This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksSep. 19, 2018

Seeking Bond Alternatives

Original Post September 2018, Updated June 2021

Portfolio protection is now top of mind for many investors.

With U.S. equities pushing all-time highs, inflation concerns rising, and “irrational exuberance” returning to the market, many investors are justifiably concerned.

Historically, advisors have recommended significant bond allocations to hedge their clients’ portfolios – and historically, it has worked. For example, during the Global Financial Crisis of November 2007 until March of 2009; the Barclay’s Bond Index rose 6% while the S&P 500 Index fell 50%. Thus, a balanced portfolio of 60% stock / 40% bonds fell around 27%.

But the landscape has changed.

The current low-yield environment, with the potential for rising rates in years to come, presents a challenge to those investors seeking capital preservation from bonds. It may be time to consider bond alternatives.

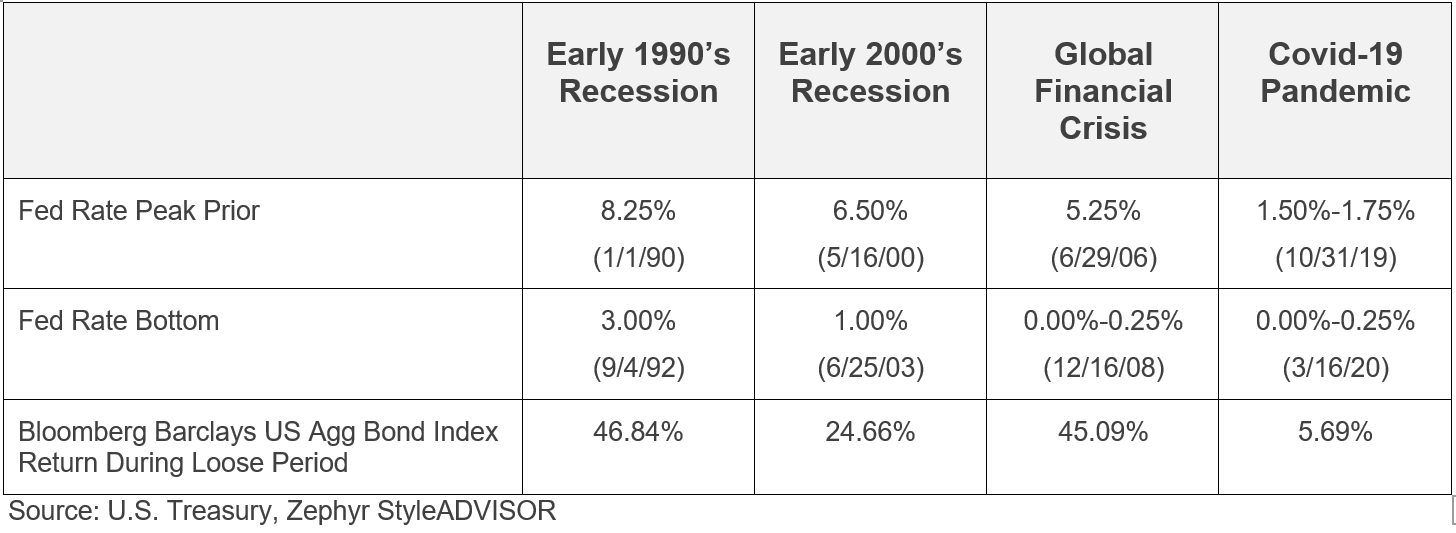

Over the last 30 years there have been four times in which the Fed entered an extended period of loose, accommodative monetary policy in order to help ease the economy through a recession. In all four cases bonds performed well. As rates fell, bond values increased, helping offset losses associated with the equity markets. If the standard, balanced portfolio contained 60% in equities and 40% in fixed income, that 40% allocation to bonds was vindicated.

The first three recessions listed started with the Federal Fund rate over 5%. In each case the Fed was able to cut over 500 basis points from short-term lending in order to help boost the economy during a recession. The Barclays Aggregate U.S. Bond Index performed quite well during these periods, providing positive returns that offset losses in the equity markets.

The most recent crisis, the Covid-19 pandemic, illustrated the perils of keeping rates too low for too long. When the pandemic swept across the globe the Fed had little scope to reduce rates. In fact, the Fed had been cutting rates ever since December 2018, even though there was no economic justification for doing so. This time when the Fed Fund rate was cut to near-zero levels, the Barclays Aggregate was only up 5.7% for the six-month period of January to July of 2020.

Without its primary tool available, the Fed had to resort to open-market operations, i.e. quantitative easing, in order to affect the economy. The speed and scale of the assets purchased by the Fed during the Covid crisis dwarfed the three rounds of Quantitative Easing that occurred during the Global Financial Crisis. Combined with the massive fiscal stimulus of 2020-21, this has led to a new set of problems.

All of this monetary creation has had a predictable effect. The effects of inflation, having been dormant for decades, is starting to climb the list of investor concerns. A sharp rebound from the “lost year” of 2020, direct and indirect fiscal support to citizens, and bottlenecks in supply chains and labor markets are all driving prices higher.

Inflation is particularly worrisome for bondholders for two reasons:

Bond investors might feel like they are in a “no-win” situation. If yields stay at their current low levels, it is unlikely the income will be enough to outpace the general rise in prices that is inflation. If interest rates start rising, bond prices will fall.

For an asset class that is supposed to represent the capital preservation portion of a portfolio, this is very concerning.

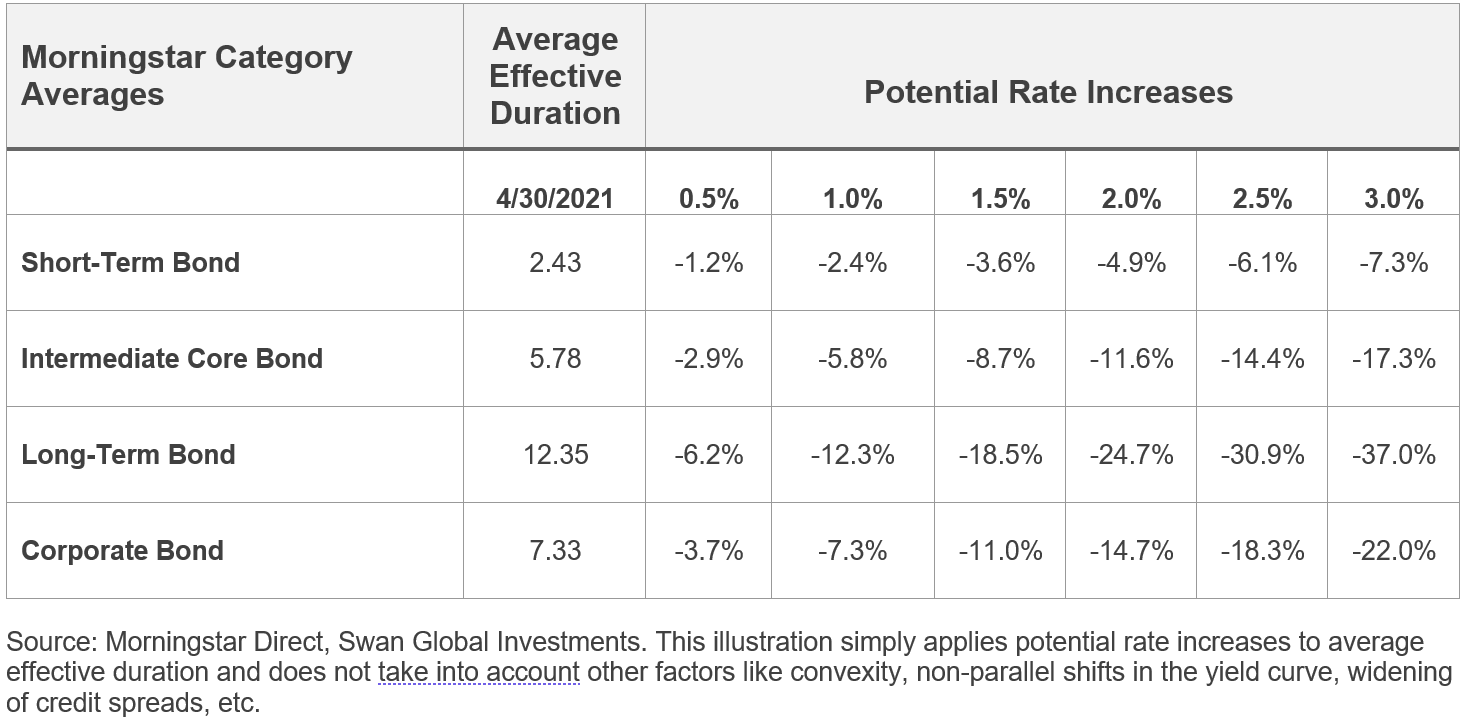

The table below shows the average durations of different fixed income categories and how susceptible they are to losses in the face of rising interest rates.

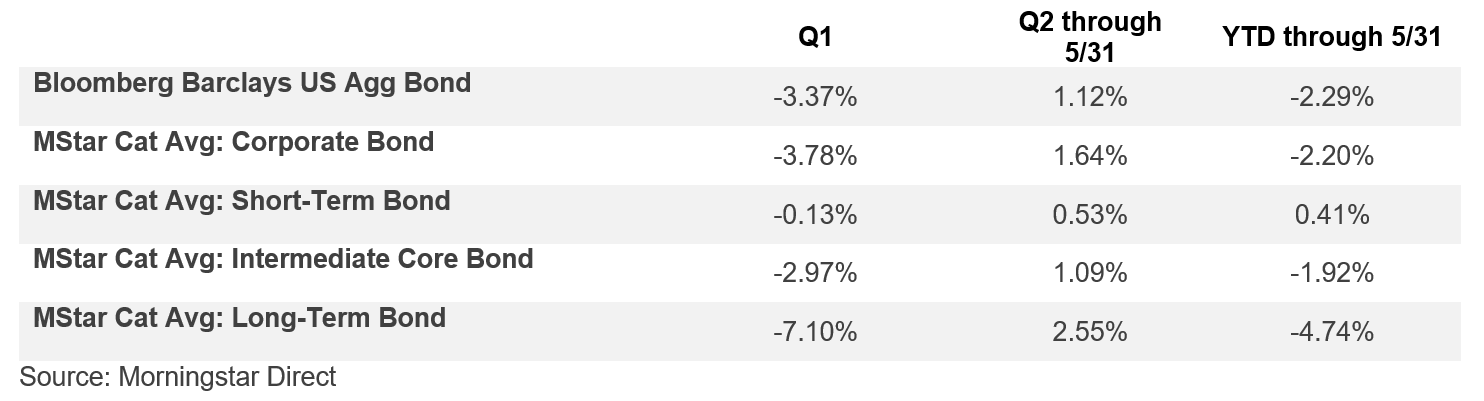

We’ve already seen this bear out a bit in 2021, as many bond funds have lost money in the first half of the year.

If rates continue to rise in a healthy economy, bond investors can expect more losses. They might want to consider an alternative to bonds.

Those depending on bonds to fulfill the conservative portion of the portfolio may be facing some tough times ahead. Luckily, there are many alternatives to bonds that don’t depend on bonds for capital preservation. Investors have more options than before.

Investors and institutions are seeking options to traditional asset allocation, especially those strategies that combine underlying equity investments with hedging methods. This has resulted in the ‘Options Trading Strategies’ segment becoming one of Morningstar’s fastest-growing categories.

At Swan Global Investments we believe this new environment requires a new solution. Our distinct hedged equity solution, the Defined Risk Strategy, seeks to fulfill the downside risk mitigation role that bonds have previously played. Our Always Invested, Always Hedged investment process seeks to pair up equity market particiption with downside hedging.

Shifting allocations to bond alternatives that directly hedge market risk may feel risky. But it may be a riskier move to stay with the familiar that isn’t working than to try something new that might provide the protection many seek and need.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly, Marc was the Director of Research at Zephyr Associates for 11 years.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms.

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970-382- 8901 or www.swanglobalinvestments.com. 160-SGI-071621