May, 13, 2021

[Orginal Post June 2020, Updated May 2021]

Our outlook for bonds has moved from bleak to dire. Over the coming decade or two, bonds are unlikely to fulfill their dual role of income and capital preservation. Bond investors will be forced to choose between income or capital preservation, and there is a good chance they could end up with neither.

In the summer of 2019, Swan Global Investments published a well-received white paper, “The Bleak Future of Bonds.” The main thesis was the economic fundamentals are unfavorable for fixed income securities across the credit spectrum creating portfolio construction challenges for many advisors.

Less than a year later, the global economy was devastated by the coronavirus pandemic. Unfortunately for investors, the monetary and fiscal consequences of the pandemic have made the outlook for bonds even worse. The trends and concerns raised a year ago have been exacerbated by the pandemic.

What was bleak two years ago is dire today.

This brief update revisits the main tenets of “The Bleak Future of Bonds” white paper and provides updates to some key numbers in the aftermath of the COVID-19/coronavirus crisis and what this means for portfolio construction going forward.

Our 2019 white paper originally made the following key points:

The COVID-19 pandemic has made the outlook for all these factors worse. If there was a doomsday clock predicting an eventual debt reckoning, the global pandemic moved the clock’s hands significantly closer to midnight. Since the onset of the COVID-19 Crisis, the bond market has gone through three major stages:

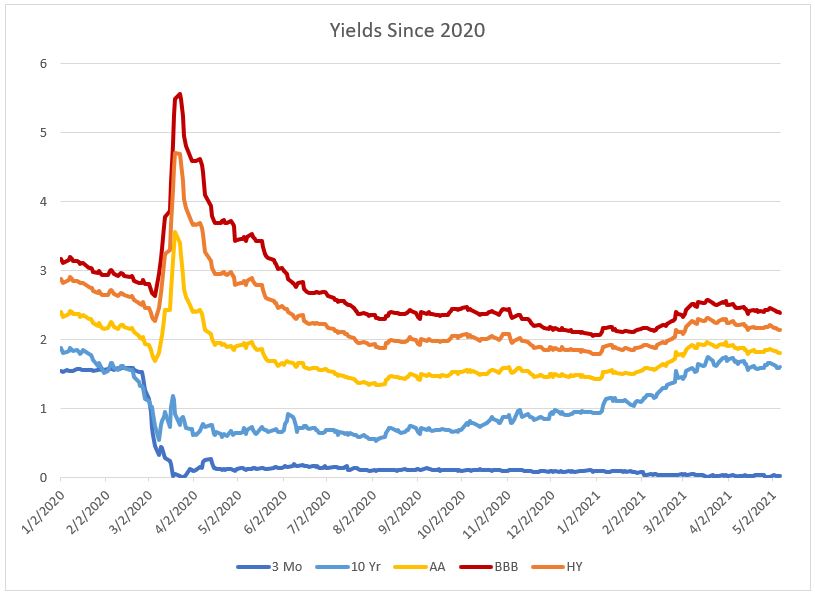

Source: U.S. Treasury, St. Louis Fed

As the coronavirus crisis broke out of China and swept across the globe, the impact on the financial markets and the world economy was severe. In the U.S. the longest economic expansion and second-longest bull market came crashing to a halt.

The S&P 500 lost over a third of its value in just over a month. In a panic, investors rushed into “safe harbor” assets like cash and Treasuries.

Yields on 3-month Treasuries approached 0% and the 10-year yield fell below 1%. Liquidity and credit quality concerns slammed corporate and high yield debt and the spreads over Treasuries spiked.

The massive fiscal and monetary stimulus had the desired effect. Markets rallied off their lows and by early August the S&P 500 had recovered all of its losses. This coincided with the yield on the 10-year Treasury bottoming at 0.52%.

As calm returned to the markets, the spreads of investment grade and high yield corporate bonds began to narrow. In absolute terms, corporate bonds were offering less yield than they were before the crisis.

The collapse in yields throughout 2020 painted the bond market into a corner. If yields remained low, investors wouldn’t be able to generate enough income to outpace inflation. If yields started rising, the prices of bonds would fall. The stage was now set for some realized pain in the bond market.

Investors tend to think of bonds as the “safe” part of their portfolio. Some mistakenly believe bonds won’t lose value. But Finance 101 tells us if yields rise, bonds will lose value.

This is what happened in the fourth quarter of 2020 and the first quarter of 2021. The benchmark 10-year Treasury rose from 0.52% to almost 1.75% in just over six months. During the first three months of 2021 the Barclays US Aggregate Bond index lost 3.37% and the Barclays US Treasury Long-Term index was down 13.51%, its biggest loss in over four decades.

What caused this reversal?

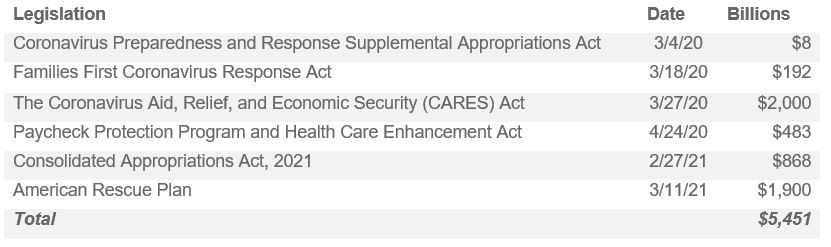

The government’s response to the Covid-19 pandemic was simple: throw money at it. And not just some money, but a truly unprecedented amount of money. Since 2020, almost $5.5 trillion in Federal government spending has been authorized to combat the impact of the pandemic:

Source: Peter G. Peterson Foundation

In addition to the trillions dedicated to the Covid responses, the new administration is proposing a massive expansion in government spending. The infrastructure plan carries a price tag of $2.3 trillion and an expansion of educational and family-support measures comes in at $1.8 trillion[1]. While it is unlikely these proposals will be adopted in their current form, it’s enough to make bond holders sweat.

This fiscal stimulus is only part of the equation; monetary stimulus is the other side of the coin. While the Federal Reserve has engaged in over a dozen major activities to bolster the economy, the one that stands out is a return of quantitative easing. Since the crisis began, the Federal Reserve has added $4 trillion to its balance sheet, going from $3.8trn to $7.8trn.

Simply put, no reasonable person should think such an extreme supply of debt can be issued without a corresponding impact on yields.

[1] Wall Street Journal, May 9, 2021, “Infrastructure Talks Could Set the Course of Biden’s Spending Plans”

The outlook for bonds is indeed looking dire, pushing advisors to look beyond traditional allocation for risk management, returns, and income. For decades the standard shorthand for a balanced portfolio was the 60% equity/40% bond model. Conventional wisdom was that the most conservative investors should have most, if not all, of their assets in bonds/fixed income.

But based upon the facts outlined above, advisors and investors should anticipate a world where bonds increase portfolio risk, rather than mitigate risk.

Allocating a significant portion of one’s portfolio to assets that are unlikely to produce a positive real return is a fool’s errand. Advisors must seek out better ways to mitigate downside risk in their clients’ portfolios.

Our outlook for bonds remains bleak and the time is now for advisors to seek out alternative solutions for managing risk and addressing income needs.

Our philosophy has always been to remain “Always Invested, Always Hedged.” We have been actively managing risk since 1997, and we do it without any bonds. Through a variety of solutions, we seek to actively hedge our equity market exposure via the use of put options.

Hedging has served us well through previous market downturns, and we believe it may continue to do so in future bear markets.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA, FRM, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

[1] “How a Deluge of Downgrades Could Sink the CLO Market”, Bloomberg, April 22, 2020

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 251-SGI-062620