This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanks

All options-based strategies are not created equal. Many investors however tend to lump all strategies that utilize options together. This is an erroneous approach, as different strategies have very different objectives and different ways of utilizing options.

One of the most common option-based strategies is the covered call.

The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To execute a covered call, the investor holds an underlying position on individual stock(s) or an index-like position. In addition, the investor seeks to supplement their return by systematically selling calls against their long position(s) and collecting option premium. Although often thought of as a way to hedge a long-only holding, covered call strategies are not hedges.

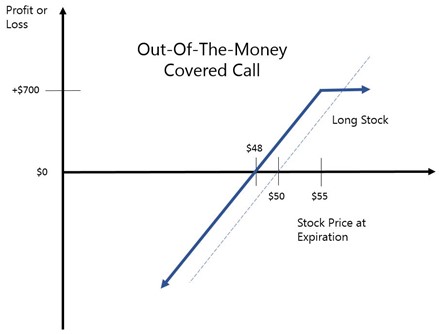

Below is a graph outlining the return profile of a covered call strategy, with the underlying stock as the dotted line and the combined equity-and-short-call return profile as the solid line.

With a covered call strategy, the lion’s share of the holdings are in a buy-and-hold position in a stock or index. While the collection of option premium might supplement the returns, the primary driver of a covered call strategy will most likely be simply the upward or downward movement in the stock price.

While the covered call strategy sounds like a clever way to supplement return with income (option premium from the sale of the call option), there are two major risks associated with it: one on the upside and one on the downside.

1) The first risk is that the markets take off too quickly and the call option goes in-the-money. Under such circumstances the investor really only has a few options:

2) The other risk is on the downside. A covered call strategy offers no downside protection. The long position is unhedged and completely exposed to losses. The income from the sale of calls might offset a bit of the losses, but in a situation where the market sells off 20%, 30%, 40% or more, it is highly likely a covered call strategy would face similar losses.

Using a dated but still useful nomenclature, a covered call strategy essentially transforms a “growth” position (i.e., a long stock) to a “growth and income” play. The potential for larger gains is in effect swapped out for immediate income. In a low-yield world where dividend-paying stocks are trading at a premium, this type of approach might boost income if it works out.

The ideal scenario for a covered call strategy is a slowly rising market, where the equity position gains but never moves past the strike price of the call option. In such a situation the portfolio can collect return from the sale of calls, but not worry about having its market gains being sold away. Sadly, this situation doesn’t accurately describe much of what we’ve seen over the last decade or more. Either markets were selling off massively (2007-08) or rallying significantly (2009-10, 2012-2016). Neither situation is good for covered call strategies.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Marc Odo, CFA®, FRM®, CAIA®, CIPM®, CFP®, Client Portfolio Manager, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. His responsibilities also include producing most of Swan’s thought leadership content. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Our portfolio managers and analysts are dedicated to creating relevant, educational Articles, Podcasts, White Papers, Videos, and more.

Swan Global Investments is an SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (DRS). Please note that registration of the Advisor does not imply a certain level of skill or training. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is no guarantee of future results and there can be no assurance that future performance will be comparable to past performance. This communication is informational only and is not a solicitation or investment advice. Further information may be obtained by contacting the company directly at970-382-8901 or www.swanglobalinvestments.com. 279-SGI-102121