This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksA Quick Guide in Drawdown Risk Management for Long-Term Investors

The recent global equity market sell-off has justifiably generated media attention and investor concern about a potential bear market. But it also presents an opportunity to evaluate risk.

While market drawdowns are inevitable and necessary for healthy markets, investors don’t exactly jump for joy when one occurs. It’s important, however, for investors to remember there are two types of market downturns: corrections and bear markets.

This post defines and explores the nature of corrections versus bear markets, with an eye on their impact on investors. While investors may want to avoid all losses, most know in order to achieve a return on their investment, some level of risk is necessary to accept.

So we pose the question: if you can’t be sure if a market downturn is a short-lived correction or the start of a bear market, and you can’t invest in risk assets and be protected from both simultaneously, which type of downturn is more important to be protected from?

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Prolonged bull markets with periods of low volatility can create risk complacency or even risk amnesia. Any subsequent market correction and/or spike in volatility often shakes investors out of their state of complacency and ignites fear of what they may have temporarily forgotten – markets can and will go down.

Because loss aversion is such a strong emotional driver, it is typical for many investors to quickly panic. Media coverage of market turmoil or daily losses for major indices can compound investor anxiety and drive nervous calls to advisors.

Investing involves the opportunity for gain or loss – but mathematically speaking, not all losses are equal. At Swan Global Investments we believe that given the difference in the nature and impacts of corrections versus bear markets, it’s more important to seek protection from the latter.

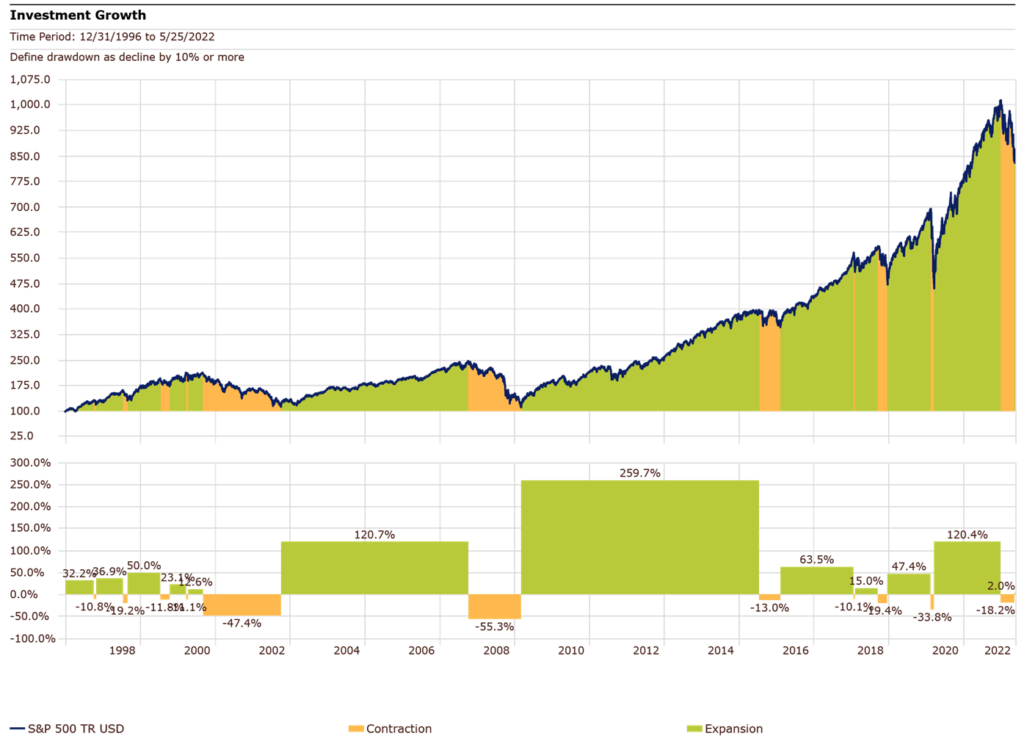

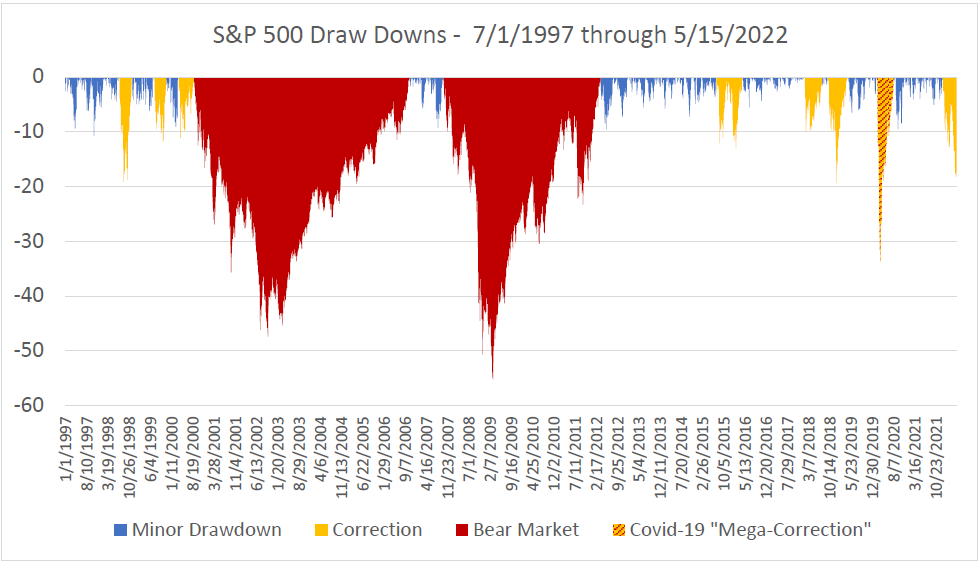

In the past 25 years, the S&P 500 Index has experienced seven corrections (not including the corrections occurring as part of the bear markets), two severe bear markets, and an unusual “mega-correction” associated with the Covid-19 pandemic.

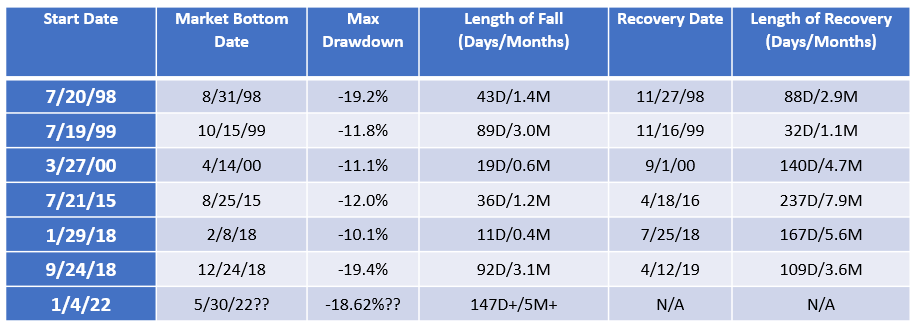

Corrections are often defined as losses in market value exceeding 10%, but less than 20% from a market high. Historically, corrections have lasted from between a few weeks to a few months. The table below lists the market corrections for the S&P 500 over the past 25 years.

Table A: Corrections in S&P 500 Total Return Index Over the Last 25 Years: 1997 – 2022

Source: Morningstar Direct. Data for 2022 is not complete as the drawdown and recovery are not complete as of the posting of this article.

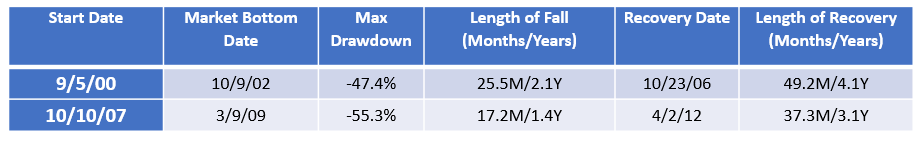

Bear markets are defined as losses in a market value of 20% or more and have historically lasted several months to several years. The losses experienced in bear markets are more intense and require longer recovery periods on average than corrections, as shown below.

Table B: Bear Markets in S&P 500 Total Return Index Over the Last 25 Years: 1997 – 2022

Source: Morningstar Direct.

Speed

The speed of the drawdown refers to how fast, measured in days, the markets fall from peak to trough. Over the past twenty-five years, the speed of the fall for corrections can be measured in a matter of days to a few months, while the bear markets took much longer, generally extending over a year.

While faster drawdowns impact emotions and media response, what is more important to investor outcomes is the magnitude or intensity of the drawdown and the length of the recovery.

Source: Morningstar Direct

Intensity

The intensity of the drawdown measures how much market value was lost. As defined earlier, corrections are market losses of between -10% and -19%. Over the last twenty-five years, the most intense correction delivered a drawdown of -19% and the least intense corrections created a market value loss of about -12% to -13%.

By comparison, the magnitude or intensity of losses during bear markets are often more difficult for investors to stomach. Although a bear market is defined as losses in value of more than -20%, the two in the past 25 years were more than -47%, more than double the losses caused by corrections. The intensity and effects of a bear market are unmatched, especially when we consider time of recovery.

Recovery Time

Recovery time refers to how long it takes for the market to recoup its losses and return to pre-fall levels. Mathematically speaking, the larger the loss, the larger the gain needed to recover. We cover that in more detail here. So it stands to reason that market corrections, with smaller losses by definition, would require less recovery time.

It is important to note here, that recovery time depends on the intensity of the drawdown, as well as the nature of the market after the drawdown ends and recovery begins, so recovery times are not always in direct correlation to the drawdown intensity.

The -19% corrections in 1998 and late 2018 both took about three months to recover. The -12% drop in 2015-16, though, took almost eight months to recover.

Despite the discrepancy between corrections’ drawdowns and recovery times over the last 25 years, most took less than half a year to recover. The recovery for the bear markets, however, required years before investors clawed back their losses.

Duration

The duration of a drawdown includes the total length of time the market took to fall from a peak to the trough and the length of time to recover the losses back to the pre-drawdown level.

The graph below shows the depth and duration of losses of the corrections and bear markets.

Source: Morningstar Direct

The bear market during the Dot-com Bust of 2000-2002 may have created a slightly smaller drawdown than the bear market during the Financial Crisis of 2008-2009, but its duration was much longer.

Generally speaking, corrections take less time overall to fall and recover. Tables A and B above show average duration of corrections can be less than a year while bear markets can go beyond four years.

So are corrections worth all the fuss/worry, if on average within a year, investors can put the correction in the past and move on?

On the other hand, a bear market generally takes years before recovery is realized – and sometimes longer for the investor to mentally and emotionally recover. That sort of recovery time can seriously wreck a long-term investment plan or delay goal accomplishment like retirement start dates or college education funding, for example.

The COVID-19 Panic: A Special Case

This brings us to the short and severe sell-off that occurred in early 2020 when the COVID-19 pandemic swept across the globe. Was it a bear market or a correction?

Based upon our previous criteria of speed, intensity, recovery, and duration, the case can be made for either. On one hand, the intensity of the sell-off was severe: the S&P 500 lost over a third of its value, easily meeting the definition of a bear market if one uses a 20% sell-off as the qualifier.

On the other hand, the speed, recovery, and duration of the sell-off and subsequent rally were all incredibly brief. In fact, it was the fastest sell-off and quickest recovery in history. The S&P 500 started selling off on February 20th, bottomed on March 23rd (33 days), and had recovered all its losses by August 10th. The whole experience, from sell-off to recovery, lasted all of 173 days and the S&P 500 actually ended up 18.4% for the calendar year 2020.

If one views bear markets as severe or permanent impairment of capital, the COVID-19 sell-off might be better classified as a “mega-correction” rather than a true bear market.

Corrections may happen more often, but on average, they tend to be less intense and shorter in duration. They generally do not derail investors from their financial goals.

Bear markets, on the other hand, are much more disruptive for people hoping to achieve their goals. Bear markets generally result in major losses that take years to recover from. For those near or in the retirement phase, a bear market is particularly detrimental.

While market corrections might actually provide a wake-up call to risk-management considerations, if investors and their portfolios are unable to withstand a 10% correction, are they prepared for the possibility of an actual bear market?

The current market and volatility regime of 2022 also presents challenges. With inflation at 40-year highs, the largest European war since World War II, and the “Fed put” seemingly off the table, it certainly seems more uncomfortable downward moves may be ahead. With equities and bonds falling in tandem, investors are presented with a ‘Dual Dilemma’ that may make it harder to maintain a “buy-and-hold” strategy.

It’s our investment philosophy to hedge market risk directly in order to limit losses during bear markets and help investors remain invested and on track with their investment goals. We understand you can’t invest in risk assets and simultaneously protect against both smaller, short-term losses (corrections) and large losses with longer-term impacts (bear markets), so we’ve chosen to remain always hedged from the latter. We believe in managing against potentially life-altering losses to portfolios, rather than seeking protection from what are often bumps on the investment journey.

“By actively seeking to not lose big, we believe our investors will be better off in the long run.“

– Randy Swan, Founder, CEO, Lead PM

David Lovell, Managing Director – Head of Marketing, is responsible for Swan’s brand, marketing, content, events, and media. David began his career in the financial industry at Mass Mutual. David currently holds a Series 65 license.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments is an SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (DRS). Please note that registration of the Advisor does not imply a certain level of skill or training. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance that future performance will be comparable to past performance. This communication is informational only and is not a solicitation or investment advice. Further information may be obtained by contacting the company directly at 970-382-8901 or www.swanglobalinvestments.com. 195-SGI-060322