This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksRetirees need their money to last. Outliving retirement income is a fear of every retiree and an outcome every advisor should seek to prevent.

Low bond yields (interest rates) mean low payments for retirees from these fixed-income investments. As a result, many retirees have turned to other, often riskier, sources of income.

Systematic withdrawals, or taking regular withdrawals from an account, can complement other sources of income for retirees. The key is to avoid large losses while growing capital.

With a track record of limiting bear market impacts and consistent returns through market cycles, the Swan Defined Risk Strategy (DRS) may serve as a sustainable source of needed cashflow while pursuing growth of capital.

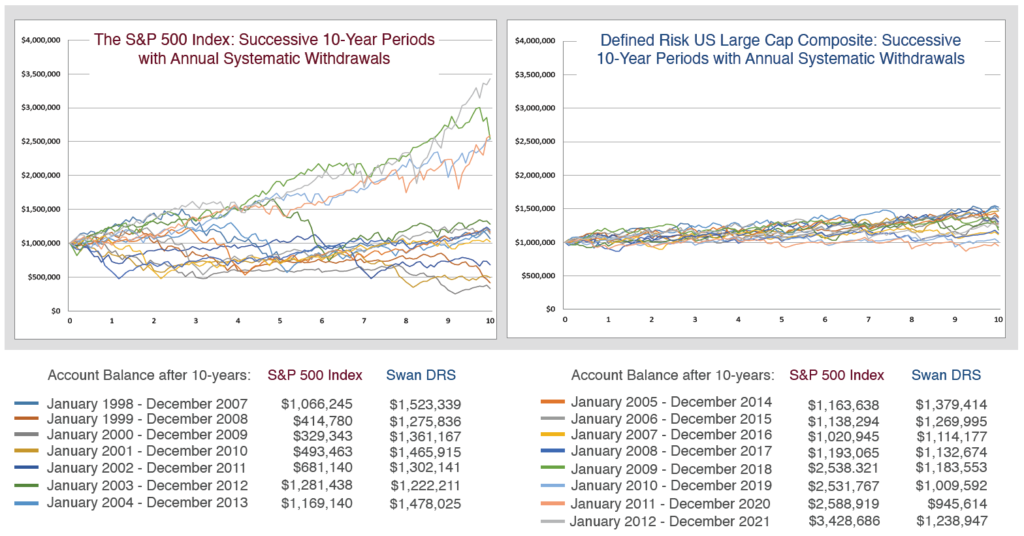

Let’s say you have accumulated $1,000,000 for retirement. You need $5,000 per month of income to complement your other sources of income, such as Social Security. The hypothetical below uses actual historical returns from three different investment choices and assumes your monthly withdrawal is adjusted annually 2% to keep pace with inflation.

Generating consistent returns and avoiding big losses may allow you to be more confident in taking account withdrawals for the cash flow necessary in retirement.

The graphs below show fifteen,10-year investment periods. The first period is 1/1998 to 12/2007; the last period is 1/2012 to 12/2021. Each 10-year period begins with a $1,000,000 account balance. Annual withdrawals are made on January 1st. The first withdrawal is $50,000, then subsequent annual withdrawals are adjusted annually 2.0% for inflation.

Source: Zephyr StyleADVISOR and Swan Global Investments. The S&P 500 Index is an unmanaged index, and cannot be invested into directly. The hypothetical analysis above is using historical performance of the Swan Defined Risk U.S. Large Cap Composite since January 1, 1998, net of all fees, not backtested performance numbers. The charts above are for illustration purposes, not a guarantee of future performance, and should not serve as the sole determining factor for making investment decisions. The calculations presented here are believed to be reliable, but their accuracy or completeness cannot be guaranteed. No guarantee is given as to actual investment results, thus the assumed growth rate used may or may not be attained. Past performance is no guarantee of future results. See our Investing for Income presentation or visit www.swanglobalinvestments.com for more information.

The Swan Defined Risk Strategy (DRS) may provide staying power and growth for your assets in retirement, even while taking systematic withdrawals from your account.

Ask your financial advisor about how you could use the DRS to provide sustainable retirement income.

Additional Disclosures: Swan Global Investments, LLC (“Swan”) is an independent Investment Advisory company headquartered in Durango, CO. Swan is registered with the US Securities and Exchange Commission under the Investment Advisers Act of 1940. Note that being an SEC registered Investment Adviser does not denote any special qualification or training. Swan offers and manages The Defined Risk Strategy (“DRS”) for its clients including individuals, institutions and other investment advisor firms. Swan Global Investments has affiliated advisers including Swan Global Management, LLC, Swan Capital Management, LLC, and Swan Wealth Advisors, LLC. There are nine DRS Composites offered: 1) The DRS Select Composite which includes non-qualified accounts. 2) The DRS IRA Composite which includes qualified accounts. 3) The DRS Composite which combines the DRS Select and DRS IRA Composites. 4) The DRS Institutional Composite which includes high net-worth, non-qualified accounts that utilize cash-settled, index-based options held at custodians that allow participation in Clearing Member Trade Agreement (CMTA) trades. 5) The Defined Risk Fund Composite which includes mutual fund accounts invested in the S&P 500 equities. 6) The DRS Emerging Markets Composite which includes mutual fund accounts invested in emerging markets equities; 7) The DRS Foreign Developed Markets Composite which includes all research and development account(s), and mutual fund accounts invested in foreign developed markets equities; 8) The DRS U.S. Small Cap Composite which includes all research and development account(s), and mutual fund accounts invested in U.S. small cap equities; 9) The DRS Growth Composite which includes all research and development account(s), and mutual fund accounts invested in the S&P 500 equities. Additional information regarding Swan’s policies and procedures for calculating and reporting performance returns is available upon request.