Different Approaches, Same End

Feb. 2, 2018

One of the new strategies attracting attention and assets these days is “low volatility” investing. Also described as “managed volatility” or “minimum volatility,” these strategies are marketed as a better mousetrap in the world of investing. With this post, we will analyze whether or not these low volatility strategies really have anything new to offer.

Before discussing the above topics, however, it is necessary to define just what people mean when they use the term “low volatility” investing.

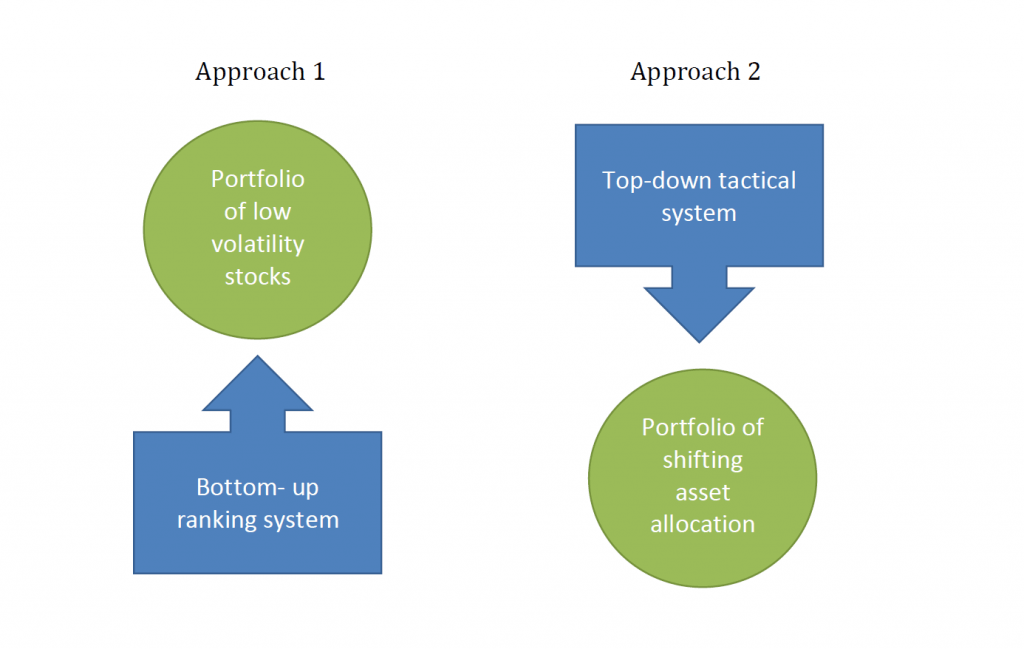

Low volatility better describes an outcome or a goal rather than an investment process; there are several different ways one can produce low volatility results. The products called low volatility or managed volatility typically follow one of two different investment strategies.

The first and more common approach to low volatility investing is essentially a form of factor analysis. Using a quantitative scoring system, a large pool of stocks is scored then ranked on either their historic or anticipated volatilities. A portfolio is then assembled from the stocks that have favorable, low volatility rankings. For anyone familiar with the “smart beta” movement, this type of factor analysis should sound quite similar.

An alternative way to produce low volatility results is to sell out of the more volatile asset classes before things go south. A strategy like this might potentially invest in equities, bonds, cash and attempt to produce less volatile results by moving from equities to fixed income before a correction or bear market and then jump back in to equities during bull markets. Of course, some would call such a strategy tactical asset allocation or market-timing, and they wouldn’t be too far from the truth.

Different Approaches, Same End

These are two very different paths that attempt to get to the same endpoint, i.e. a pattern of returns less volatile than that of a buy-and-hold, fully invested, cap-weighted index like the S&P 500. The former approach of scoring individual stocks on their volatility characteristics is more of a bottom-up strategy, whereas the latter, tactical asset allocation approach can be described as top-down. When it comes to the returns, risks, and roles of low volatility or minimum volatility, the two approaches must be treated differently.

Source: Swan Global Investments

If a low volatility strategy is built from the bottom up by ranking individual stocks on their “volatility scores,” then success or failure will largely depend on whether or not that factor happens to be in favor. Smart beta, factor analysis, strategic beta, whatever you want to call it, is all the same thing. A subset of stocks from a large pool is identified to be more sensitive to or display certain quantifiable traits. The list of potential traits is inexhaustible, but some of the more common ones are value, growth, dividends, momentum, size, and, yes, volatility. The problem, however, is that there is no one magic factor that always works. Every factor will have periods when it is working and periods when it does not.

For the top-down, market-timing approach to volatility management, the drivers of returns will be at the asset class level, and the keys to success is being in the right place at the right time. Certainly if one has the wherewithal to 1) successfully forecast major market sell-offs and avoid them and 2) predict when markets are about to take off and capitalize on rallies, then their performance results would look fantastic.

As discussed previously, when it comes to factor analysis, no factor works all the time. The best a factor-based approach can reasonably hope for is to be right more often than it is wrong. The bigger risk, however, is that most factor analysis does nothing to address the biggest “factor” of all—market risk. A fully invested portfolio that tilts toward low volatility, or any other factor, is unlikely to avoid significant losses should the markets sell off by 30%, 40%, 50% or more. This topic is explored in our blog post on smart beta strategies and systematic risk.

For those low volatility strategies that employ a top-down, market timing approach, the risks are different. As stated before, the key to success with the market is being in the right place at the right time. The risks, however, are being in the wrong place at the wrong time. If one “misses the boat” with their tactical asset allocation decisions, either absolute or relative performance can suffer greatly. Market-timing is explored in depth in this blog post, but can be summarized with the old catchphrase, “Live by the sword, die by the sword.”

If either a bottom-up, factor-driven or top-down, market timing low volatility strategy is able to successfully generate lower overall volatility, then it would likely benefit an overall portfolio. In a previous blog, we discussed the detrimental impact volatility drag or variance drain can have on an investment’s return.

Low volatility is certainly a desirable trait in an investment. In fact, our Defined Risk Strategy (DRS) also has “low volatility” as a goal for its portfolio, but we seek to accomplish low volatility in a different fashion.

Where the DRS differs from “low volatility” or “managed volatility” strategies are in philosophy and approach. Swan believes that the biggest risk that any investor faces is market and systematic risk. During the big, bear market sell-offs, almost everything tends to go down at the same time. A factor-based, bottom-up, low volatility strategy might outperform the S&P 500 on a relative basis, but it will likely still lose a significant amount in absolute terms.

With respect to market-timing, Swan has always been skeptical. Swan believes it is too difficult to consistently call the tops and bottoms of markets and reposition the portfolio accordingly.

It is these two core beliefs—the concern regarding market risk and a lack of faith in market-timing—that underpin our “always invested, always hedged” philosophy. Unlike the top-down, market-timing strategies, we remain “always invested” with our buy-and-hold positions in market ETFs. While bottom-up, volatility-factor analysis fails to address systematic risk, we seek to do so and remain “always hedged” by protecting the portfolio via long-term put options. Using this time-tested strategy, we believe we have a better way of producing low volatility results.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

More Articles in This Series

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan Global Investments offers and manages the Defined Risk Strategy for investors including individuals, institutions and other investment advisor firms. All Swan products utilize the Swan DRS but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results and comparing results among the Swan products and composites may be of limited use. Indices are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. DRS results are from the Select Composite, net of fees, as of 12/31/2016. The charts and graphs contained herein should not serve as the sole determining factor for making investment decisions. Hypothetical performance analysis is not actual performance history. Actual results may materially vary and differ significantly from the suggested hypothetical analysis performance data. This analysis is not a guarantee or indication of future performance. Swan claims compliance with the Global Investment Performance Standards (GIPS®). Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes nonqualified discretionary accounts invested in since inception, July 1997 and are net of fees and expenses. All data used herein; including the statistical information, verification and performance reports are available upon request.

The benchmarks used for the DRS Select Composite are the S&P 500 Index, which consists of approximately 500 large cap stocks often used as a proxy for the overall U.S. equity market, and a 60/40 blended composite, weighted 60% in the aforementioned S&P 500 Index and 40% in the Barclays US Aggregate Bond Index. The 60/40 is rebalanced monthly. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The advisor’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the advisor invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. Further information is available upon request by contacting the company directly at 970.382.8901 or visit www.swanglobalinvestments.com. 068-SGI-020218