Following an extended bull run for both bonds and equities, future returns of many traditional investing strategies are unlikely to duplicate past success.

As a result, institutional investors need to address risk beyond the use of traditional means.

Dynamic portfolio overlays that can hedge downside risk and generate income offer a distinct, non-traditional solution to the current and future capital markets landscape. Portfolio overlays can serve:

Since 1997 we’ve been applying our distinct hedging and options overlay strategies to redefine the risk/return profile of portfolios.

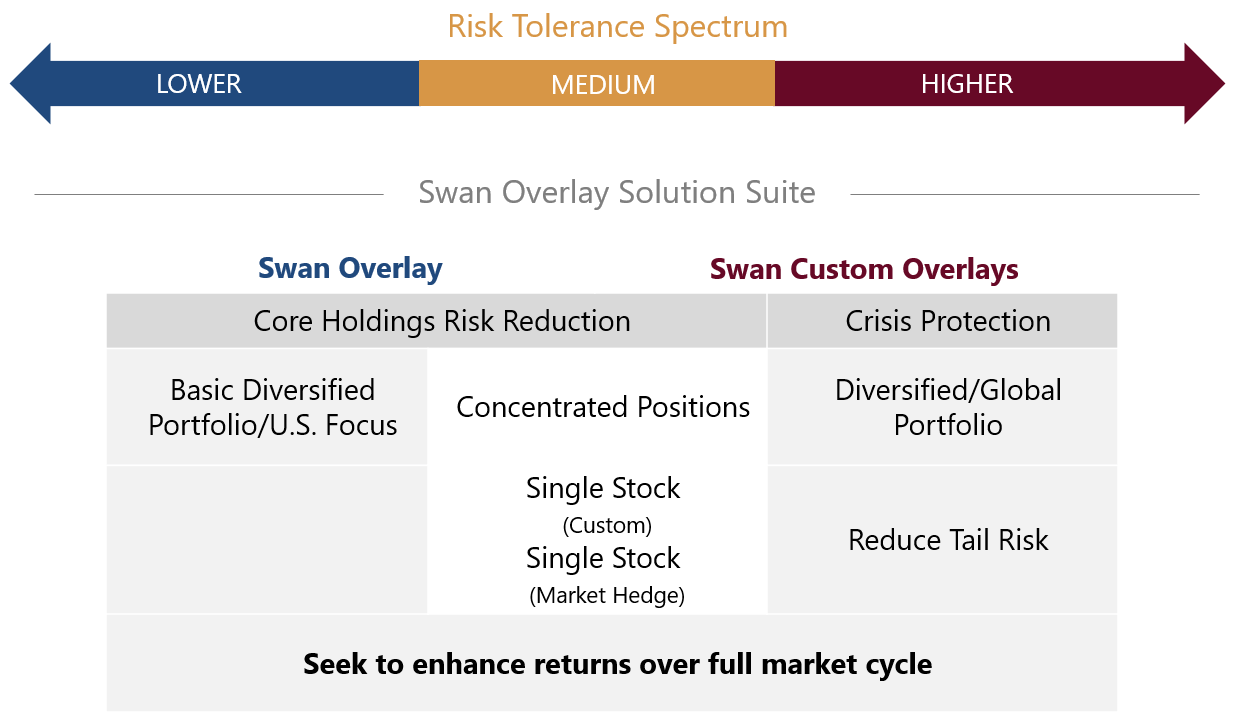

Swan Overlay Strategies are designed to enhance traditional investment return streams by providing a portfolio hedge and potential for option income suitable for a wide range of investment objectives.