This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksIn a recent blog post, we made the argument that debate between passive and active management is irrelevant. By focusing on small differences in relative performance, investors risk losing the forest for the trees. Both passive and active managers are heavily exposed to market risk. Also known as systematic risk, market risk is the biggest risk an investor faces.

But what about “smart beta” or “factor investing”? These managers often present themselves as a third way, combining some active bets with inexpensive, passive investing. Smart beta managers claim to be the best-of-both-worlds.

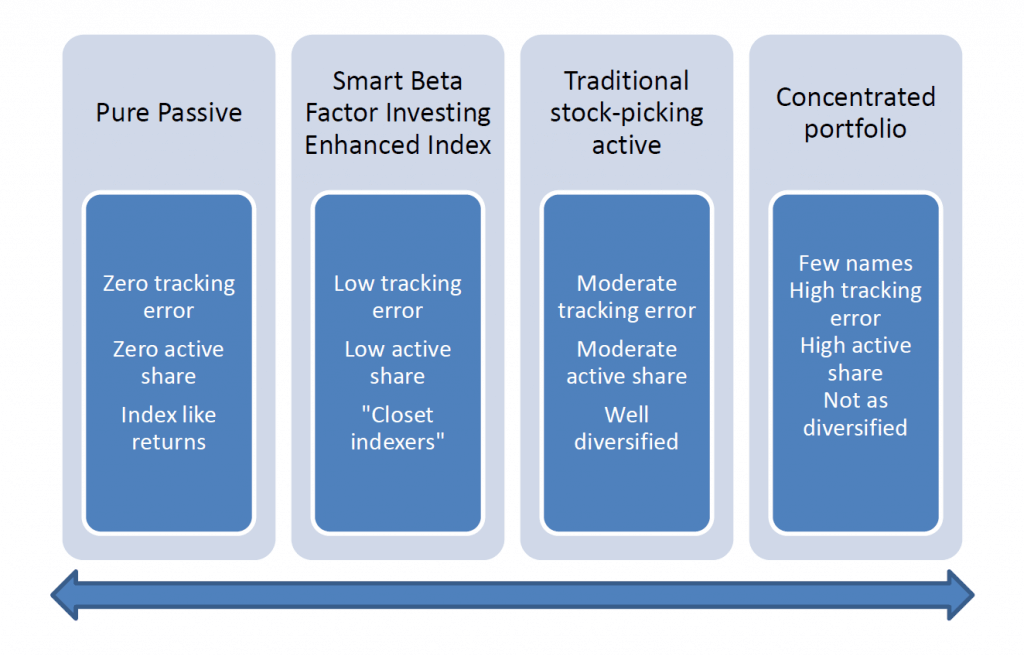

At Swan Global Investments, we reject this line of thinking. In our view, smart beta or factor-based investors occupy a spot on the same continuum and are every bit as exposed to market risk as traditional active and passive managers. If markets sell off by 30%, 40%, 50% or more during a bear market, all managers on the spectrum will be exposed.

Source: Swan Global Investments

To understand smart beta and factor investing, it is useful to understand its history and evolution. Half a century ago, people started using the Capital Asset Pricing Model (CAPM) to explain how sensitive an individual investment was to movements in the market. The CAPM was the original factor model, and there was only one factor: the market.

Over the following decades, refinements were made to the original CAPM model to capture and quantify additional variables. Eugene Fama and Kenneth French determined that small cap stocks and stocks with a value tilt tended to outperform over time. Fama and French added both these factors to the original CAPM.

Dimensional Fund Advisors built their highly successful fund family upon these theories. Instead of paying active managers hefty salaries to research companies and assemble portfolios, DFA instead simply assigned “value” and “small” scores to stocks, sorted them from highest to lowest, and built their portfolios around those biases.

Once the concept of factor-based investing and cheap computing power became widely available 20 years ago, the floodgates opened. There was a surge in quantitative money managers, many using Barr Rosenberg’s Barra Risk Factor Analysis platform to construct portfolios. A whole new breed of “quants” spent their days trying to identify new explanatory factors or design optimization algorithms.

Smart Beta: All that Different?

This idea of factor-based investing eventually merged with the nascent exchange-traded fund industry to coalesce into the “smart beta” movement. The basic thesis behind smart beta is that indices based solely on market capitalization are lacking. The idea is systematic biases exist that would generate excess relative returns if these factors were over- or under-weighted relative to the cap-weighted market.

Every deviation from the original Capital Asset Pricing Model is some variation on this basic premise. Fama-French, BARRA, factor analysis, smart beta…it’s all variations on the same theme.

The main objection Swan Global Investments has with all these strategies is that systematic risk remains unaddressed. In all of the CAPM-based models, the biggest factor is always simple market risk. Market risk represents absolute risk: the risk of catastrophic loss, the risk of running out of money.

Of the 787 large cap mutual funds analyzed, 746 had R-squareds of greater than 80% to the S&P 500. This means that for almost 95% of the large cap funds studied, over 80% of their return patterns could be explained by movements in the S&P 500. Over two-thirds of the funds had R-squareds greater than 90%.

Clearly, the market is the primary driver of returns for most large cap funds, regardless if they are passive, smart beta, or active.

We explore the development and impact of Smart Beta investing in the white paper “Losing the Forest for the Trees.”

Where Is the Volatility? Examining the current low volatility environment with all of the volatile political events, happening domestically and internationally, over the past few years.

NEXT ARTICLEMarc Odo, CFA®, CAIA®, CIPM®, CFP®, Director of Investment Solutions, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.www.swanglobalinvestments.com. 298-SGI-110117