in the future.

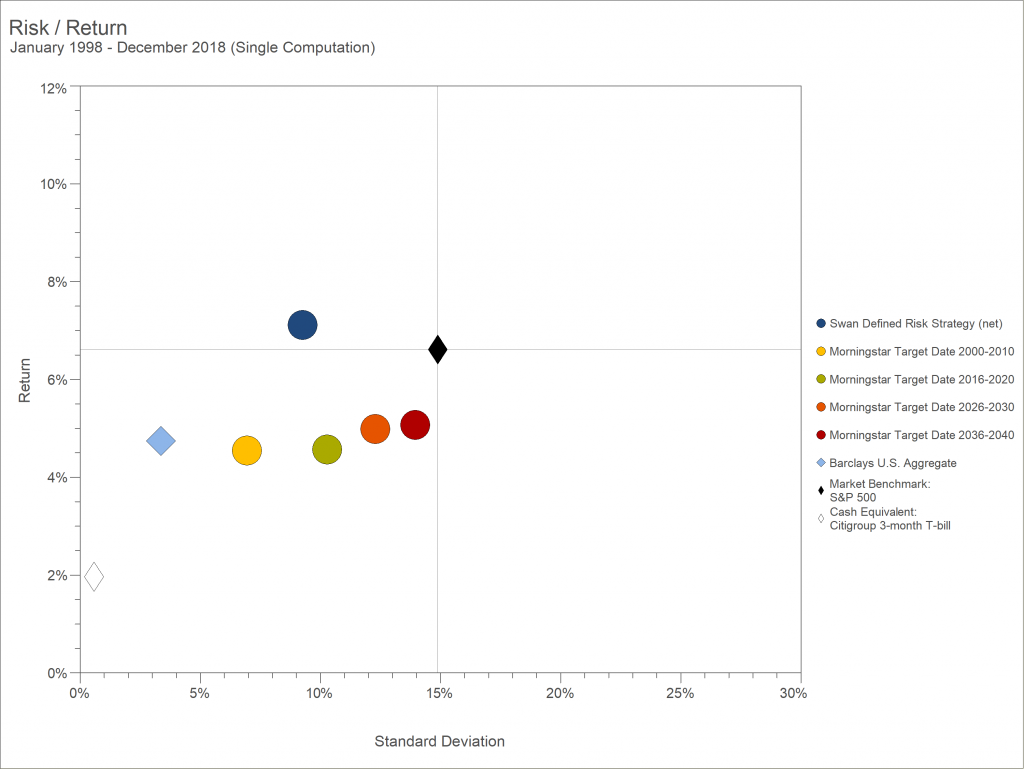

Unfortunately, the track record of the average target date fund has been underwhelming. The graph below shows the risks and returns across several “vintages” of Morningstar category average target date funds, versus the Swan Defined Risk Strategy.

Source: Zephyr StyleADVISOR, Swan Global Investments

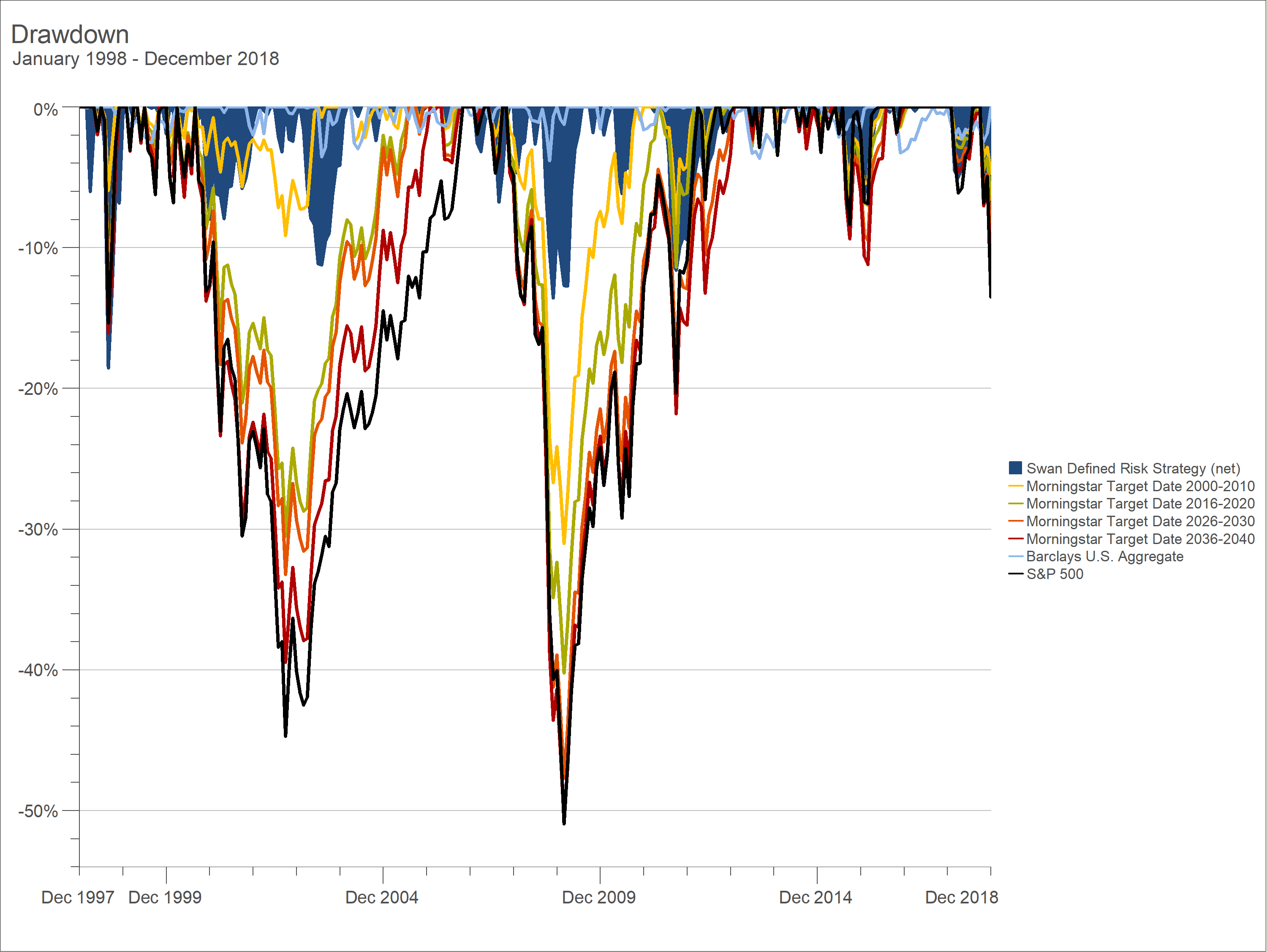

If target-date funds are supposed to get plan participants to their retirement goal, they should help protect participants as they get closer to retirement from bear markets that threaten their life’s hard work.

So how well do they do that?

The chart below details the peak-to-trough losses of the average target-date funds over the last 20 years versus the Defined Risk Strategy (DRS), a hedged equity approach that seeks to lessen the damage to portfolios during bear markets.

Source: Zephyr StyleADVISOR, Swan Global Investments

The poor performance of the target date funds, especially during the two major bear markets since 2000, highlights one of the core tenets of Swan Global Investments’ philosophy.

We believe that traditional asset allocation and diversification fails to sufficiently protect wealth during periods of severe market downturns.

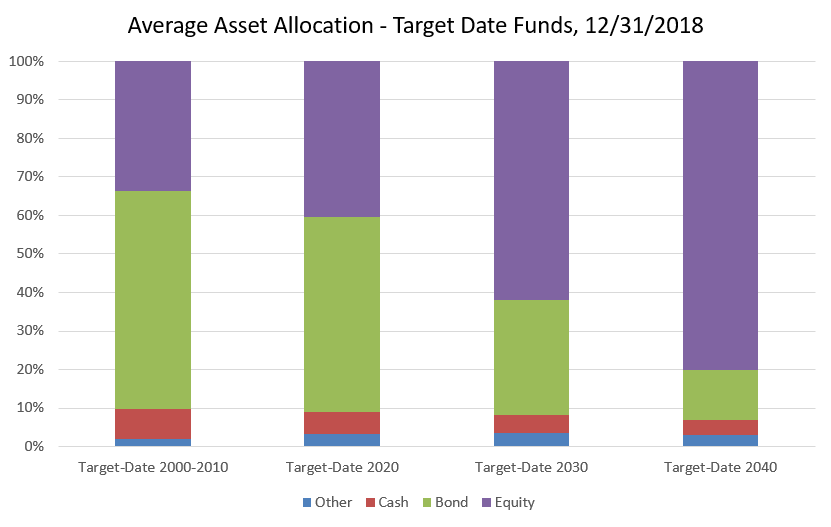

After all, the textbook descriptions of asset allocation often state that market risk, or systematic risk, simply cannot be diversified away. The vast majority of target date funds seem to passively accept this risk by holding the vast majority of their assets in simple stock-bond combination.

Source: Morningstar Direct

Marc Odo, CFA®, FRM®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

[1] “2019 Target-Date Fund Landscape” May 2019

[2] “Retirement Security: Most Households Approaching Retirement Have Low Savings”

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 orwww.www.swanglobalinvestments.com. 248-SGI-060419