The Federal Reserve signaling a shift in monetary policy is causing a shift in the markets that have run hot on many years of stimulus and low rates. Now investors must shift with the Fed, identify different strategies suited for a tighter policy regime, and adjust portfolios to stay on track towards long-term goals.

For more than a decade, US equity investors have enjoyed a party comprised of strong overall gains and short-lived corrections that were treated as opportunities to “buy the dip” and “party on”.

The party began in 2009 after the Great Financial crisis. It was hosted by the Fed and the US Congress, who offered a highly accommodative “punchbowl” in the form of low-interest rates, stimulative monetary policy, and fiscal stimulus.

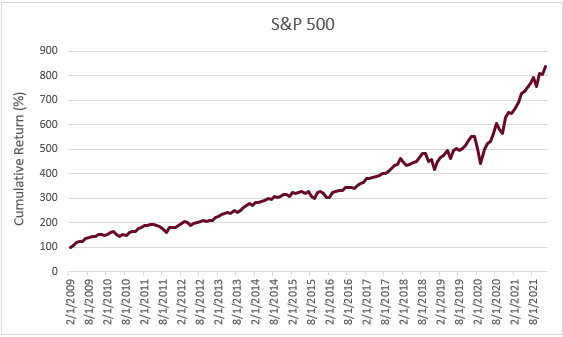

It was truly a party for the ages, lifting the S&P 500 dramatically and generating an eye-popping 740.04% cumulative return, with an average annual return of 18.04% from March 2009 through December 2021. This may be skewing investor expectations for stock market returns going forward.

Source: Zephyr StyleADVISOR, Swan Global Investments

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

But like any great party, it must inevitably come to an end. Now investors are realizing the music has stopped and the punch bowl is being removed.

Jerome Powell, Chairman of the Federal Reserve, says the market no longer needs the punchbowl, and actually Federal Reserve officials suggest they may raise rates faster then initially assumed and withdrawal support of the economy. In testimony before the U.S. Senate Banking Committee on January 4th 2022, Federal Reserve Chair Jerome Powell said:

“The economy no longer needs or wants the very accommodative policies we have had in place to deal with the pandemic and the aftermath.” Source: Reuters, republished by Yahoo!News

Investors are now reconciling with this fact. And just like when the lights come on at the end of the party, a recognition of the harsh reality occurs.

To begin this year, investors are repricing risk as the Fed announced in December it will shift policy by tapering its purchases of bonds and mortgage-backed securities in order to reduce its overall balance sheet (removing liquidity) and signaled it could hike interest rates as many as three times in 2022 to fight a growing inflation problem.

Not only does inflation threaten bond investors, but too much inflation can impact equities. If left unchecked, inflation can lead to economic slowdown and stagflation.

In fact, it seems the Fed’s shift in opinion on inflation may have forced the overall monetary policy shift and removal of the ‘punchbowl’. Over the course of 2021, inflation grew from what the Fed initially described as a ‘transitory’ problem to a serious concern that Powell eventually admitted could pose a major threat to the labor market. As inflation has spiked, labor market woes also intensified due to health impacts from COVID variants, as well as, impacts from spending, policy, and regulatory responses to the virus.

Not only did stimulative monetary policy spur asset prices, but there was also the underlying assumption from many investors that the Fed effectively served as a ‘put’ or hedge on the market—there to step in if sell-offs became serious. That assumption may not serve investors well going forward as the Fed has larger problems to address and few tools left.

Increased volatility and a decline overall in US equities to open the year is not a surprising response to a shift in Fed policy and the low probability of additional stimulative programs. Historically, equity markets fall after the Federal Reserve’s initiation of interest rate hikes.

“History shows that the first Fed hike triggers a sell-off of between -7% and -15% (10% on average), while the end of liquidity over the past decade has hit the market by between -6% and -19%; end QE1 -16%, QE2 -19%, QE3 -6%.” – Cross Asset Market commentaries, US Research Sales Desk Summary, Société Générale S.A.,

While a correction in equity markets, in particular the S&P 500 and Nasdaq, may be expected after years of strong punchbowl-induced returns, the magnitude and duration of the correction (hangover) along with the degree and speed with which the punchbowl is removed are top of mind for investors.

When the music stops and the lights come on, the hard part begins—getting back to reality.

Just like a Monday morning after a Super Bowl party or a lengthy vacation, the hard part is ‘going back to work’. For investors, that process begins with assessing risks and ramifications of the shift in Fed policy, then adjusting portfolios accordingly.

A number of areas to reassess include:

Most importantly, investors may need to wrestle with the reality that the portfolio strategies and allocations that worked during the ‘party time’ may not work going forward.

For example, traditional portfolio construction, coupling stocks and bonds in a 60/40 or similar proportion, will be hard pressed to duplicate historic returns and risk management. As a possible signal of things to come, January 2022 saw simultaneous losses in both stocks and bonds.

Overallocation to bonds may invite more risk than investors may be aware of or comfortable with. In a low-but-rising interest rate and inflationary environment, many bond investments seem to have shifted from a risk-free source of return, to a return-free source of risk. In addition, many bonds have become increasingly correlated to equity markets, reducing their perceived diversification and capital preservation benefits.

Meanwhile, over-allocating to equities might expose investors to more volatility and downside risk than they can stomach.

As such, investors are seeking other tools to provide the desired risk-adjusted returns necessary to meet the long-term investment objectives.

Even though the “easy money party” may be winding down, that does not mean investors are necessarily left without reason for hope of achieving their goals.

We believe hedged equity provides investors with a timely option.

Hedged equity involves combining equity holdings with a hedge to provide risk mitigation. If investors cannot rely on bonds to deliver both income and capital preservation, they may need an alternative. An effective hedge that is designed to increase in value during market sell-offs may provide diversification and help mitigate equity market losses, without adding risks associated with bonds.

Our “Always Invested, Always Hedged” approach to hedged equity enables investors to remain invested in equities to fuel potential returns, while remaining hedged to manage downside risk using put options. Our distinct approach to hedged equity, first launched in 1997, is applied to a range of hedged equity funds and strategies.

No one knows how the shift in Fed policy may ultimately impact the markets and inflation, but investors utilizing Swan’s hedged equity approach are prepared.

David Lovell, Managing Director – Head of Marketing, is responsible for Swan’s brand, marketing, content, events, and media. David began his career in the financial industry at Mass Mutual. David currently holds a Series 65 license.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

1A bear market is technically defined as a loss of 20% or more.

Swan Global Investments is an SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (DRS). Please note that registration of the Advisor does not imply a certain level of skill or training. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance that future performance will be comparable to past performance. This communication is informational only and is not a solicitation or investment advice. Further information may be obtained by contacting the company directly at 970-382-8901

or www.swanglobalinvestments.com. ***-SGI-02**22