This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksAlthough the Defined Risk Strategy (DRS) was originally designed to be a total portfolio solution, Swan Global Investments realizes it is unlikely that many people will place 100% of their money in the DRS.

One of the most frequently asked questions regarding the Defined Risk Strategy is, “Where does the DRS fit?” While it is true that the DRS can perform many different roles within a portfolio, we tend to position the DRS first and foremost as a core equity solution.

The flagship DRS solution, with its inception in July 1997, is based on large cap U.S. equity. Although the DRS is now offered upon other asset classes like small cap equity, foreign developed, and emerging markets, the flagship offering has always utilized U.S. large cap ETFs for its equity exposure. Typically, the DRS holds 85%-90% of its positions in ETFs.

One can make the case that the DRS is fundamentally a core equity position, with the hedge and income components overlaid on top of it. The DRs is distinctly always invested and always hedged.

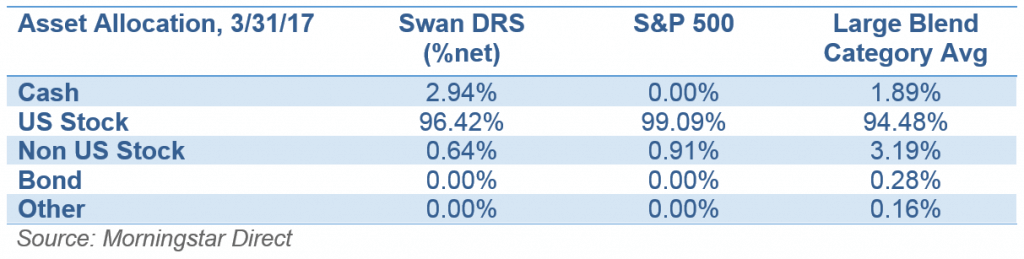

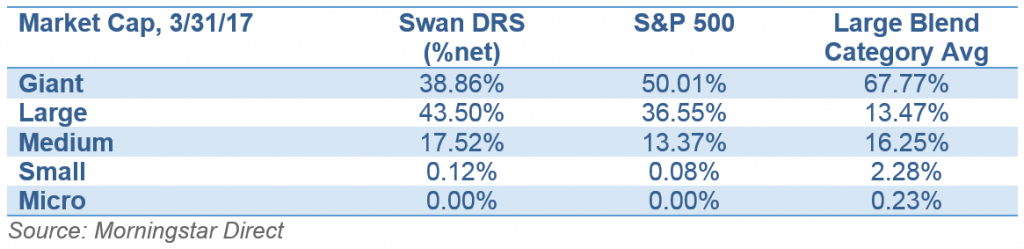

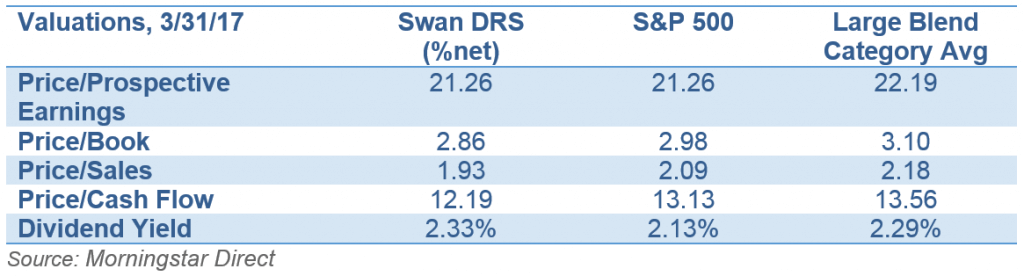

If one were to compare the portfolio characteristics of the Swan Defined Risk Strategy Select Composite against the S&P 500 Index and the Morningstar category for Large Blend, the DRS is right in line with other core, large cap equity offerings.

Given the fact that typically 85% to 90% of the portfolio is held in S&P Select Sector ETFs, these numbers are completely logical. The strategy does, however, pursue more of an equal-weight sector approach to the market. The S&P 500 is a market capitalization-weighted index. The equal-weight sector approach leads to a bit of a tilt to both smaller names and value characteristics, which you see in the market cap and valuation tables, respectively. If one is a proponent of Fama-French and the belief that there is a systematic value premium and a small cap premium, the equal-weighted sector approach is a way to emphasize those factors. But there is little doubt that the portfolio characteristics of the DRS are large cap, core equity.

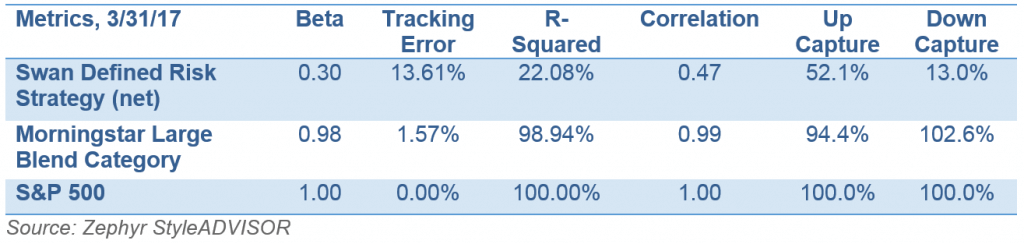

On the other hand, you will certainly see a difference of returns between the DRS and the S&P 500 index or the typical large blend mutual fund. If one were to look at traditional “tracking” metrics like correlation and R-squared, you will see much higher levels of dispersion from the S&P 500 than you would with a traditional large cap core fund.

This, of course, is by design. The whole intent of the DRS is to avoid those times when the market is down significantly. The driving idea behind the DRS is that those large bear markets are too painful to endure, so the DRS is engineered to have a different risk-return profile than a traditional long position.

The Target Return Band

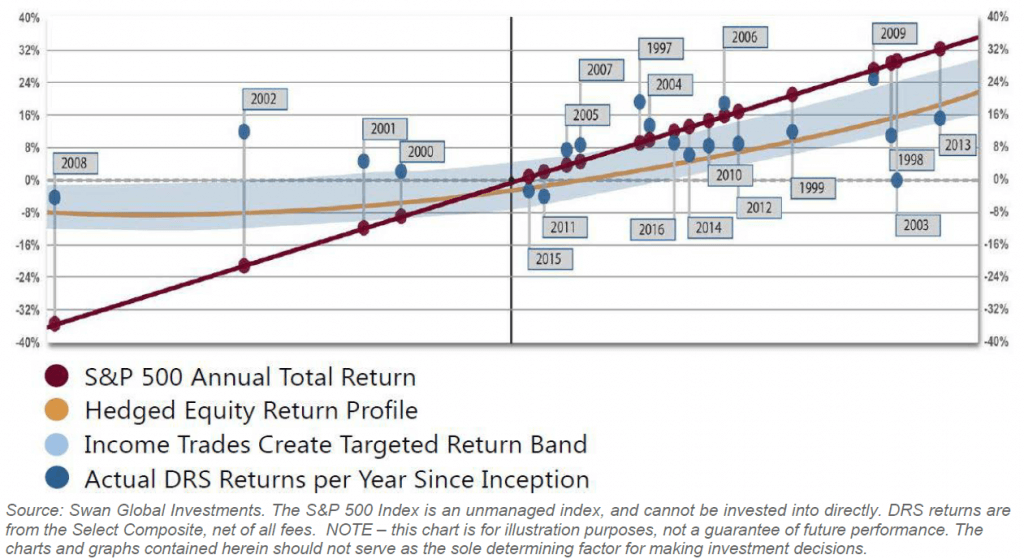

One of the key charts we use at Swan to convey this message is the Target Return Band below:

It is our goal that returns of the DRS will be within or above the blue shaded area. Historically, in every year but one, they have been.

In our opinion, the DRS allows one to have their cake and eat it too. The investor has large cap, core equity exposure via our large holdings in the S&P Select Sector ETFs. However, the DRS redefines the risk-return profile of those holdings has been altered to manage and diminish the impact of bear markets.

It is this difference in return patterns and the use of options that drive some to classify the Defined Risk Strategy as an “alternative” strategy. The argument for treating the DRS as an alternative investment will be explored in an upcoming blog post.

Other roles we have explored in this series are:

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Director of Investment Solutions, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan Global Investments offers and manages the Defined Risk Strategy for investors including individuals, institutions and other investment advisor firms. All Swan products utilize the Swan DRS but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results and comparing results among the Swan products and composites may be of limited use. Swan claims compliance with the Global Investment Performance Standards (GIPS®). Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997 and are net of fees and expenses. All data used herein; including the statistical information, verification and performance reports are available upon request. The benchmarks used for the DRS Select Composite are the S&P 500 Index, which consists of approximately 500 large cap stocks often used as a proxy for the overall U.S. equity market, and a 60/40 blended composite, weighted 60% in the aforementioned S&P 500 Index and 40% in the Barclays US Aggregate Bond Index. The 60/40 is rebalanced monthly. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The advisor’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the advisor invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com. 140-SGI-052617