This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksThe debate between stock-picking active and index-based passive management has been raging for years. So far, the momentum is all on the side of passive managers. BlackRock, Vanguard, and State Street occupy the top spots on the AUM tables, each passively managing trillions of dollars.

Meanwhile, traditional stock-picking active managers[1] have been hemorrhaging assets. According to Morningstar research[2], U.S. passive mutual funds added $492bn in 2016, whereas active managers have shed $204bn. These numbers are for open-ended mutual funds and don’t include ETFs or the shift in institutional assets, where the same trends are underway.

Each side makes valid points:

Active Management argues…

Passive investing doesn’t allow for the efficient allocation of capital.

There is no attention paid to valuations, fundamentals, etc.

Passive has no chance of outperforming the benchmark

Passive management argues…

Active management has very high fees

Few active managers outperform their benchmarks after fees

Identifying active managers likely to outperform is difficult

In the end, however, it doesn’t matter.

Active or passive: It doesn’t matter.

The argument is largely futile because it misses the point for two reasons.

First, the active vs. passive argument is about relative performance, not absolute performance. There will be differences between the relative performance of active and passive managers, but absolute performance reveals the gains and losses experienced. Out of these two measurements, which one would an investor prefer?

By focusing on differences measured in basis points, the investor risks losing the forest for the trees.

Second, the active vs. passive argument mainly focuses on fees, asset allocation, and outperforming the benchmark. But what do they offer for mitigating market risk? How does an active management approach or a passive management approach help reduce risk exposure?

The choice between active and passive managers becomes irrelevant because both active and passive managers are heavily exposed to systematic risk. This is the biggest risk an investor faces, yet neither side really addresses it.

While many investment professionals define risk in terms of volatility or relative performance, the perspective of most investors is different. Most investors define risk in terms of simple capital preservation. Market risk represents absolute risk: the risk of catastrophic loss or the risk of running out of money.

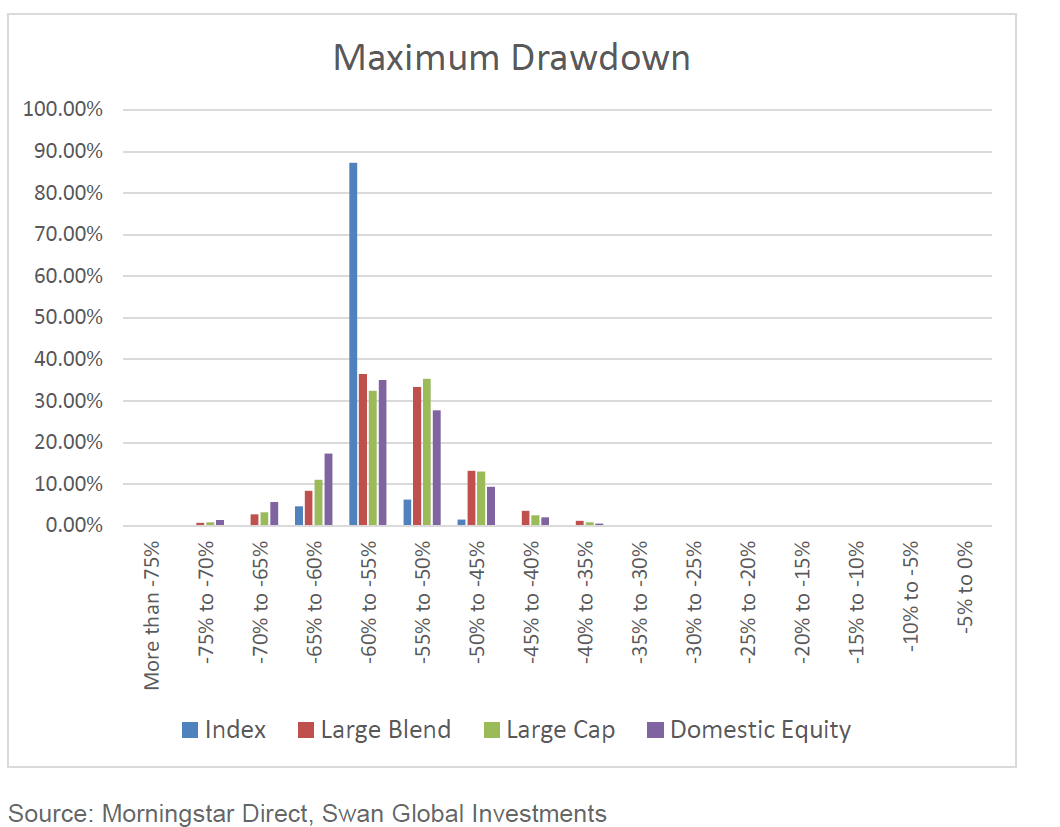

In the graph below, we examine how systematic risk impacts the following classifications of managers[3]:

Index funds within the large cap blend space

Active managers classified as Large Blend by Morningstar

Active managers classified as Large Value, Large Growth or Large Blend by Morningstar

Active managers across all nine Morningstar style boxes — Large, Mid, and Small and Value Blend and Growth

From peak-to-trough, how much did these managers lose? When the markets collapsed between mid-2007 and early-2009, were any of the funds in this study successful at mitigating the losses?

During the Financial Crisis of 2007 to 2009, the vast majority of passive and active funds lost over half their value in a very short time span. Only one fund out of 1,451 was able to lose less than 25%. This is the impact of systematic, market risk: losing big.

When things go wrong, the relative advantages or disadvantages in the active vs. passive debate are rendered irrelevant.

While many investment professionals define risk in terms of volatility or relative performance, the perspective of most investors is different. Most investors define risk in terms of simple capital preservation. Market risk represents absolute risk: the risk of catastrophic loss or the risk of running out of money.

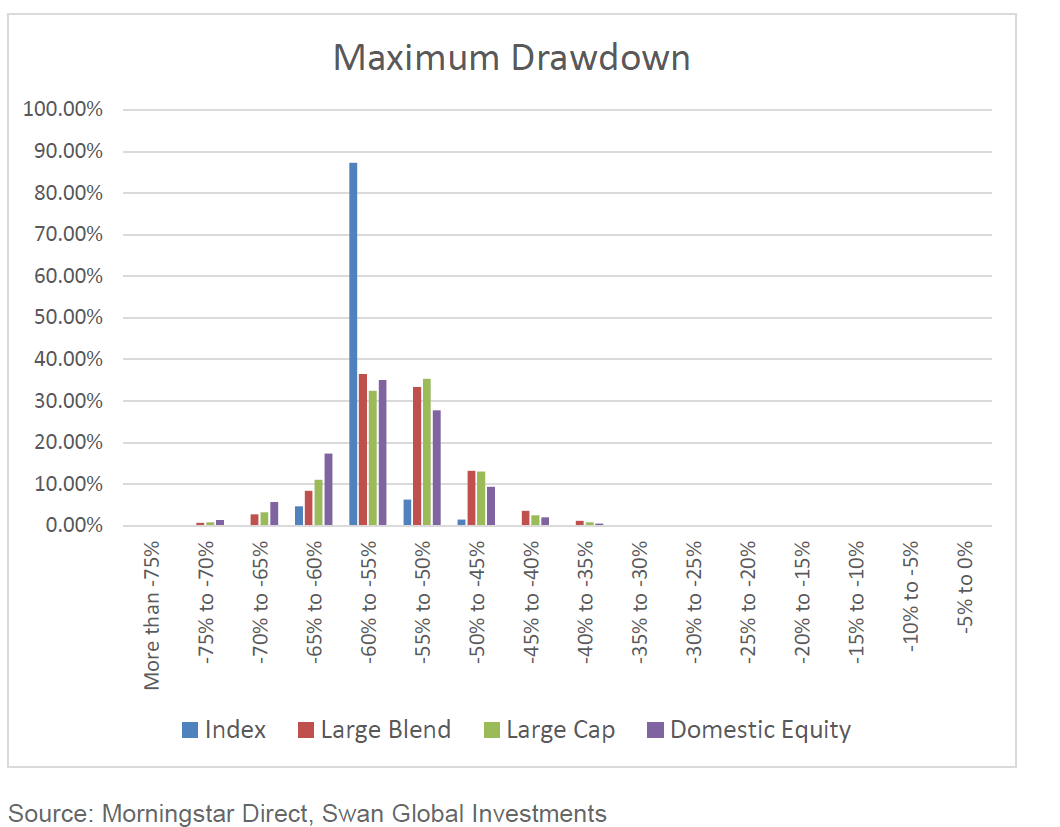

In the graph below, we examine how systematic risk impacts the following classifications of managers[3]:

Index funds within the large cap blend space

Active managers classified as Large Blend by Morningstar

Active managers classified as Large Value, Large Growth or Large Blend by Morningstar

Active managers across all nine Morningstar style boxes — Large, Mid, and Small and Value Blend and Growth

From peak-to-trough, how much did these managers lose? When the markets collapsed between mid-2007 and early-2009, were any of the funds in this study successful at mitigating the losses?

During the Financial Crisis of 2007 to 2009, the vast majority of passive and active funds lost over half their value in a very short time span. Only one fund out of 1,451 was able to lose less than 25%. This is the impact of systematic, market risk: losing big.

When things go wrong, the relative advantages or disadvantages in the active vs. passive debate are rendered irrelevant.

Even though Gamma does not directly measure changes in option values for changes in underlying prices, it is still an important risk measurement. It signifies the potential changes in option premium as measured by Delta. Many option premium strategies are short term in nature, and as a result, these strategies take on a tremendous amount of Gamma risk. Premium selling strategies that appear Delta-neutral may have hidden risks such as Deltas moving around as options approach expiration or the potential for certain types of spreads to produce an inordinate number of Deltas under certain market conditions.

NEXT ARTICLEOur stance and an analysis on the impact of systematic risk on four types of strategies are explored in depth in our white paper “Losing the Forest for the Trees: How the Active vs. Passive Debate Misses the Point.”

For updates on new blog posts and other content sign up here.

Marc Odo, CFA®,CAIA®, CIPM®, CFP®, Director of Investment Solutions, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

[1] FT Alphaville, “It’s Really Very Quiet Out There,” David Keohane, May 3, 2017

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.www.swanglobalinvestments.com. 208-SGI-080217