This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Privacy Policy

Okay, thanksWhen people discuss “the market”, what exactly are they referring to?

Thankfully, the Dow Jones Industrial 30 average, with its numerous shortcomings is used less and less as a broad proxy for the overall market. These days the go-to benchmark for stock market performance is the S&P 500 index. But how much of “the stock market” does the S&P 500 really cover?

The S&P 500 is a market-capitalization weighted index of 500 U.S. based companies, selected by a committee to broadly represent the U.S. economy. Since the index is cap-weighted there is definitely a large-cap bias to it. The top 10 names out of 500 make up 17.61% and the top 25 names equate to 32.53% (Source: Morningstar Direct. As of 12/29/2015). However, for the purposes of this post, what is more important is what is NOT included in the S&P 500.

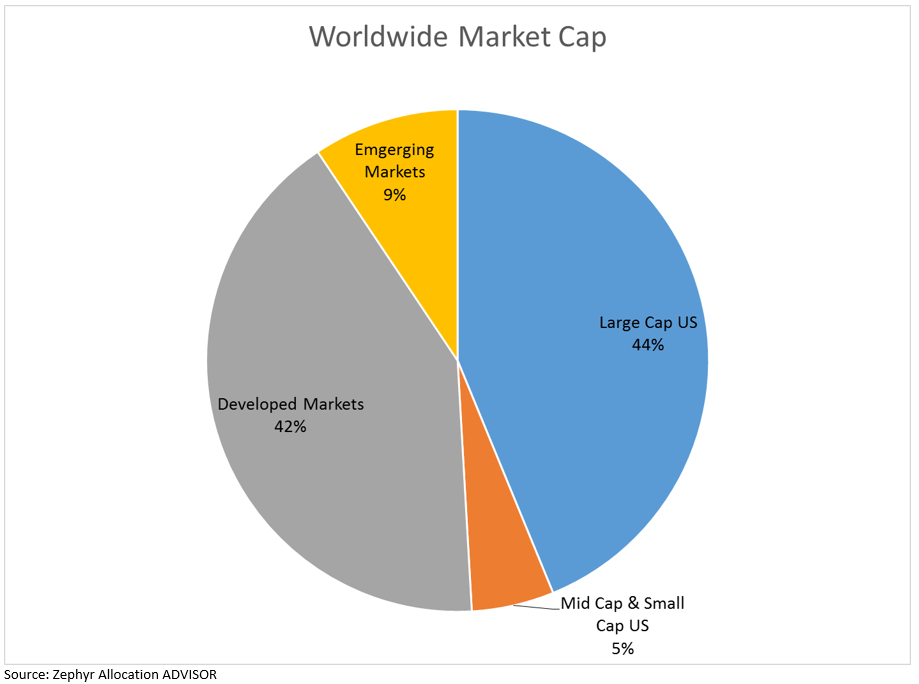

By design, the S&P 500 does not include small cap companies or non-U.S. based firms. In the pie chart below we see the market capitalizations of the world’s equity markets. While the S&P 500 counts for a significant chunk of the world markets at $18.3trn, it is, in fact, a minority of the world portfolio.

As of November 30th, the mid cap and small cap markets account for $2.2trn dollars. The developed international markets are almost as large as the U.S. markets at $17.4trn. In spite of their recent woes, emerging markets are still significant at $3.9trn.

All told, there is $23.5trn, or 56.2% of the world’s equity markets not represented in the S&P 500. (Source: Zephyr AllocationADVISOR)

Does that matter? Certainly from a portfolio construction standpoint it seems logical that an investor would desire to have as many “tools in the toolbox” as possible. Intentionally limiting one’s opportunity set to only large cap U.S. investments seems narrow-minded and self-defeating.

Moreover, there would be an opportunity cost to forgoing small caps, developed international, and emerging markets.

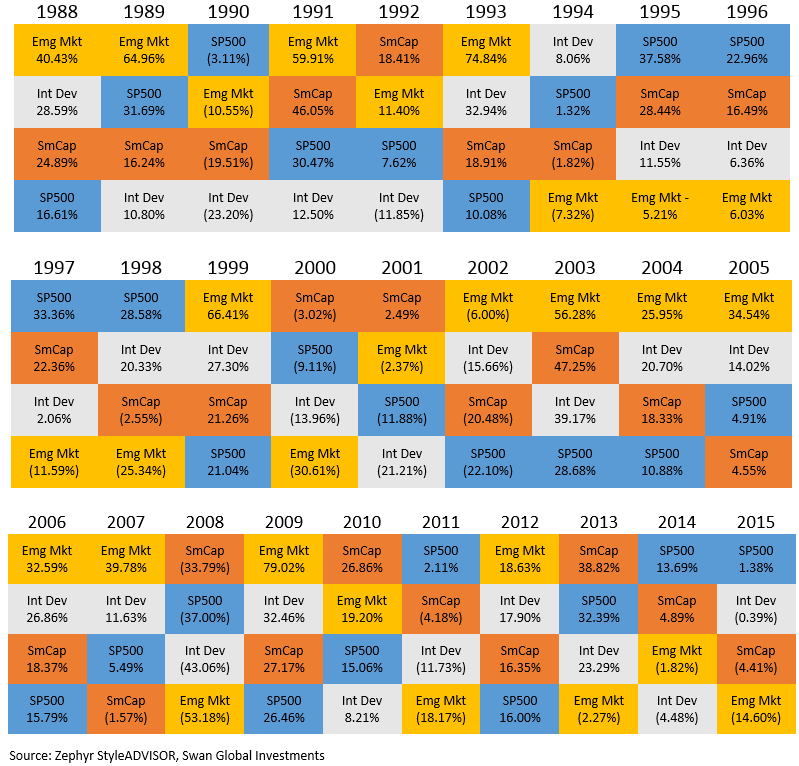

If there is one truth to investing, it is that things move in cycles. Just because one asset class or style is in favor one period is no guarantee it will be in favor the next. In the table below we see a color-coded illustration of the annual performance of these four asset classes from 1989 to 2015.

While certainly there have been times when the S&P 500 was the best option, more often than not, other options have outperformed. In fact, in 9 years out of 28, the S&P 500 was the worst-performing option.

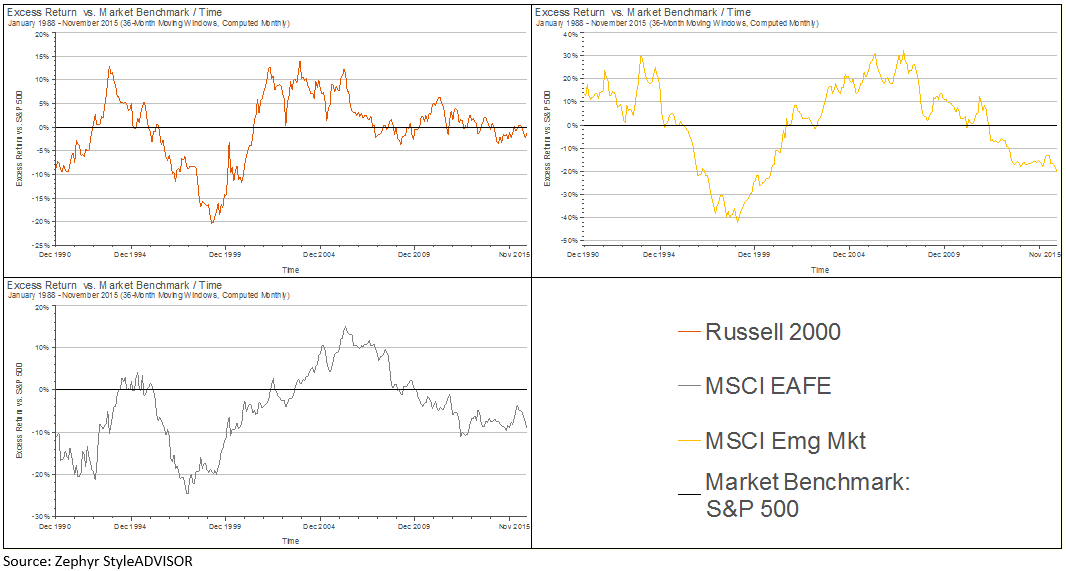

Viewed another way, sometimes these other equity asset classes can have extended periods of outperformance versus the S&P 500.

The graph below illustrates the rolling, three-year excess returns of small caps (Russell 2000), developed international (MSCI EAFE) and emerging markets (MSCI Emg Mkt) versus the S&P 500.

With that in mind, Swan Global Investments is bringing the Defined Risk Strategy to different asset classes, such as U.S. small-cap and foreign developed market stocks. The emerging markets fund has been available for just over a year now. The implementation of the Defined Risk Strategy remains exactly the same — “Always invested, always hedged.” Swan invests 85%-90% of a strategy’s holdings in a passively managed ETF on the asset class. Swan then hedges against major market sell-offs by purchasing long-term put options and seeks to generate additional returns via selling short-term option premium. Given the fact that these asset classes are often viewed as being riskier than U.S. Large Cap equities further strengthens the argument for applying the Defined Risk Strategy to them. By having multiple asset classes available with DRS protection, Swan believes one can create better overall portfolios through diversification from differing correlations.

Swan Global Investments explores its efforts to expand its solution set to cover additional asset classes in a piece called “Diversifying with the Defined Risk Strategy.”

Also feel free to contact your Swan representative at 970–382-8901, or visit our Contact page if you have further questions.

The volatility of an option’s underlying asset is one of the major factors in determining the value of that option. An option’s sensitivity to volatility is known as “vega” and is one of the so-called “Greeks” that are used to determine an option’s value. Other Greeks include delta, gamma, theta, and rho.

NEXT ARTICLEMarc Odo, CFA®, CAIA®, CIPM®, CFP®, Director of Investment Solutions, is responsible for helping clients and prospects gain a detailed understanding of Swan’s Defined Risk Strategy, including how it fits into an overall investment strategy. Formerly Marc was the Director of Research for 11 years at Zephyr Associates.

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 orwww.www.swanglobalinvestments.com. 002-SGI-010616